Pfizer 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

105

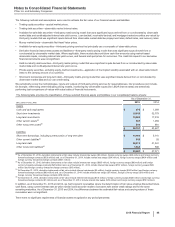

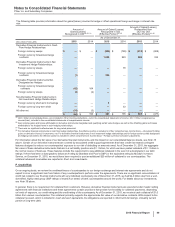

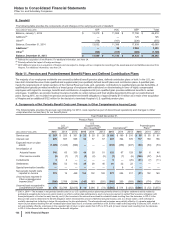

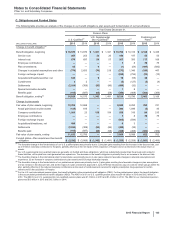

C. Obligations and Funded Status

The following table provides an analysis of the changes in our benefit obligations, plan assets and funded status of our benefit plans:

Year Ended December 31,

Pension Plans

U.S. Qualified(a) U.S. Supplemental

(Non-Qualified)(b) International(c) Postretirement

Plans(d)

(MILLIONS OF DOLLARS) 2015 2014 2015 2014 2015 2014 2015 2014

Change in benefit obligation(e)

Benefit obligation, beginning $ 16,575 $13,976 $ 1,481 $ 1,341 $ 10,796 $ 10,316 $ 3,168 $ 3,438

Service cost 287 253 22 20 186 197 55 55

Interest cost 676 697 54 57 307 393 117 169

Employee contributions ————7879 75

Plan amendments 62 —4—(1) (54) (497) (692)

Changes in actuarial assumptions and other (774)2,653 (70) 218 (273) 1,346 (185) 447

Foreign exchange impact ————(938) (794) (20) (10)

Acquisitions/divestitures/other, net 542 —9—19 (55) 49 —

Curtailments 32——(2) (127) (3) (4)

Settlements (2,034) (308)(93) (96) (499) (32) ——

Special termination benefits ————18——

Benefits paid (412)(697)(65) (58) (389) (408) (300) (309)

Benefit obligation, ending(e) 14,926 16,575 1,343 1,481 9,214 10,796 2,463 3,168

Change in plan assets

Fair value of plan assets, beginning 12,706 12,869 ——8,588 8,250 762 741

Actual gain/(loss) on plan assets (124)819 ——290 1,046 (3) 45

Company contributions 1,000 23 158 154 558 316 84 210

Employee contributions ————7879 75

Foreign exchange impact ————(602) (594) ——

Acquisitions/divestitures, net 496 ———63——

Settlements (2,034) (308)(93) (96) (499) (32) ——

Benefits paid (412)(697)(65) (58) (389) (408) (300) (309)

Fair value of plan assets, ending 11,633 12,706 ——7,959 8,588 622 762

Funded status—Plan assets less than benefit

obligation $ (3,292) $ (3,869) $(1,343) $ (1,481) $ (1,255) $ (2,208) $ (1,841) $ (2,406)

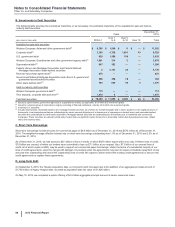

(a) The favorable change in the funded status of our U.S. qualified plans was primarily due to (i) the plan gains resulting from the increase in the discount rate, and

(ii) a $1 billion voluntary contribution to the plans, partially offset by (i) the net impact of the acquisition of Hospira and (ii) a decrease in the actual return on

assets.

(b) Our U.S. supplemental (non-qualified) plans are generally not funded and these obligations, which are substantially greater than the annual cash outlay for

these liabilities, will be paid from cash generated from operations. The decrease in the benefit obligation is primarily due to an increase in the discount rate.

(c) The favorable change in the international plans’ funded status was primarily due to (i) plan gains related to favorable changes in actuarial assumptions and

experience, (ii) an increase in company contributions to plan assets and (iii) foreign exchange impacts.

(d) The favorable change in the funded status of our postretirement plans was primarily due to (i) plan gains resulting from favorable changes in plan assumptions

and an increase in the discount rate, and (ii) the impact of a plan amendment approved in June 2015 that introduced a cap on costs for certain groups within the

plan, partially offset by (i) the reduced company contributions as the result of reimbursements received for eligible prescription drug expenses for certain

retirees and (ii) the acquisition of Hospira.

(e) For the U.S. and international pension plans, the benefit obligation is the projected benefit obligation (PBO). For the postretirement plans, the benefit obligation

is the accumulated postretirement benefit obligation (ABO). The ABO for all of our U.S. qualified pension plans was $14.8 billion in 2015 and $16.3 billion in

2014. The ABO for our U.S. supplemental (non-qualified) pension plans was $1.3 billion in 2015 and $1.4 billion in 2014. The ABO for our international pension

plans was $8.8 billion in 2015 and $10.3 billion in 2014.