Pfizer 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

48

2015 Financial Report

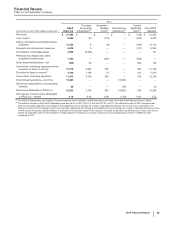

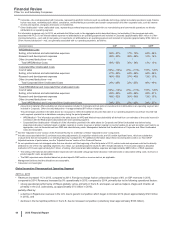

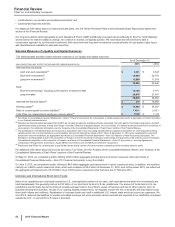

• Cost of sales as a percentage of Revenues increased by 1.1 percentage points in 2014 compared to 2013, primarily due to the impact of

losses of exclusivity and an unfavorable change in product mix. The 3% decrease in Cost of sales was primarily driven by favorable foreign

exchange.

• Selling, informational and administrative expenses decreased 17% in 2014, compared to 2013, due to lower expenses for field force and

marketing expenses, reflecting the benefits of cost-reduction and productivity initiatives.

• Research and development expenses decreased 11% in 2014 compared to 2013, due to lower clinical trial expenses and the benefits from

cost-reduction and productivity initiatives, partially offset by increased spending on our biosimilars development programs.

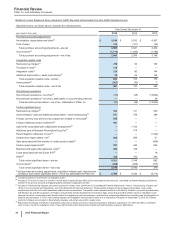

ANALYSIS OF THE CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

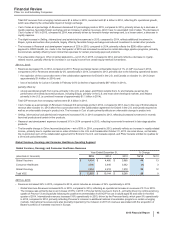

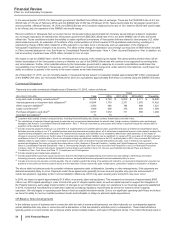

Changes in the components of Accumulated other comprehensive loss reflect the following:

2015

• For Foreign currency translation adjustments, net, reflects primarily the strengthening of the U.S. dollar against the euro, Brazilian real,

Canadian dollar, Australian dollar, British pound, Mexican peso and Japanese yen.

• For Unrealized holding gains on derivative financial instruments, net and Unrealized holding gains/(losses) on available-for-sale securities,

net, reflects the impact of fair value remeasurements and the reclassification of realized amounts into income. For additional information, see

Notes to Consolidated Financial Statements—Note 7. Financial Instruments.

• For Benefit plans: actuarial gains/(losses), net, primarily reflects the reclassification into income of amounts related to (i) the amortization of

changes in the pension benefit obligation previously recognized in Other comprehensive income, (ii) lower actual return on plan assets as

compared to the expected return on assets, and (iii) settlement activity, as well as the impact of foreign exchange. For additional information,

see Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement Benefit Plans and Defined Contribution Plans and

the “Significant Accounting Policies and Application of Critical Accounting Estimates––Benefit Plans” section of this Financial Review.

• For Benefit plans: prior service credits and other, net, reflects a $507 million reduction in our U.S. Postretirement Plan obligation due to a

plan amendment approved in June 2015 that introduced a cap on costs for certain groups within the plan, partially offset by the

reclassification into income of amounts related to (i) amortization of changes in prior service costs and credits previously recognized in Other

comprehensive income and (ii) curtailment activity. For additional information, see Notes to Consolidated Financial Statements—Note 11.

Pension and Postretirement Benefit Plans and Defined Contribution Plans.

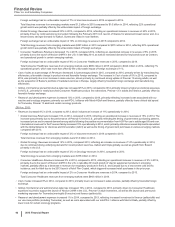

2014

• For Foreign currency translation adjustments, reflects primarily the weakening of the euro against the U.S. dollar, and, to a lesser, extent the

weakening of the Japanese yen, Canadian dollar, Brazilian real and U.K. pound against the U.S dollar. Also, includes the reclassification of

amounts associated with legal entity dispositions into income.

• For Unrealized holding gains on derivative financial instruments, net reflects the impact of fair value remeasurements and the reclassification

of realized amounts into income. For additional information, see Notes to Consolidated Financial Statements—Note 7. Financial Instruments.

• For Unrealized holding gains/(losses) on available-for-sale securities, net reflects the impact of fair value remeasurements and the

reclassification of realized amounts into income. For additional information, see Notes to Consolidated Financial Statements—Note 7.

Financial Instruments.

• For Benefit plans: actuarial gains/(losses), net, reflects the actuarial losses related primarily to a decrease in the discount rate. For additional

information, see Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement Benefit Plans and Defined Contribution

Plans and the “Significant Accounting Policies and Application of Critical Accounting Estimates––Benefit Plans” section of this Financial

Review.

• For Benefit plans: prior service credits and other, net, reflects an amendment to our post-retirement plans that decreased the benefit

obligation by transferring certain plan participants to a retiree drug coverage program eligible for a Medicare Part D plan subsidy. For

additional information, see Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement Benefit Plans and Defined

Contribution Plans.

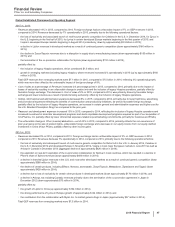

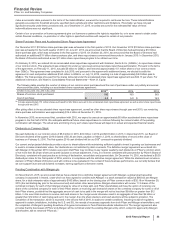

2013

• For Foreign currency translation adjustments, reflects the weakening of several currencies against the U.S. dollar, primarily the Japanese

yen, the Australian dollar, the Canadian dollar and the Brazilian real, partially offset by the strengthening of several currencies against the

U.S. dollar, primarily the euro and to a lesser extent the U.K. pound, as well as the reclassification of amounts associated with dispositions

into income.

• For Unrealized holding gains on derivative financial instruments, net reflects the impact of fair value remeasurements and the reclassification

of realized gains into income. For additional information, see Notes to Consolidated Financial Statements—Note 7. Financial Instruments.

• For Unrealized holding gains/(losses) on available-for-sale securities, net reflects the impact of fair value remeasurements and the

reclassification of realized gains into income. For additional information, see Notes to Consolidated Financial Statements—Note 7. Financial

Instruments.

• For Benefit plans: actuarial gains/(losses), net, reflects the impact of actuarial gains (due to an increase in the discount rate and higher than

expected returns on plan assets) and the reclassification of certain amounts related to amortization and curtailments/settlements into income.

For additional information, see Notes to Consolidated Financial Statements—Note 11. Pension and Postretirement Benefit Plans and Defined

Contribution Plans and the “Significant Accounting Policies and Application of Critical Accounting Estimates––Benefit Plans” section of this

Financial Review.