Pfizer 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

47

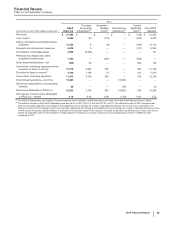

Global Established Pharmaceutical Operating Segment

2015 vs. 2014:

• Revenues decreased 14% in 2015, compared to 2014. Foreign exchange had an unfavorable impact of 7% on GEP revenues in 2015,

compared to 2014. Revenues decreased by 7% operationally in 2015, primarily due to the following operational factors:

the loss of exclusivity and associated launch of multi-source generic competition for Celebrex in the U.S. in December 2014, for Zyvox in

the U.S. beginning in the first half of 2015, for Lyrica in certain developed Europe markets beginning in the first quarter of 2015, and

Inspra in developed Europe markets beginning in August 2014 (collectively, down by approximately $2.5 billion in 2015);

a decline in Lipitor revenues in developed markets as a result of continued generic competition (down approximately $160 million in

2015);

the decline in Zosyn/Tazocin revenues due to a disruption in supply due to manufacturing issues (down approximately $160 million in

2015); and

the termination of the co-promotion collaboration for Spiriva (down approximately $110 million in 2015),

partially offset by:

the inclusion of legacy Hospira operations, which contributed $1.5 billion; and

growth in emerging markets (excluding legacy Hospira), where revenues increased 2% operationally in 2015 (up by approximately $160

million in 2015).

Total GEP revenues from emerging markets were $7.1 billion in 2015, compared to $7.5 billion in 2014, reflecting 3% operational growth,

which was more than offset by the unfavorable impact of foreign exchange of 9%.

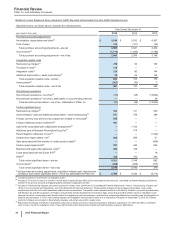

• Cost of sales as a percentage of Revenues increased 2.6 percentage points in 2015, compared to 2014, primarily due to the impact of

losses of exclusivity resulting in an unfavorable change in product mix and the inclusion of legacy Hospira operations, partially offset by

favorable foreign exchange. The decrease in Cost of sales of 2% in 2015, compared to 2014, was primarily driven by favorable foreign

exchange and lower volumes as a result of products losing exclusivity, offset by the inclusion of legacy Hospira operations.

• Selling, informational and administrative expenses decreased 8% in 2015, compared to 2014, primarily due to lower field force, advertising

and promotional expenses reflecting the benefits of cost-reduction and productivity initiatives, as well as favorable foreign exchange,

partially offset by the inclusion of legacy Hospira operations, an increase in certain general and administrative expenses and higher cost for

the U.S. Branded Prescription Drug Fee compared to the prior year.

• Research and development expenses increased 15% in 2015, compared to 2014, reflecting the inclusion of legacy Hospira operations and

increased investment in biosimilar development programs and sterile injectable development programs acquired as part of our acquisition of

InnoPharma, Inc. partially offset by lower clinical trial expenses related to postmarketing commitments, primarily for Celebrex and Pristiq.

• The unfavorable change in Other (income)/deductions––net of 43% in 2015, compared to 2014, primarily reflects the non-recurrence of

prior year gains on the sale of product rights, unfavorable foreign exchange and a decrease in our equity income from our equity-method

investment in China (Hisun Pfizer), partially offset by other income gains.

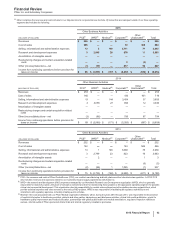

2014 vs. 2013:

• Revenues decreased 9% in 2014, compared to 2013. Foreign exchange had an unfavorable impact of 2% on GEP revenues in 2014

compared to 2013. Revenues decrease 7% operationally in 2014, compared to 2013, primarily due to the following operational factors:

the loss of exclusivity and subsequent launch of multi-source generic competition for Detrol LA in the U.S. in January 2014, Celebrex in

the U.S. in December 2014 and developed Europe in November 2014, Viagra in most major European markets in June 2013 as well as

Aricept in Canada in December 2013 (aggregate decline of approximately $826 million in 2014);

the expiration or near-term expiration of the co-promotion collaboration for Spiriva in most countries, which has resulted in a decline in

Pfizer’s share of Spiriva revenues (down approximately $490 million in 2014);

a decline in branded Lipitor revenues in the U.S. and most other developed markets as a result of continued generic competition (down

approximately $388 million in 2014);

the decline of certain products, including Effexor, Norvasc, atorvastatin, Zosyn/Tazocin, Metaxalone, Ziprasidone and Tygacil (down

approximately $428 million in 2014);

a decline due to loss of exclusivity for certain other products in developed markets (down approximately $170 million in 2014); and

a decline in Aricept, not including Canada, revenues primarily due to the termination of the co-promotion agreement in Japan in

December 2012 (down approximately $75 million in 2014),

partially offset by:

the growth of Lipitor in China (up approximately $164 million in 2014);

the strong performance of Lyrica in Europe (growth of approximately $144 million in 2014); and

the contribution from the collaboration with Mylan Inc. to market generic drugs in Japan (approximately $37 million in 2014).

Total GEP revenues from emerging markets were $7.5 billion in 2014.