Pfizer 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

56

2015 Financial Report

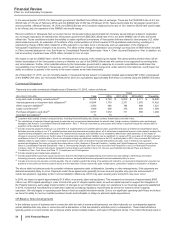

NEW ACCOUNTING STANDARDS

Recently Issued Accounting Standards, Not Adopted as of December 31, 2015

See Notes to Consolidated Financial Statements—Note 1B. Basis of Presentation and Significant Accounting Policies: Adoption of New

Accounting Standards.

The following table provides a brief description of recently issued accounting standards, not yet adopted:

Standard Description Effective Date Effect on the Financial

Statements or Other

Significant Matters

In November 2014, the Financial

Accounting Standards Board

(FASB) issued amended guidance

related to accounting for hybrid

financial instruments issued or

held as investments.

The new guidance clarifies that for hybrid

financial instruments in the form of stock,

the assessment of whether the embedded

derivative is clearly and closely related to

the host instrument must consider the

economic characteristics and risks of the

entire hybrid financial instrument, including

the embedded derivative feature that is

being evaluated for separate accounting

from the host contract.

January 1, 2016. We do not expect that the

provisions of this new

standard will have any

material impact on our

consolidated financial

statements.

In August 2014, the FASB issued

amended guidance related to

disclosure of uncertainties about

the ability of an entity to continue as

a going concern.

The new guidance requires management of

all entities to evaluate whether there is

substantial doubt about the entity’s ability to

continue as a going concern and, as

necessary, to provide related footnote

disclosures.

December 31, 2016.

Earlier application is

permitted.

We do not expect that the

provisions of this new

standard will have any impact

on our consolidated financial

statements.

In July 2015, the FASB issued an

update related to inventory.

The new guidance requires that inventory be

measured at the lower of cost or net

realizable value.

January 1, 2017.

Earlier application is

permitted as of the

beginning of an

interim or annual

reporting period.

We do not expect the

provisions of this new

standard will have a material

impact on our consolidated

financial statements.

In May 2014, the FASB issued

amended guidance related to

revenue from contracts with

customers. In August 2014, the

FASB issued updated guidance

deferring the effective date of the

revenue recognition standard.

The new guidance introduces a new

principles-based framework for revenue

recognition and disclosure.

January 1, 2018.

Earlier application is

permitted only as of

annual reporting

periods beginning

after December 15,

2016, including

interim reporting

periods within that

reporting period.

We have not yet completed

our final review of the impact

of this guidance, although we

currently do not anticipate a

material impact on our

revenue recognition practices.

We continue to review

variable consideration,

potential disclosures, and our

method of adoption to

complete our evaluation of the

impact on our consolidated

financial statements. In

addition, we continue to

monitor additional changes,

modifications, clarifications or

interpretations being

undertaken by the FASB,

which may impact our current

conclusions.

In September 2015, the FASB

issued an update to its guidance on

business combinations.

The new guidance requires that an acquirer

recognize adjustments to provisional

amounts identified during the measurement

period be recorded in the reporting period

determined. The new guidance also requires

that the acquirer records, in the same

period’s financial statements, the effect on

earnings of changes in depreciation,

amortization, or other income effects, if any,

as a result of the change to the provisional

amounts. These are calculated as if the

accounting had been completed as of the

acquisition date. The new guidance also

requires separate presentation on the face

of the income statement, or disclosure within

the notes for the portion of the amount that

would have been recorded in previous

reporting periods if the adjustment to the

provisional amounts had been recognized

as of the acquisition date.

January 1, 2016.

Effective for all

adjustments made

to provisional

amounts reported

for acquisitions still

in the measurement

stage as of the

effective date.

We will use this guidance for

any adjustments made after

January 1, 2016 to any

provisional amounts reported

for acquisitions, but do not

expect it to have a material

impact on our consolidated

financial statements.