Pfizer 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

83

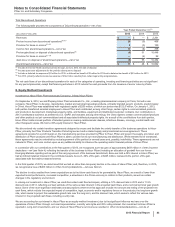

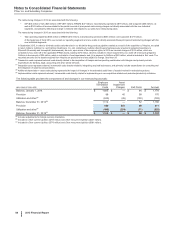

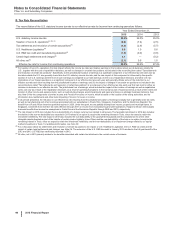

Total Discontinued Operations

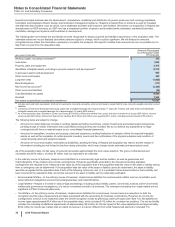

The following table provides the components of Discontinued operations—net of tax:

Year Ended December 31,(a)

(MILLIONS OF DOLLARS) 2015 2014 2013

Revenues $—$—$

2,201

Pre-tax income from discontinued operations(a), (b) 20 (9) 408

Provision for taxes on income(b), (c) 2(3) 100

Income from discontinued operations––net of tax 17 (6) 308

Pre-tax gain/(loss) on disposal of discontinued operations(b) (6) 51 10,446

Provision for taxes on income(b), (d) —(4) 92

Gain/(loss) on disposal of discontinued operations––net of tax (6) 55 10,354

Discontinued operations––net of tax $11$48$

10,662

(a) Includes the Animal Health (Zoetis) business through June 24, 2013, the date of disposal.

(b) Includes post-close adjustments for the periods subsequent to disposal.

(c) Includes a deferred tax expense of $2 million for 2015, a deferred tax benefit of $3 million for 2014 and a deferred tax benefit of $23 million for 2013.

(d) For 2013, primarily reflects income tax expense of $122 million resulting from certain legal entity reorganizations.

The net cash flows of our discontinued operations for each of the categories of operating, investing and financing activities are not significant

for any period presented, except that financing activities in 2013 include the cash proceeds from the issuance of senior notes by Zoetis.

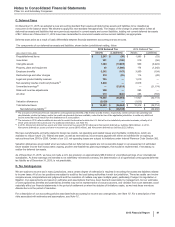

E. Equity-Method Investments

Investment in Hisun Pfizer Pharmaceuticals Company Limited (Hisun Pfizer)

On September 6, 2012, we and Zhejiang Hisun Pharmaceuticals Co., Ltd., a leading pharmaceutical company in China, formed a new

company, Hisun Pfizer, to develop, manufacture, market and sell pharmaceutical products, primarily branded generic products, predominately

in China. Hisun Pfizer was established with registered capital of $250 million, of which our portion was $122.5 million. On January 1, 2013,

both parties transferred selected employees to Hisun Pfizer and contributed, among other things, certain rights to commercialized products

and products in development, intellectual property rights, and facilities, equipment and distribution/customer contracts. Our contributions in

2013 constituted a business, as defined by U.S. GAAP, and included, among other things, the China rights to certain commercialized products

and other products not yet commercialized and all associated intellectual property rights. As a result of the contributions from both parties,

Hisun Pfizer holds a broad portfolio of branded generics covering cardiovascular disease, infectious disease, oncology, mental health and

other therapeutic areas. We hold a 49% equity interest in Hisun Pfizer.

We also entered into certain transition agreements designed to ensure and facilitate the orderly transfer of the business operations to Hisun

Pfizer, primarily the Pfizer Products Transition Period Agreement and a related supply and promotional services agreement. These

agreements provide for a profit margin on the manufacturing services provided by Pfizer to Hisun Pfizer and govern the supply, promotion and

distribution of Pfizer products until Hisun Pfizer is able to provide for its own manufacturing and distribution. While intended to be transitional,

these agreements may be extended by mutual agreement of the parties for several years and, possibly, indefinitely. These agreements are not

material to Pfizer, and none confers upon us any additional ability to influence the operating and/or financial policies of Hisun Pfizer.

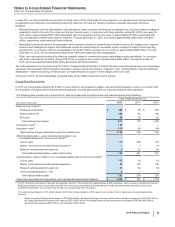

In connection with our contributions in the first quarter of 2013, we recognized a pre-tax gain of approximately $459 million in Other (income)/

deductions––net (see Note 4), reflecting the transfer of the business to Hisun Pfizer (including an allocation of goodwill from our former

Emerging Markets reporting unit as part of the carrying amount of the business transferred). Since we hold a 49% interest in Hisun Pfizer, we

had an indirect retained interest in the contributed assets. As such, 49% of the gain, or $225 million, represents the portion of the gain

associated with that indirect retained interest.

In the third quarter of 2015, we determined that we had an other-than-temporary decline in the value of Hisun Pfizer, and, therefore, in 2015,

we recognized a loss of $463 million in Other (income)/deductions––net (see Note 4).

The decline in value resulted from lower expectations as to the future cash flows to be generated by Hisun Pfizer, as a result of lower than

expected recent performance, increased competition, a slowdown in the China economy in relation to their products, as well as certain

changes in the regulatory environment.

In valuing our investment in Hisun Pfizer, we used discounted cash flow techniques, utilizing a 12% discount rate in 2015 and a 11.5%

discount rate in 2013, reflecting our best estimate of the various risks inherent in the projected cash flows, and a nominal terminal year growth

factor. Some of the more significant estimates and assumptions inherent in this approach include: the amount and timing of the projected net

cash flows, which include the expected impact of competitive, legal, economic and/or regulatory forces on the products; the long-term growth

rate, which seeks to project the sustainable growth rate over the long-term; and the discount rate, which seeks to reflect the various risks

inherent in the projected cash flows, including country risk.

We are accounting for our interest in Hisun Pfizer as an equity-method investment, due to the significant influence we have over the

operations of Hisun Pfizer through our board representation, minority veto rights and 49% voting interest. Our investment in Hisun Pfizer is

reported in Long-term investments, and our share of Hisun Pfizer’s net income is recorded in Other (income)/deductions––net. As of