Pfizer 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

88

2015 Financial Report

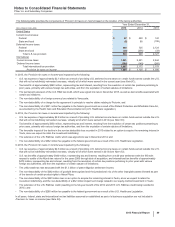

In 2013, includes intangible asset impairment charges of $803 million, reflecting (i) $394 million of developed technology rights (for use in the development of

bone and cartilage) acquired in connection with our acquisition of Wyeth; (ii) $227 million related to IPR&D compounds; (iii) $109 million of indefinite-lived

brands, primarily related to our biopharmaceutical indefinite-lived brand Xanax/Xanax XR; and (iv) $73 million of other finite-lived intangible assets, related to

platform technology, that no longer have an alternative future use. The intangible asset impairment charges for 2013 are associated with the following: GIP

($448 million); GEP ($201 million); WRD ($140 million); and Consumer Healthcare ($14 million). In addition, 2013 includes an impairment charge of

approximately $43 million for certain private company investments and an impairment charge of $32 million related to our investment in Teuto.

The intangible asset impairment charges for 2013 reflect, among other things, updated commercial forecasts and, with regard to IPR&D, also reflect the impact

of new scientific findings and delayed launch dates.

(i) Represents expenses for changes to our infrastructure to align our operations, as well as reporting for our business segments established in 2014.

(j) Represents costs incurred in connection with the IPO of an approximate 19.8% ownership interest in Zoetis. Includes expenditures for banking, legal,

accounting and similar services. For additional information, see Note 2D.

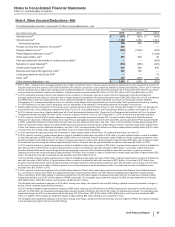

(k) In 2015, includes, among other things, (i) charges of $194 million related to the write-down of assets to net realizable value; (ii) charges of $159 million,

reflecting the change in the fair value of contingent consideration liabilities; and (iii) income of $45 million associated with equity-method investees. In 2014,

includes, among other things, (i) gains of approximately $40 million, reflecting the change in the fair value of contingent consideration liabilities associated with

prior acquisitions; (ii) income associated with equity-method investees of $86 million; (iii) income of $55 million resulting from a decline in the estimated loss on

an option to acquire the remaining interest in Teuto; and (iv) a loss of $30 million due to a change in our ownership interest in ViiV. In 2013, includes, among

other things, (i) a gain of approximately $114 million, reflecting the change in the fair value of the contingent consideration liabilities associated with a prior

acquisition; (ii) an estimated loss of $223 million related to an option to acquire the remaining interest in Teuto; and (iii) a loss of $32 million due to a change in

our ownership interest in ViiV. For additional information concerning Teuto and ViiV, see Note 2E.

The asset impairment charges included in Other (income)/deductions––net in 2015 are based on estimates of fair value.

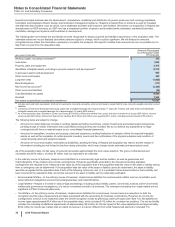

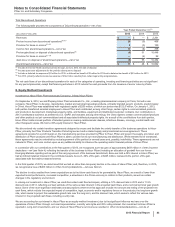

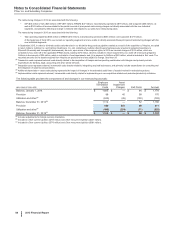

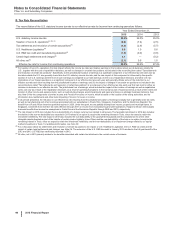

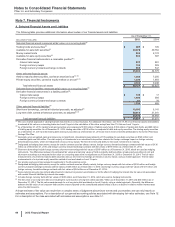

The following table provides additional information about the intangible assets that were impaired during 2015 in Other (income)/

deductions––net :

Year Ended

December 31,

Fair Value(a) 2015

(MILLIONS OF DOLLARS) Amount Level 1 Level 2 Level 3 Impairment

Intangible assets––IPR&D(b) $46 $—$—$46$ 71

Intangible assets––Developed technology rights(b) 85 ——85 120

Intangible assets––Indefinite-lived Brands(b) 145 — — 145 132

Total $276$—$—$

276 $323

(a) The fair value amount is presented as of the date of impairment, as these assets are not measured at fair value on a recurring basis. See also Note 1E.

(b) Reflects intangible assets written down to fair value in 2015. Fair value was determined using the income approach, specifically the multi-period excess

earnings method, also known as the discounted cash flow method. We started with a forecast of all the expected net cash flows associated with the asset and

then applied an asset-specific discount rate to arrive at a net present value amount. Some of the more significant estimates and assumptions inherent in this

approach include: the amount and timing of the projected net cash flows, which includes the expected impact of competitive, legal and/or regulatory forces on

the product and the impact of technological risk associated with IPR&D assets; the discount rate, which seeks to reflect the various risks inherent in the

projected cash flows; and the tax rate, which seeks to incorporate the geographic diversity of the projected cash flows.

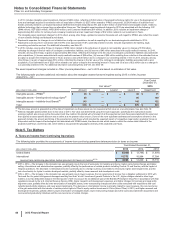

Note 5. Tax Matters

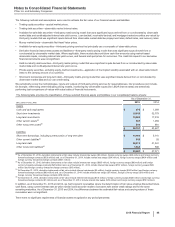

A. Taxes on Income from Continuing Operations

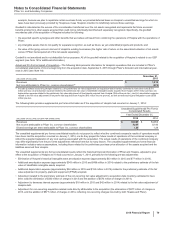

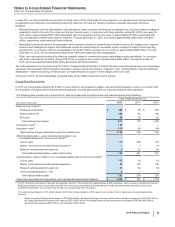

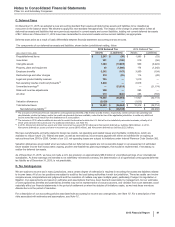

The following table provides the components of Income from continuing operations before provision for taxes on income:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2015 2014 2013

United States $ (6,809) $(4,744)$ (1,678)

International 15,773 16,984 17,394

Income from continuing operations before provision for taxes on income(a), (b) $8,965 $12,240 $15,716

(a) 2015 v. 2014––The increase in the domestic loss was primarily due to the loss of exclusivity for Celebrex and Zyvox, higher restructuring charges and higher

selling, informational and administrative expenses, partially offset by the performance of certain products including Prevnar 13 and Ibrance, and the impact of

Hospira operations. The decrease in international income is primarily due to a foreign currency loss related to Venezuela, higher asset impairments, and the

loss of exclusivity for Lyrica in certain developed markets, partially offset by lower research and development costs.

(b) 2014 v. 2013––The increase in the domestic loss was primarily due to lower revenues, the non-recurrence of income from a litigation settlement in 2013 with

Teva and Sun for patent-infringement damages resulting from their “at-risk” launches of generic Protonix in the U.S., higher charges related to other legal

matters, a non-tax deductible charge in the third quarter of 2014 to account for an additional year of the Branded Prescription Drug Fee in accordance with final

regulations issued by the U.S. Internal Revenue Service (IRS), higher research and development expenses, and higher charges for business and legal entity

alignment costs, partially offset by lower amortization of intangible assets, lower restructuring charges and other costs associated with acquisitions and cost-

reduction/productivity initiatives, and lower asset impairments. The decrease in international income is primarily related to lower revenues, the non-recurrence

of the gain associated with the transfer of certain product rights to Pfizer’s equity-method investment in China (Hisun Pfizer) in 2013, and higher research and

development expenses, partially offset by lower amortization of intangible assets, lower restructuring charges and other costs associated with acquisitions and

cost-reduction/productivity initiatives and the non-recurrence of certain charges.