Pfizer 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

12

2015 Financial Report

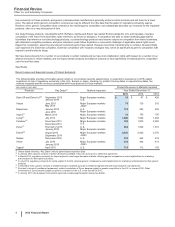

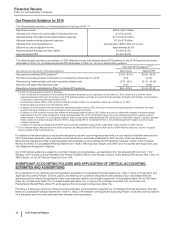

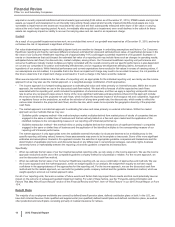

Our Financial Guidance for 2016

The following table provides our financial guidance for full-year 2016(a), (b):

Reported revenues $49.0 to $51.0 billion

Adjusted cost of sales as a percentage of reported revenues 21.0% to 22.0%

Adjusted selling, informational and administrative expenses $13.2 to $14.2 billion

Adjusted research and development expenses $7.3 to $7.8 billion

Adjusted other (income)/deductions Approximately ($300 million) of income

Effective tax rate on adjusted income Approximately 24.0%

Reported diluted Earnings per Share (EPS) $1.54 to $1.67

Adjusted diluted EPS $2.20 to $2.30

The following table provides a reconciliation of 2016 Adjusted income and Adjusted diluted EPS guidance to the 2016 Reported net income

attributable to Pfizer Inc. and Reported diluted EPS attributable to Pfizer Inc. common shareholders guidance:

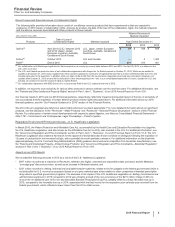

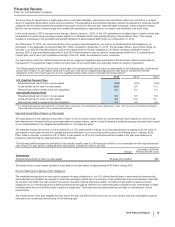

Full-Year 2016 Guidance(a), (b)

(BILLIONS OF DOLLARS, EXCEPT PER SHARE AMOUNTS) Net Income Diluted EPS

Adjusted income/diluted EPS guidance(b) $13.6 - $14.2 $2.20 - $2.30

Purchase accounting impacts of transactions completed as of December 31, 2015 (2.8) (0.46)

Restructuring, implementation and other acquisition-related costs (0.7) - (0.9) (0.11) - (0.14)

Business and legal entity alignment costs (0.4) (0.06)

Reported net income attributable to Pfizer Inc./diluted EPS guidance $9.5 - $10.3 $1.54 - $1.67

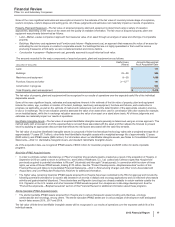

(a) The 2016 financial guidance reflects the following:

• Does not assume the completion of any business-development transactions not completed as of December 31, 2015, including any one-time upfront

payments associated with such transactions. Our 2016 financial guidance excludes any impact from the pending combination with Allergan. The transaction

is expected to close during the second half of 2016.

• Excludes the potential effects of the resolution of litigation-related matters not substantially resolved as of February 12, 2016.

• Exchange rates assumed are as of mid-January 2016.

• Guidance for 2016 reported revenues reflects the anticipated negative impact of $2.3 billion due to recent and expected generic competition for certain

products that have recently lost or are anticipated to soon lose patent protection.

• Guidance for 2016 reported revenues also reflects the anticipated negative impact of $2.3 billion as a result of unfavorable changes in foreign exchange

rates relative to the U.S. dollar compared to foreign exchange rates from 2015, including $0.8 billion due to the estimated significant negative currency

impact related to Venezuela. The anticipated negative impact on reported and adjusted diluted EPS resulting from unfavorable changes in foreign exchange

rates compared to foreign exchange rates from 2015 is approximately $0.16, including $0.07 due to the estimated significant negative currency impact

related to Venezuela.

• Guidance for reported and adjusted diluted EPS assumes diluted weighted-average shares outstanding of approximately 6.2 billion shares.

(b) For an understanding of Adjusted income and its components and Adjusted diluted EPS (all of which are non-GAAP financial measures), see the “Adjusted

Income” section of this Financial Review.

For additional information about our actual and anticipated costs and cost savings associated with our cost-reduction initiatives announced in

2014, the Hospira acquisition, and our global commercial structure, which was established in 2014, see the “Costs and Expenses––

Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives” section of this Financial

Review and Notes to Consolidated Financial Statements––Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and

Cost-Reduction/Productivity Initiatives.

Our 2016 financial guidance is subject to a number of factors and uncertainties—as described in the “Our Operating Environment”, “Our

Strategy” and “Forward-Looking Information and Factors That May Affect Future Results” sections of this Financial Review and Part I, Item 1A,

“Risk Factors,” of our 2015 Annual Report on Form 10-K.

SIGNIFICANT ACCOUNTING POLICIES AND APPLICATION OF CRITICAL ACCOUNTING

ESTIMATES AND ASSUMPTIONS

For a description of our significant accounting policies, see Notes to Consolidated Financial Statements––Note 1. Basis of Presentation and

Significant Accounting Policies. Of these policies, the following are considered critical to an understanding of our consolidated financial

statements as they require the application of the most subjective and the most complex judgments: (i) Acquisitions (Note 1D); (ii) Fair Value

(Note 1E); (iii) Revenues (Note 1G); (iv) Asset Impairments (Note 1K); (v) Income Tax Contingencies (Note 1O); (vi) Pension and

Postretirement Benefit Plans (Note 1P); and Legal and Environmental Contingencies (Note 1Q).

Following is a discussion about the critical accounting estimates and assumptions impacting our consolidated financial statements. See also

Notes to Consolidated Financial Statements––Note 1C. Basis of Presentation and Significant Accounting Policies: Estimates and Assumptions

for a discussion about the risks associated with estimates and assumptions.