Pfizer 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

89

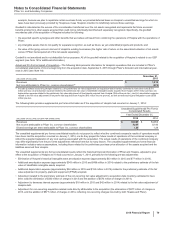

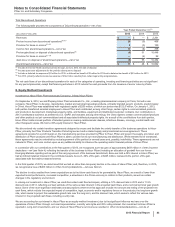

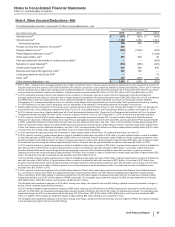

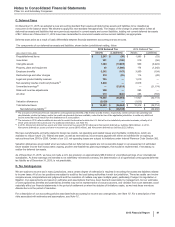

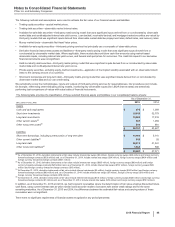

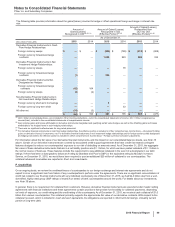

The following table provides the components of Provision for taxes on income based on the location of the taxing authorities:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2015 2014 2013

United States

Current income taxes:

Federal $67$393 $142

State and local (8) 85 (106)

Deferred income taxes:

Federal 300 725 2,124

State and local (36)(256)(33)

Total U.S. tax provision 323 948 2,127

International

Current income taxes 1,951 2,321 2,544

Deferred income taxes (284)(149)(365)

Total international tax provision 1,667 2,172 2,179

Provision for taxes on income $1,990 $3,120 $4,306

In 2015, the Provision for taxes on income was impacted by the following:

• U.S. tax expense of approximately $2.1 billion as a result of providing U.S. deferred income taxes on certain funds earned outside the U.S.

that will not be indefinitely reinvested overseas, virtually all of which were earned in the current year (see Note 5C);

• Tax benefits of approximately $360 million, representing tax and interest, resulting from the resolution of certain tax positions pertaining to

prior years, primarily with various foreign tax authorities, and from the expiration of certain statutes of limitations;

• The permanent extension of the U.S. R&D tax credit, which was signed into law in December 2015, as well as tax benefits associated with

certain tax initiatives;

• The non-deductibility of a foreign currency loss related to Venezuela;

• The non-deductibility of a charge for the agreement in principle to resolve claims relating to Protonix; and

• The non-deductibility of a $251 million fee payable to the federal government as a result of the Patient Protection and Affordable Care Act,

as amended by the Health Care and Education Reconciliation Act (U.S. Healthcare Legislation).

In 2014, the Provision for taxes on income was impacted by the following:

• U.S. tax expense of approximately $2.2 billion as a result of providing U.S. deferred income taxes on certain funds earned outside the U.S.

that will not be indefinitely reinvested overseas, virtually all of which were earned in 2014 (see Note 5C);

• Tax benefits of approximately $350 million, representing tax and interest, resulting from the resolution of certain tax positions pertaining to

prior years, primarily with various foreign tax authorities, and from the expiration of certain statutes of limitations;

• The favorable impact of the decline in the non-tax deductible loss recorded in 2013 related to an option to acquire the remaining interest in

Teuto, since we expect to retain the investment indefinitely;

• The extension of the U.S. R&D tax credit, which was signed into law in December 2014; and

• The non-deductibility of a $362 million fee payable to the federal government as a result of the U.S. Healthcare Legislation.

In 2013, the Provision for taxes on income was impacted by the following:

• U.S. tax expense of approximately $2.3 billion as a result of providing U.S. deferred income taxes on certain funds earned outside the U.S.

that will not be indefinitely reinvested overseas, virtually all of which were earned in 2013 (see Note 5C);

• U.S. tax benefits of approximately $430 million, representing tax and interest, resulting from a multi-year settlement with the IRS with

respect to audits of the Wyeth tax returns for the years 2006 through date of acquisition, and international tax benefits of approximately

$470 million, representing tax and interest, resulting from the resolution of certain tax positions pertaining to prior years with various

foreign tax authorities, and from the expiration of certain statutes of limitations;

• The unfavorable tax rate associated with the $1.3 billion of patent litigation settlement income;

• The non-deductibility of the $292 million of goodwill derecognized and the jurisdictional mix of the other intangible assets divested as part

of the transfer of certain product rights to Hisun Pfizer;

• The non-deductibility of the $223 million loss on an option to acquire the remaining interest in Teuto, since we expect to retain the

investment indefinitely, and the non-deductibility of a $32 million impairment charge related to our equity-method investment in Teuto;

• The extension of the U.S. R&D tax credit (resulting in the full-year benefit of the 2012 and 2013 U.S. R&D tax credit being recorded in

2013); and

• The non-deductibility of a $280 million fee payable to the federal government as a result of the U.S. Healthcare Legislation.

In all years, federal, state and international net tax liabilities assumed or established as part of a business acquisition are not included in

Provision for taxes on income (see Note 2A).