Pfizer 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

101

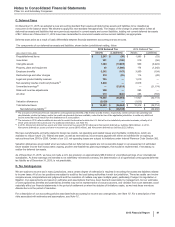

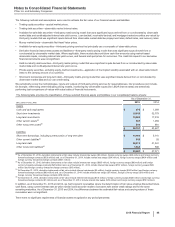

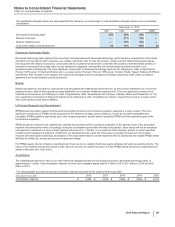

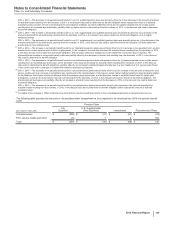

Our identifiable intangible assets are associated with the following, as a percentage of total identifiable intangible assets, less accumulated

amortization:

December 31, 2015

GIP VOC GEP WRD

Developed technology rights 22% 29% 49% —

Brands, finite-lived —81%19%

—

Brands, indefinite-lived —70%30%

—

In-process research and development 2% 10% 85% 3%

Developed Technology Rights

Developed technology rights represent the amortized cost associated with developed technology, which has been acquired from third parties

and which can include the right to develop, use, market, sell and/or offer for sale the product, compounds and intellectual property that we

have acquired with respect to products, compounds and/or processes that have been completed. We possess a well-diversified portfolio of

hundreds of developed technology rights across therapeutic categories, representing the commercialized products included in our

biopharmaceutical businesses. The more significant components of developed technology rights are the following (in order of significance):

Prevnar 13/Prevenar 13 Infant and Enbrel and, to a lesser extent, Premarin, Prevnar 13/Prevenar 13 Adult, Pristiq, Tygacil, Refacto AF, Effexor

and Benefix. Also included in this category are infusion technologies and the post-approval milestone payments made under our alliance

agreements for certain biopharmaceutical products.

Brands

Brands represent the amortized or unamortized cost associated with tradenames and know-how, as the products themselves do not receive

patent protection. Most of these assets are associated with our Consumer Healthcare business unit. The more significant components of

indefinite-lived brands are the following (in order of significance): Advil, Xanax/Xanax XR, Centrum, Caltrate, Medrol and Preparation H. The

more significant components of finite-lived brands are the following (in order of significance): Nexium, Depo-Provera and, to a lesser extent,

Advil Cold and Sinus and Idoform Bifiform.

In-Process Research and Development

IPR&D assets represent research and development assets that have not yet received regulatory approval in a major market. The more

significant components of IPR&D are the programs for the treatment of staph aureus infections, as well as the sterile injectables and

biosimilars IPR&D portfolios acquired as part of the Hospira acquisition and the sterile injectables IPR&D portfolio acquired as part of the

InnoPharma acquisition.

IPR&D assets are required to be classified as indefinite-lived assets until the successful completion or the abandonment of the associated

research and development effort. Accordingly, during the development period after the date of acquisition, these assets will not be amortized

until approval is obtained in a major market, typically either the U.S. or the EU, or in a series of other countries, subject to certain specified

conditions and management judgment. At that time, we will determine the useful life of the asset, reclassify the asset out of in-process

research and development and begin amortization. If the associated research and development effort is abandoned, the related IPR&D assets

will likely be written-off, and we will record an impairment charge.

For IPR&D assets, the risk of failure is significant and there can be no certainty that these assets ultimately will yield successful products. The

nature of the biopharmaceutical business is high-risk and, as such, we expect that many of these IPR&D assets will become impaired and be

written off at some time in the future.

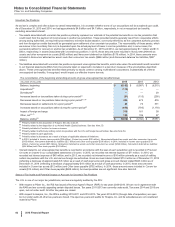

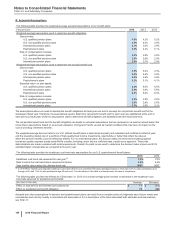

Amortization

The weighted-average life for each of our total finite-lived intangible assets and the largest component, developed technology rights, is

approximately 11 years. Total amortization expense for finite-lived intangible assets was $3.8 billion in 2015, $4.1 billion in 2014 and $4.8

billion in 2013.

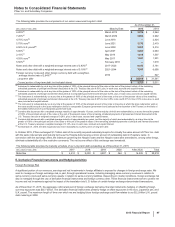

The following table provides the annual amortization expense expected for the years 2016 through 2020:

(MILLIONS OF DOLLARS) 2016 2017 2018 2019 2020

Amortization expense $3,885 $3,780 $3,666 $3,386 $2,419