Pfizer 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

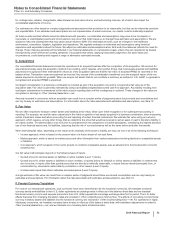

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

72

2015 Financial Report

Note 1. Basis of Presentation and Significant Accounting Policies

A. Basis of Presentation

The consolidated financial statements include our parent company and all subsidiaries, and are prepared in accordance with accounting

principles generally accepted in the United States of America (U.S. GAAP). The decision of whether or not to consolidate an entity requires

consideration of majority voting interests, as well as effective economic or other control over the entity. Typically, we do not seek control by

means other than voting interests. For subsidiaries operating outside the United States (U.S.), the financial information is included as of and for

the year ended November 30 for each year presented. Pfizer's fiscal year-end for U.S. subsidiaries is as of and for the year ended December

31 for each year presented. Substantially all unremitted earnings of international subsidiaries are free of legal and contractual restrictions. All

significant transactions among our businesses have been eliminated. Taxes paid on intercompany sales transactions are deferred until

recognized upon sale of the asset to a third party.

In the consolidated balance sheet as of December 31, 2014, we performed certain reclassifications to conform to the current period

presentation of all deferred taxes as noncurrent in accordance with the adoption of a new accounting standard (for additional information, see

Note 1B). We also performed certain other reclassifications in the consolidated balance sheet as of December 31, 2014 to conform to the

current period presentation, none of which were material to our financial statements.

On November 23, 2015, we announced that we have entered into a definitive merger agreement with Allergan plc (Allergan), a global

pharmaceutical company incorporated in Ireland, under which we have agreed to combine with Allergan in a stock transaction valued at

$363.63 per Allergan share, for a total enterprise value of approximately $160 billion, based on the closing price of Pfizer common stock of

$32.18 on November 20, 2015 (the last trading day prior to the announcement) and certain other assumptions. While we have taken actions

and incurred costs associated with the pending combination that are reflected in our financial statements, the pending combination with Allergan

will not be reflected in our financial statements until consummation. See Note 19. for additional information.

On September 3, 2015 (the acquisition date), we acquired Hospira, Inc. (Hospira), a provider of sterile injectable drugs and infusion

technologies as well as a provider of biosimilars. The total consideration for the acquisition was approximately $16.1 billion in cash.

Commencing from the acquisition date, our financial statements reflect the assets, liabilities, operating results and cash flows of Hospira, and,

in accordance with our domestic and international reporting periods, our consolidated financial statements for the year ended December 31,

2015 reflect four months of legacy Hospira U.S. operations and three months of legacy Hospira international operations. Hospira is now a

subsidiary of Pfizer and its commercial operations are now included within the Global Established Pharmaceutical (GEP) segment. The

combination of local Pfizer and Hospira entities may be pending in various jurisdictions and integration is subject to completion of various local

legal and regulatory steps. See Note 2A for additional information.

On June 24, 2013, we completed the full disposition of our Animal Health business (Zoetis), and recognized a gain of approximately $10.3

billion net of tax, in Gain on disposal of discontinued operations––net of tax in the consolidated statement of income for the year ended

December 31, 2013. The operating results of this business through June 24, 2013, the date of disposal, are reported as Income from

discontinued operations––net of tax in the consolidated statement of income for the year ended December 31, 2013. For additional information,

see Note 2D.

Certain amounts in the consolidated financial statements and associated notes may not add due to rounding. All percentages have been

calculated using unrounded amounts.

B. Adoption of New Accounting Standards

We adopted a new accounting and disclosure standard as of January 1, 2015 that limits the presentation of discontinued operations to when

the disposal of the business operation represents a strategic shift that has had or will have a major effect on our operations and financial

results. This new standard is applied prospectively to all disposals (or classifications as held for sale) of components of an entity that occur

within annual periods beginning on or after December 15, 2014, and interim periods within those years. In 2015, we did not have any disposals

within the scope of this new standard and, therefore, there were no impacts to our consolidated financial statements from the adoption of this

new standard.

On December 31, 2015, we adopted a new accounting standard that requires all deferred tax assets and liabilities to be classified as noncurrent

in the balance sheet. We elected to apply this new standard retrospectively. The impact of the change in presentation is that all deferred tax

assets and liabilities that were previously reported in current assets and current liabilities, totaling net current deferred tax assets of $2.1 billion

as of December 31, 2014 have been reclassified to noncurrent assets and noncurrent liabilities, as appropriate. For additional information, see

Note 5C.

C. Estimates and Assumptions

In preparing the consolidated financial statements, we use certain estimates and assumptions that affect reported amounts and disclosures,

including amounts recorded and disclosed in connection with acquisitions. These estimates and underlying assumptions can impact all

elements of our financial statements. For example, in the consolidated statements of income, estimates are used when accounting for

deductions from revenues (such as rebates, chargebacks, sales allowances and sales returns), determining the cost of inventory that is sold,

allocating cost in the form of depreciation and amortization, and estimating restructuring charges and the impact of contingencies. On the

consolidated balance sheets, estimates are used in determining the valuation and recoverability of assets, such as accounts receivable,

investments, inventories, deferred tax assets, fixed assets and intangible assets (including acquired in-process research & development

(IPR&D) assets), and estimates are used in determining the reported amounts of liabilities, such as taxes payable, benefit obligations, accruals