Pfizer 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

54

2015 Financial Report

In the second quarter of 2015, the Venezuelan government identified three official rates of exchange. These are the CENCOEX rate of 6.3; the

SICAD rate of 13.5 (as of February 2016); and the SIMADI rate of 200 (as of February 2016). News reports state the Venezuelan government

announced that, effective February 18, 2016, the CENCOEX rate of 6.3 would be replaced by the rate of 10.0; that the SICAD rate would cease

to be offered; and, the operation of the SIMADI rate would change.

Recent conditions in Venezuela had us resolve that our Venezuelan bolivar-denominated net monetary assets that are subject to revaluation

are no longer expected to be settled at the Venezuelan government CENCOEX official rate of 6.3, but at the SIMADI rate of 200, the lowest

official rate. Those conditions included the inability to obtain significant conversions of Venezuelan bolivars related to intercompany U.S. dollar

denominated accounts, an evaluation of the effects of the implementation of a fourth-quarter 2015 operational restructuring, resulting in a

restructuring charge of $39 million related to a 36% reduction in our labor force in Venezuela, and our expectation of the changes in

Venezuela’s responses to changes in its economy. The effect of that change in expectation was a foreign currency loss of $806 million included

in Other (income)/deductions––net. See Notes to Consolidated Financial Statements—Note 4. Other (Income)/Deductions—Net. In addition, we

had an inventory impairment loss of $72 million included in Cost of sales.

We expect to use the SIMADI rate in 2016 for remeasurement purposes of the remaining net assets, We cannot predict whether there will be

further devaluations of the Venezuelan currency or whether our use of the SIMADI official rate will continue to be supported by evolving facts

and circumstances. Further, other potential actions by the Venezuelan government in response to economic uncertainties could impact the

recoverability of our investment in Venezuela, which could result in an impairment charge and, under extreme circumstances, could impact our

ability to continue to operate in the country in the same manner as we have historically.

As of December 31, 2015, our net monetary assets in Venezuela that are subject to revaluation totaled approximately $27 million (remeasured

at the SIMADI 200 rate). Our Venezuela Revenues for 2015 are equivalent to approximately $34 million (converted using the SIMADI 200 rate).

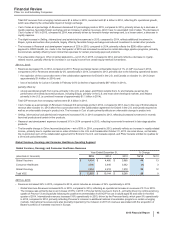

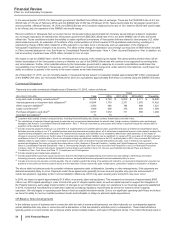

Contractual Obligations

Payments due under contractual obligations as of December 31, 2015, mature as follows:

Years

(MILLIONS OF DOLLARS) Total 2016 2017-2018 2019-2020 Thereafter

Long-term debt, including current portion(a) $32,538 $3,720 $6,812 $5,171 $16,835

Interest payments on long-term debt obligations(b) 16,944 1,170 2,371 1,978 11,425

Other long-term liabilities(c) 3,390 388 794 688 1,521

Lease commitments(d) 1,849 206 370 265 1,009

Purchase obligations and other(e) 3,727 1,072 711 659 1,284

Uncertain tax positions(f) 73 73 — — —

(a) Long-term debt consists of senior unsecured notes, including fixed and floating rate, foreign currency denominated, and other notes.

(b) Our calculations of expected interest payments incorporate only current period assumptions for interest rates, foreign currency translation rates and hedging

strategies (see Notes to Consolidated Financial Statements—Note 7. Financial Instruments), and assume that interest is accrued through the maturity date or

expiration of the related instrument.

(c) Includes expected payments relating to our unfunded U.S. supplemental (non-qualified) pension plans, postretirement plans and deferred compensation plans.

Excludes amounts relating to our U.S. qualified pension plans and international pension plans, all of which have a substantial amount of plan assets, because the

required funding obligations are not expected to be material and/or because such liabilities do not necessarily reflect future cash payments, as the impact of

changes in economic conditions on the fair value of the pension plan assets and/or liabilities can be significant. In January 2016, we made a $1.0 billion voluntary

contribution to the U.S. qualified plans. We do not anticipate making any additional contributions to the U.S. qualified plans in 2016. Also, excludes $4.5 billion of

liabilities related to legal matters, employee terminations and the fair value of derivative financial instruments and other, most of which do not represent

contractual obligations. See also our liquidity discussion above in this “Analysis of Financial Condition, Liquidity and Capital Resources” section, as well as the

Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity

Initiatives, Note 7A. Financial Instruments: Selected Financial Assets and Liabilities, Note 11E. Pension and Postretirement Benefit Plans and Defined

Contribution Plans: Cash Flows, and Note 17. Commitments and Contingencies.

(d) Includes operating and capital lease obligations.

(e) Includes agreements to purchase goods and services that are enforceable and legally binding and includes amounts relating to advertising, information

technology services, employee benefit administration services, and potential milestone payments deemed reasonably likely to occur.

(f) Includes only income tax amounts currently payable. We are unable to predict the timing of tax settlements related to our noncurrent obligations for uncertain tax

positions as tax audits can involve complex issues and the resolution of those issues may span multiple years, particularly if subject to negotiation or litigation.

The above table includes amounts for potential milestone payments under collaboration, licensing or other arrangements, if the payments are

deemed reasonably likely to occur. Payments under these agreements generally become due and payable only upon the achievement of

certain development, regulatory and/or commercialization milestones, which may span several years and which may never occur.

In 2016, we expect to spend approximately $1.9 billion on property, plant and equipment. This represents an increase of approximately $500

million over 2015 capital spending in order to fund a full year of Hospira capital needs, as well as capital required to support the integration of

the Hospira business, early-stage implementation of changes to our infrastructure to align our operations to our business segments established

in 2014, incremental manufacturing investment to address increasing regulatory requirements as well as for business-driven capacity

expansion. We rely largely on operating cash flows to fund our capital investment needs. Due to our significant operating cash flows, we believe

we have the ability to meet our capital investment needs and anticipate no delays to planned capital expenditures.

Off-Balance Sheet Arrangements

In the ordinary course of business and in connection with the sale of assets and businesses, we often indemnify our counterparties against

certain liabilities that may arise in connection with a transaction or that are related to activities prior to a transaction. These indemnifications

typically pertain to environmental, tax, employee and/or product-related matters, and patent-infringement claims. If the indemnified party were to