Pfizer 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

46

2015 Financial Report

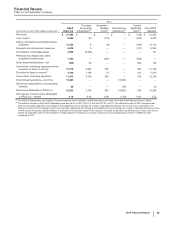

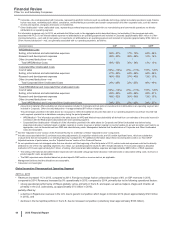

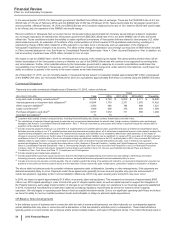

Foreign exchange had an unfavorable impact of 7% on Vaccines revenues in 2015 compared to 2014.

Total Vaccines revenues from emerging markets were $1.2 billion in 2015 compared to $1.0 billion in 2014, reflecting 22% operational

growth which was partially offset by the unfavorable impact of foreign exchange.

Global Oncology Revenues increased 33% in 2015, compared to 2014, reflecting an operational increase in revenues of 43% in 2015,

primarily driven by continued strong momentum following the February 2015 U.S. launch of Ibrance for advanced breast cancer and, to a

lesser extent, stronger demand for Xalkori, Sutent and Inlyta in most markets.

Foreign exchange had an unfavorable impact of 10% on Oncology revenues in 2015 compared to 2014.

Total Oncology revenues from emerging markets were $397 million in 2015 compared to $375 million in 2014, reflecting 22% operational

growth which was partially offset by the unfavorable impact of foreign exchange.

Consumer Healthcare Revenues decreased 1% in 2015, compared 2014, reflecting an operational increase in revenues of 5% in 2015,

primarily due to the launch of Nexium 24HR in the U.S. in late-May 2014, as well as increased demand for key brands such as Centrum,

and operational growth in certain emerging markets.

Foreign exchange had an unfavorable impact of 6% on Consumer Healthcare revenues in 2015, compared to 2014.

Total Consumer Healthcare revenues from emerging markets were $909 million in 2015 compared to $943 million in 2014, reflecting 7%

operational growth, which was more than offset by the unfavorable impact of foreign exchange of 11%.

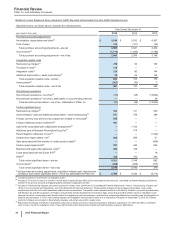

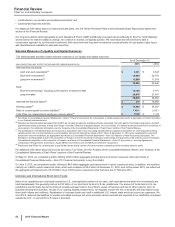

• Cost of sales as a percentage of Revenues decreased 3.3 percentage points in 2015, compared to 2014, primarily driven by manufacturing

efficiencies, a favorable change in product mix and favorable foreign exchange. The increase in Cost of sales of 5% in 2015, compared to

2014, was primarily due to an increase in sales volumes, driven primarily by continued strong uptake of Prevnar 13 among adults, as well

as the acquisition of Baxter’s portfolio of marketed vaccines in Europe, largely offset by favorable foreign exchange and manufacturing

efficiencies.

• Selling, informational and administrative expenses increased 25% in 2015, compared to 2014, primarily driven by higher promotional expenses

in the U.S., primarily for newly launched Consumer Healthcare product line extensions, Prevnar 13 in adults and Ibrance, partially offset by

favorable foreign exchange.

• Research and development expenses increased 13% in 2015, compared to 2014, primarily reflecting increased costs associated with our

vaccine and oncology programs, primarily our anti-PD-L1 alliance with Merck KGaA and Ibrance, partially offset by lower clinical trial spend

for Trumenba, Prevnar 13 adult and certain oncology products.

2014 vs. 2013:

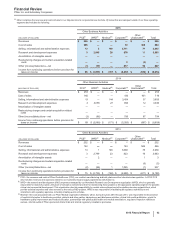

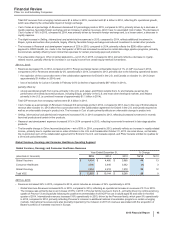

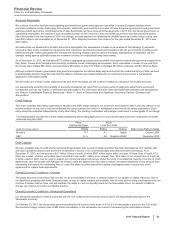

• Revenues increased 9% in 2014, compared to 2013, which includes an increase of 11% operationally in 2014.

Global Vaccines Revenues increased 13% in 2014, compared to 2013, reflecting an operational increase in revenues of 15% in 2014. The

increase was primarily due to the performance of Prevnar 13 in the U.S., primarily reflecting the timing of government purchasing patterns,

increased prices and increased demand among adults following the positive recommendation from ACIP for use in adults aged 65 and over.

International revenues for the Prevenar family increased 10% operationally in 2014, which primarily reflects increased shipments associated

with the Global Alliance for Vaccines and Immunization (GAVI) as well as the timing of government purchases in various emerging markets

compared with 2013.

Foreign exchange had an unfavorable impact of 2% on Vaccines revenues in 2014 compared to 2013.

Total Vaccines revenues from emerging markets were $1.0 billion in 2014.

Global Oncology Revenues increased 12% in 2014, compared 2013, reflecting an increase in revenues of 14% operationally in 2014,

due to continued strong underlying demand for recent product launches, Xalkori and Inlyta globally, as well as growth from Bosulif,

primarily in the U.S.

Foreign exchange had an unfavorable impact of 2% on Oncology revenues in 2014, compared to 2013.

Total Oncology revenues from emerging markets were $375 million in 2014.

Consumer Healthcare Revenues increased 3% in 2014, compared to 2013, reflecting an operational increase in revenues of 5% in 2014,

primarily due to the launch of Nexium 24HR in the U.S. in late-May 2014 and growth of vitamin supplement products in emerging

markets, partially offset by a decrease in revenues for respiratory products in the U.S. and Canada due to a less severe cold and flu

incidence, and for Advil due to the 2013 launch of Advil Film-Coated, which triggered increased retail purchases in the prior year.

Foreign exchange had an unfavorable impact of 2% on Consumer Healthcare revenues in 2014, compared to 2013.

Total Consumer Healthcare revenues from emerging markets were $943 million in 2014.

• Cost of sales increased 8% in 2014, compared to 2013, primarily due to an increase in sales volumes, partially offset by favorable foreign

exchange.

• Selling informational and administrative expenses increased 10% in 2014, compared to 2013, primarily driven by Consumer Healthcare

expenses incurred to support the launch of Nexium 24HR in the U.S., Prevnar 13 adult investment, as well as the launch and pre-launch

marketing expenses for Trumenba (meningitis B vaccine) and Ibrance (palbociclib).

• Research and development expenses increased 1% in 2014, compared to 2013, reflecting increased investment in Ibrance (palbociclib) and

our vaccines portfolio (including Trumenba), as well as costs associated with our anti-PD-L1 alliance with Merck KGaA, partially offset by

lower costs for certain oncology programs.