Pfizer 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

5

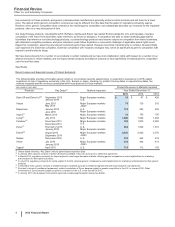

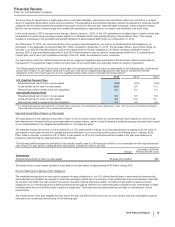

Recent Losses and Expected Losses of Collaboration Rights

The following table provides information about certain of our alliance revenue products that have experienced or that are expected to

experience in 2016 losses of collaboration rights, showing, by product, the date of the loss of the collaboration rights, the markets impacted

and the alliance revenues associated with those products in those markets:

(MILLIONS OF DOLLARS)

Alliance Revenues in

Markets Impacted

Products

Date of Loss of

Collaboration Rights Markets Impacted Year Ended December 31,

2015 2014 2013

Spiriva(a) April 2014 (U.S.), between 2012

and 2016 (Japan, certain

European countries, Australia,

Canada and South Korea)

U.S., Japan, certain European

countries, Australia, Canada and

South Korea

$27$168 $659

Enbrel(b) October 2013 U.S. and Canada —3 1,400

Rebif(c) End of 2015 U.S. 371 415 401

(a) Our collaboration with Boehringer Ingelheim for Spiriva expires on a country-by-country basis between 2012 and 2016. On April 29, 2014, our alliance in the

U.S. came to an end.

(b) The U.S. and Canada co-promotion term of our collaboration agreement with Amgen Inc. for Enbrel expired on October 31, 2013. While we are entitled to

royalties until October 31, 2016, those royalties have been and are expected to continue to be significantly less than our share of Enbrel profits from U.S. and

Canada sales prior to the expiration. In addition, while our share of the profits from this co-promotion agreement previously was included in Revenues, our

royalties after October 31, 2013 are and will be included in Other (income)/deductions––net, in our consolidated statements of income. Outside the U.S. and

Canada, we continue to have the exclusive rights to market Enbrel.

(c) Our collaboration agreement with EMD Serono Inc. to co-promote Rebif in the U.S. expired at the end of 2015.

In addition, we expect to lose exclusivity for various other products in various markets over the next few years. For additional information, see

the “Patents and Other Intellectual Property Rights” section in Part I, Item 1, “Business”, of our 2015 Annual Report on Form 10-K.

Our financial results in 2015 and our 2016 financial guidance, respectively, reflect the impact and projected impact of the loss of exclusivity of

various products and the expiration of certain alliance product contract rights discussed above. For additional information about our 2016

financial guidance, see the “Our Financial Guidance for 2016” section of this Financial Review.

We will continue to aggressively defend our patent rights whenever we deem appropriate. For more detailed information about our significant

products, see the discussion in the “Revenues––Major Products” and “Revenues––Selected Product Descriptions” sections of this Financial

Review. For a discussion of certain recent developments with respect to patent litigation, see Notes to Consolidated Financial Statements––

Note 17A1. Commitments and Contingencies: Legal Proceedings––Patent Litigation.

Regulatory Environment/Pricing and Access––U.S. Healthcare Legislation

In March 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act (together,

the U.S. Healthcare Legislation, and also known as the Affordable Care Act or ACA), was enacted in the U.S. For additional information, see

the “Government Regulation and Price Constraints” section in Part I, Item 1, “Business”, of our 2015 Annual Report on Form 10-K. The U.S.

Healthcare Legislation also created a framework for the approval of biosimilars (also known as follow-on biologics) following the expiration of

12 years of exclusivity for the innovator biologic, with a potential six-month pediatric extension. For additional information on the biosimilar

approval pathway, the U.S. Food and Drug Administration’s (FDA) guidance documents and competition from biosimilar manufacturers, see

the “Patents and Intellectual Property—Biotechnology Products” and “Government Regulation and Price Constraints—Biosimilar Regulation”

sections in Part I, Item 1 “Business”, of our 2015 Annual Report on Form 10-K.

Impacts on our 2015 Results

We recorded the following amounts in 2015 as a result of the U.S. Healthcare Legislation:

• $977 million recorded as a reduction to Revenues, related to the higher, extended and expanded rebate provisions and the Medicare

“coverage gap” discount provision, as well as an increase in Medicaid rebates; and

• $251 million recorded in Selling, informational and administrative expenses, related to the fee payable to the federal government (which is

not deductible for U.S. income tax purposes) based on our prior-calendar-year share relative to other companies of branded prescription

drug sales to specified government programs. The decrease in the impact of the U.S. Healthcare Legislation on Selling, informational and

administrative expenses in 2015 compared to 2014 was primarily a result of the non-recurrence of the $215 million charge in 2014 to

account for an additional year of the non-tax deductible Branded Prescription Drug Fee, partially offset by a lower favorable true-up in

2015, compared to the favorable true-up in 2014, associated with the final invoice for the respective prior-calendar year received from the

federal government, which reflected a lower share than that of the initial invoice.