Pfizer 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

35

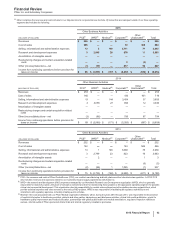

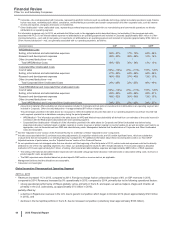

• the non-recurrence of the non-deductibility of the $223 million loss on an option to acquire the remaining interest in Teuto in 2013, since we

expect to retain the investment indefinitely and income in 2014 resulting from a decline in the non-tax deductible estimated loss, from the

aforementioned option,

partially offset by:

• the non-deductibility of the $215 million charge to account for an additional year of the Branded Prescription Drug Fee in accordance with

final regulations issued in the third quarter of 2014 by the IRS;

• a decrease in the favorable impact of the U.S. R&D tax credit as compared to 2013;

• the non-recurrence of the U.S. tax benefits of approximately $430 million, representing tax and interest, resulting from a settlement with

the IRS with respect to audits of the Wyeth tax returns for the year 2006 through date of acquisition; and

• a decrease in 2014 of the favorable impact of the resolution of certain tax positions, pertaining to prior years with various foreign tax

authorities, and from the expiration of certain statutes of limitations as compared to 2013.

Changes in Tax Laws

On February 28, 2013, the Governor of Puerto Rico signed into law Act No. 2-2013, amending Sections 2101 and 2102 of the Puerto Rico

Internal Revenue Code of 1994, which provided for an excise tax that was effective beginning in 2011 (Act 154). The excise tax is imposed on

the purchase of products by multinational corporations and their affiliates from their Puerto Rico affiliates. As originally adopted, the excise tax

was to be in effect from 2011 through 2016 and the tax rate was to decline over time from 4% in 2011 to 1% in 2016. Act No. 2-2013 extended

the excise tax through 2017 and, effective July 1, 2013, increased the tax rate to 4% for all years through 2017. The impact of Act No. 2-2013

is being recorded in Cost of sales and Provision for taxes on income, as appropriate. All expected impacts in 2016 have been reflected in our

financial guidance for 2016.

On December 18, 2015, the President of the United States signed into law the Protecting Americans from Tax Hikes Act of 2015 (the 2015

Act), which generally provides for the temporary or permanent extension, retroactive to January 1, 2015, of certain tax benefits and credits that

had expired, including the U.S. R&D tax credit, which was extended permanently. Given the enactment date of the 2015 Act, the benefit

related to our 2015 R&D spending was recorded in 2015. All expected impacts in 2016 have been reflected in our financial guidance for 2016.

DISCONTINUED OPERATIONS

For information about our discontinued operations, see Notes to Consolidated Financial Statements—Note 2D. Acquisitions, Licensing

Agreements, Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-Method Investment: Divestitures.

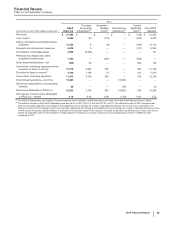

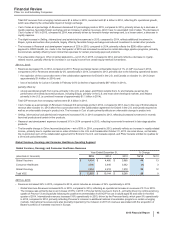

ADJUSTED INCOME

General Description of Adjusted Income Measure

Adjusted income is an alternative view of performance used by management, and we believe that investors’ understanding of our performance

is enhanced by disclosing this performance measure. We report Adjusted income, and certain components of Adjusted income, in order to

portray the results of our major operations––the discovery, development, manufacture, marketing and sale of prescription medicines,

consumer healthcare (OTC) products, and vaccines––prior to considering certain income statement elements. We have defined Adjusted

income as Net income attributable to Pfizer Inc. before the impact of purchase accounting for acquisitions, acquisition-related costs,

discontinued operations and certain significant items, which are described below. Similarly, we have defined the Adjusted income components

as Revenues, Cost of sales, Selling, informational and administrative expenses, Research and development expenses, Amortization of

intangible assets and Other (income)/deductions––net each before the impact of purchase accounting for acquisitions, acquisition-related

costs and certain significant items. The Adjusted income measure and the Adjusted income component measures are not, and should not be

viewed as, a substitute for U.S. GAAP net income or U.S. GAAP net income components.

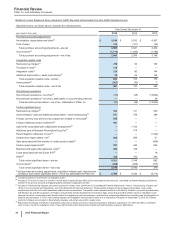

The Adjusted income measure is an important internal measurement for Pfizer. We measure the performance of the overall Company on this

basis in conjunction with other performance metrics. The following are examples of how the Adjusted income measure is utilized:

• senior management receives a monthly analysis of our operating results that is prepared on an Adjusted income basis;

• our annual budgets are prepared on an Adjusted income basis; and

• senior management’s annual compensation is derived, in part, using this Adjusted income measure. Adjusted income is the performance

metric utilized in the determination of bonuses under the Pfizer Inc. Executive Annual Incentive Plan that is designed to limit the bonuses

payable to the Executive Leadership Team (ELT) for purposes of Internal Revenue Code Section 162(m). Subject to the Section 162(m)

limitation, the bonuses are funded from a pool based on the performance measured by three financial metrics, including adjusted diluted

earnings per share, which is derived from Adjusted income. This metric accounts for 40% of the bonus pool funding. The pool applies to

the bonus plans for virtually all bonus-eligible, non-sales-force employees worldwide, including the ELT members and other members of

senior management. In addition, commencing with the 2015 Performance Share Awards, adjusted operating income will be one of the

measures utilized to determine payout. Adjusted operating income is derived from Adjusted income.

Despite the importance of this measure to management in goal setting and performance measurement, Adjusted income is a non-GAAP

financial measure that has no standardized meaning prescribed by U.S. GAAP and, therefore, has limits in its usefulness to investors.

Because of its non-standardized definition, Adjusted income (unlike U.S. GAAP net income) may not be comparable to the calculation of

similar measures of other companies. Adjusted income is presented solely to permit investors to more fully understand how management

assesses performance.