Pfizer 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

41

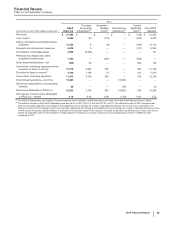

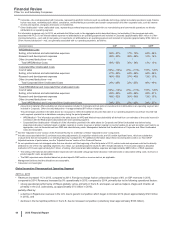

(e) Included in Provision for taxes on income. Income taxes includes the tax effect of the associated pre-tax amounts, calculated by determining the jurisdictional

location of the pre-tax amounts and applying that jurisdiction’s applicable tax rate. As applicable, each period may also include the impact of the remeasurement

of certain deferred tax liabilities resulting from our plant network restructuring activities: in 2014, there was a favorable impact; and in 2013, there was an

unfavorable impact.

(f) Included in Discontinued operations––net of tax. For 2015 and 2014, represents post-close adjustments. For 2013, virtually all relates to our former Animal

Health business, through June 24, 2013, the date of disposal (see Notes to Consolidated Financial Statements—Note 2D. Acquisitions, Licensing Agreements,

Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-Method Investment: Divestitures).

(g) Amounts relate to our cost-reduction and productivity initiatives not related to acquisitions. Included in Restructuring charges and certain acquisition-related

costs (see Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/

Productivity Initiatives).

(h) Amounts relate to our cost-reduction/productivity initiatives not related to acquisitions (see Notes to Consolidated Financial Statements—Note 3. Restructuring

Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives). For 2015, virtually all included in Cost of sales ($145

million), Selling, informational and administrative expenses ($83 million) and Research and development expenses ($19 million). For 2014, virtually all included

in Cost of sales ($253 million), Selling, informational and administrative expenses ($141 million) and Research and development expenses ($83 million). For

2013, included in Selling, informational and administrative expenses ($156 million), Research and development expenses ($127 million) and Cost of sales

($115 million).

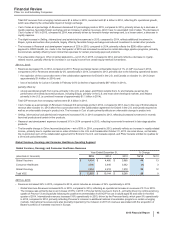

(i) In 2015, represents (i) an $806 million foreign currency loss included in Other (income)/deductions––net related to recent conditions in Venezuela, that had us

resolve that our Venezuelan bolivar-denominated net monetary assets that are subject to revaluation are no longer expected to be settled at the Venezuelan

government CENCOEX official rate of 6.30, but rather at the SIMADI rate of 200, the lowest official rate. Those conditions included the inability to obtain

significant conversions of Venezuelan bolivars related to intercompany U.S. dollar denominated accounts, an evaluation of the effects of the implementation of a

fourth-quarter 2015 operational restructuring, resulting in a 36% reduction in our labor force in Venezuela, and our expectation of the changes in Venezuela’s

responses to changes in its economy; and (ii) a $72 million charge included in Cost of sales related to inventory impairment in Venezuela related to the foreign

currency change described above.

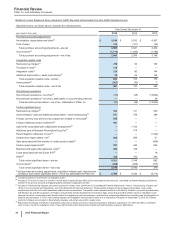

(j) Included in Cost of sales ($72 million) and Selling, informational and administrative expenses ($419 million). In 2015, primarily represents a non-recurring

charge related to settlement of pension obligations in accordance with an offer to certain terminated employees who are vested in their pension benefits to elect

a lump-sum payment or annuity of their deferred vested pension benefits.

(k) Virtually all included in Research and development expenses. Represents a charge associated with a collaborative arrangement with Merck KGaA, announced

in November 2014, to jointly develop and commercialize avelumab, an investigational anti-PD-L1 antibody currently in development as a potential treatment for

multiple types of cancer. The charge includes an $850 million upfront cash payment as well as an additional amount of $309 million, reflecting the estimated fair

value of the co-promotion rights for Xalkori given to Merck KGaA.

(l) Included in Selling, informational and administrative expenses. In 2014, represents a charge to account for an additional year of the non-tax deductible Branded

Prescription Drug Fee in accordance with final regulations issued in the third quarter of 2014 by the IRS.

(m) In 2013, reflects income from a litigation settlement with Teva Pharmaceutical Industries Ltd. and Sun Pharmaceutical Industries Ltd. for patent-infringement

damages resulting from their “at-risk” launches of generic Protonix in the U.S. Included in Other (income)/deductions—net (see the “Other (Income)/Deductions

—Net” section of this Financial Review and Notes to Consolidated Financial Statements—Note 4. Other (Income)/Deductions—Net).

(n) Included in Other (income)/deductions—net (see the “Other (Income)/Deductions—Net” section of this Financial Review and Notes to Consolidated Financial

Statements—Note 4. Other (Income)/Deductions—Net).

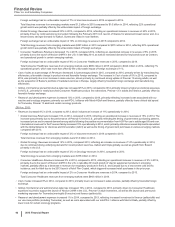

(o) Included in Other (income)/deductions––net. In 2015 and 2014, represents expenses for changes to our infrastructure to align our operations, as well as

reporting for our business segments established in 2014.

(p) Represents costs incurred in connection with the initial public offering of an approximate 19.8% ownership interest in Zoetis. Includes expenditures for banking,

legal, accounting and similar services. For 2013, included in Other (income)/deductions—net (see the “Other (Income)/Deductions—Net” section of this

Financial Review and Notes to Consolidated Financial Statements—Note 4. Other (Income)/Deductions—Net).

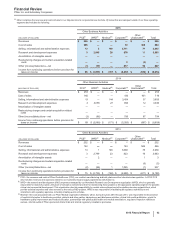

(q) For 2015, virtually all included in Cost of sales ($149 million income), and Other (income)/deductions––net ($473 million). For 2014, virtually all included in

Revenues ($198 million), Cost of sales ($238 million), Selling, informational and administrative expenses ($21 million) and Other (income)/deductions––net

($103 million). For 2013, included in Revenues ($132 million), Cost of sales ($105 million), Selling, informational and administrative expenses ($26 million) and

Other (income)/deductions––net ($291 million). For 2015, includes, among other things, a change in the profit deferred in inventory relating to inventory that had

not been sold to third parties that is included in Cost of sales (non-cash benefit of $221 million), losses of $239 million, which are included in Other (income)/

deductions––net, and are related to our share of an equity method investee’s charges incurred for its re-measurement of a contingent consideration liability, and

charges of $173 million related to the write-down of assets to net realizable value that are primarily included in Other (income)/deductions––net. In 2013,

includes an estimated loss on an option to acquire the remaining interest in Laboratório Teuto Brasileiro S.A. (Teuto), a 40%-owned generics company in Brazil

(approximately $223 million). In 2014, includes income resulting from a decline in the estimated loss from the aforementioned option (approximately $55

million). For 2014, includes, among other things, income associated with the manufacturing and supply agreements with Zoetis Inc. that are virtually all included

in Revenues ($272 million) and Cost of sales ($237 million). For 2013, includes, among other things, income associated with the manufacturing and supply

agreements with Zoetis Inc. that are included in Revenues ($132 million) and Cost of sales ($116 million).

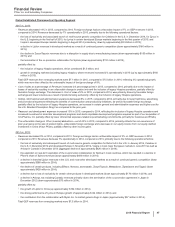

(r) Included in Provision for taxes on income. Income taxes includes the tax effect of the associated pre-tax amounts, calculated by determining the jurisdictional

location of the pre-tax amounts and applying that jurisdiction’s applicable tax rate. The amount in 2015 was favorably impacted by tax benefits associated with

certain tax initiatives. In addition, the amount in 2015 was unfavorably impacted by a non-deductible foreign currency loss related to Venezuela and the non-

deductible charge for the agreement in principle to resolve claims relating to Protonix. The amount in 2014 was favorably impacted by the decline in the non-tax

deductible estimated loss recorded in the third quarter of 2013 related to an option to acquire the remaining interest in Teuto, since we expect to retain the

investment indefinitely, and unfavorably impacted by a non-tax deductible charge to account for an additional year of the Branded Prescription Drug Fee in

accordance with final regulations issued in the third quarter of 2014 by the IRS. The amount in 2013 was favorably impacted by U.S. tax benefits of

approximately $430 million, representing tax and interest, resulting from a settlement with the IRS with respect to audits of the Wyeth tax returns for the years

2006 through date of acquisition and unfavorably impacted by (i) the tax rate associated with the patent litigation settlement income, (ii) the non-deductibility of

goodwill derecognized and the jurisdictional mix of the other intangible assets divested as part of the transfer of certain product rights to Hisun Pfizer, and (iii)

the aforementioned non-tax deductible estimated loss related to the Teuto option, since we expect to retain the investment indefinitely, and the non-deductibility

of an impairment charge related to our equity-method investment in Teuto. See Notes to Consolidated Financial Statements—Note 5A. Tax Matters: Taxes on

Income from Continuing Operations.