Pfizer 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

81

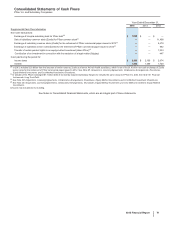

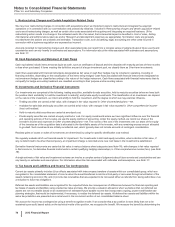

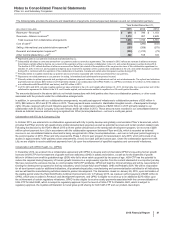

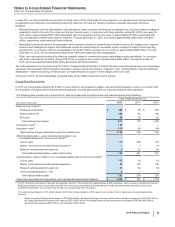

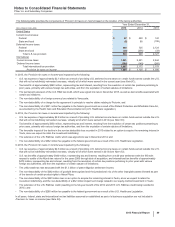

The following table provides the amounts and classification of payments (income/(expense)) between us and our collaboration partners:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2015 2014 2013

Revenues—Revenues(a) $644 $786 $1,153

Revenues—Alliance revenues(b) 1,312 957 2,628

Total revenues from collaborative arrangements 1,956 1,743 3,781

Cost of sales(c) (282)(280)(333)

Selling, informational and administrative expenses(d) (287)(268)(279)

Research and development expenses(e) (330)(1,210)(73)

Other income/(deductions)—net(f) 482 518 103

(a) Represents sales to our partners of products manufactured by us.

(b) Substantially all relates to amounts earned from our partners under co-promotion agreements. The increase in 2015 reflects an increase in alliance revenues

from Eliquis, partially offset by Spiriva (as a result of the expiration of the co-promotion collaboration in the U.S. and certain European countries during 2014).

The decline in 2014 reflects declines in alliance revenues from Enbrel (as a result of the expiration of the co-promotion term of the collaboration agreement on

October 31, 2013 in the U.S. and Canada) and Spiriva (as a result of the expiration of the co-promotion collaboration in the U.S. and certain European countries

during 2014, combined with the expiration of the collaboration in Australia, Canada and certain other European countries during 2013).

(c) Primarily relates to royalties earned by our partners and cost of sales associated with inventory purchased from our partners.

(d) Represents net reimbursements to our partners for selling, informational and administrative expenses incurred.

(e) Primarily relates to upfront payments and pre-approval milestone payments earned by our partners as well as net reimbursements. The upfront and milestone

payments were as follows: $310 million in 2015 (primarily related to our collaboration with OPKO Health, Inc. (OPKO), see below), $1.2 billion in 2014 (related to

our collaboration with Merck KGaA, see below), and $67 million in 2013.

(f) In 2015, 2014 and 2013, includes royalties earned on sales of Enbrel in the U.S. and Canada after October 31, 2013. On that date, the co-promotion term of the

collaboration agreement for Enbrel in the U.S. and Canada expired, and we became entitled to royalties for a 36-month period thereafter.

The amounts disclosed in the above table do not include transactions with third parties other than our collaboration partners, or other costs

associated with the products under the collaborative arrangements.

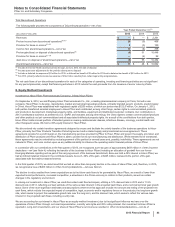

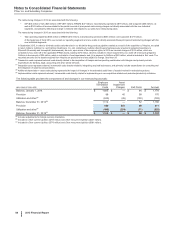

In addition, in connection with our collaborative arrangements, we paid post-approval milestones to collaboration partners of $20 million in

2015, $80 million in 2014 and $175 million in 2013. These payments were recorded in Identifiable intangible assets––Developed technology

rights. We also received upfront and milestone payments from our collaboration partners of $200 million in 2015 primarily related to our

collaboration with Eli Lilly & Company (Lilly) (see below) and $128 million in 2013. These amounts were recorded in our consolidated balance

sheets as deferred revenue and are being recognized into Other (income)/deductions––net over a multi-year period.

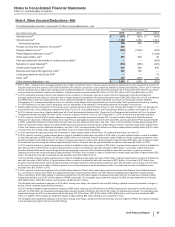

Collaboration with Eli Lilly & Company (Lilly)

In October 2013, we entered into a collaboration agreement with Lilly to jointly develop and globally commercialize Pfizer’s tanezumab, which

provides that Pfizer and Lilly will equally share product-development expenses as well as potential revenues and certain product-related costs.

Following the decision by the FDA in March 2015 to lift the partial clinical hold on the tanezumab development program, we received a $200

million upfront payment from Lilly in accordance with the collaboration agreement between Pfizer and Lilly, which is recorded as deferred

revenue in our consolidated balance sheet and is being recognized into Other (income)/deductions––net over a multi-year period beginning in

the second quarter of 2015. Pfizer and Lilly resumed the Phase 3 chronic pain program for tanezumab in July 2015, which will consist of six

studies in approximately 7,000 patients across osteoarthritis, chronic low back pain and cancer pain. Under the collaboration agreement with

Lilly, we are eligible to receive additional payments from Lilly upon the achievement of specified regulatory and commercial milestones.

Collaboration with OPKO Health, Inc. (OPKO)

In December 2014, we entered into a collaborative agreement with OPKO to develop and commercialize OPKO’s long-acting human growth

hormone (hGH-CTP) for the treatment of growth hormone deficiency (GHD) in adults and children, as well as for the treatment of growth

failure in children born small for gestational age (SGA) who fail to show catch-up growth by two years of age. hGH-CTP has the potential to

reduce the required dosing frequency of human growth hormone to a single weekly injection from the current standard of one injection per day.

We have received the exclusive license to commercialize hGH-CTP worldwide. OPKO will lead the clinical activities and will be responsible for

funding the development programs for the key indications, which include Adult and Pediatric GHD and Pediatric SGA. We will be responsible

for all development costs for additional indications, all postmarketing studies, manufacturing and commercialization activities for all indications,

and we will lead the manufacturing activities related to product development. The transaction closed on January 28, 2015, upon termination of

the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act. In February 2015, we made an upfront payment of $295 million to

OPKO, which was recorded in Research and development expenses, and OPKO is eligible to receive up to an additional $275 million upon

the achievement of certain regulatory milestones. OPKO is also eligible to receive royalty payments associated with the commercialization of

hGH-CTP for Adult GHD, which is subject to regulatory approval. Upon the launch of hGH-CTP for Pediatric GHD, which is subject to

regulatory approval, the royalties will transition to tiered gross profit sharing for both hGH-CTP and our product, Genotropin.