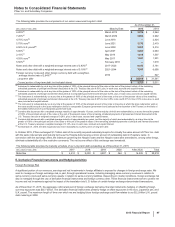

Pfizer 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2015 Financial Report

87

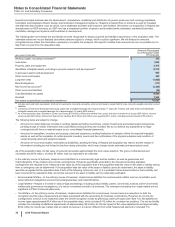

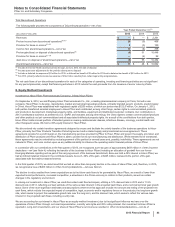

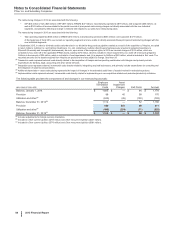

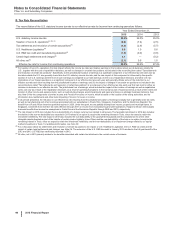

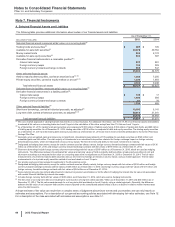

Note 4. Other (Income)/Deductions—Net

The following table provides components of Other (income)/deductions––net:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2015 2014 2013

Interest income(a) $(471)$(425)$ (403)

Interest expense(a) 1,199 1,360 1,414

Net interest expense 728 935 1,011

Foreign currency loss related to Venezuela(b) 806 ——

Royalty-related income(c) (922)(1,002)(523)

Patent litigation settlement income(d) ——(1,342)

Other legal matters, net(e) 975 993 35

Gain associated with the transfer of certain product rights(f) ——(459)

Net gains on asset disposals(g) (232)(288)(320)

Certain asset impairments(h) 818 469 878

Business and legal entity alignment costs(i) 282 168 —

Costs associated with the Zoetis IPO(j) ——18

Other, net(k) 403 (265)170

Other (income)/deductions––net $2,860 $1,009 $(532)

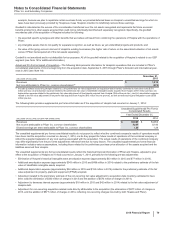

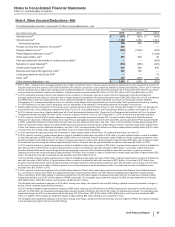

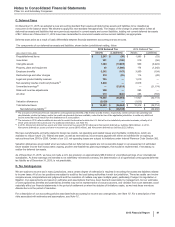

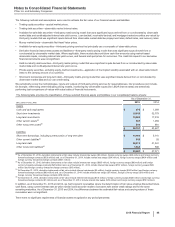

(a) 2015 v. 2014––Interest income increased primarily due to higher investment returns. Interest expense decreased, primarily due to the repayment of a portion of

long-term debt in the first quarter of 2015 and the benefit of the effective conversion of some fixed-rate liabilities to floating-rate liabilities. 2014 v. 2013––Interest

income increased due to higher cash equivalents and investment balances. Interest expense decreased, primarily due to the benefit of the effective conversion

of some fixed-rate liabilities to floating-rate liabilities. Capitalized interest expense totaled $32 million in 2015, $41 million in 2014 and $32 million in 2013.

(b) In 2015, represents a foreign currency loss related to recent conditions in Venezuela, that had us resolve that our Venezuelan bolivar-denominated net

monetary assets that are subject to revaluation are no longer expected to be settled at the Venezuelan government CENCOEX official rate of 6.30, but rather at

the SIMADI rate of 200, the lowest official rate. Those conditions included the inability to obtain significant conversions of Venezuelan bolivars related to

intercompany U.S. dollar denominated accounts, an evaluation of the effects of the implementation of a fourth-quarter 2015 operational restructuring, resulting

in a 36% reduction in our labor force in Venezuela, and our expectation of the changes in Venezuela’s responses to changes in its economy.

(c) Royalty related income increased in 2014 primarily due to royalties earned on sales of Enbrel in the U.S. and Canada after October 31, 2013. On that date, the

co-promotion term of the collaboration agreement for Enbrel in the U.S. and Canada expired, and Pfizer became entitled to royalties until October 31, 2016.

(d) In 2013, reflects income from a litigation settlement with Teva Pharmaceutical Industries Ltd. (Teva) and Sun Pharmaceutical Industries Ltd. (Sun) for patent-

infringement damages resulting from their “at-risk” launches of generic Protonix in the U.S. As of December 31, 2014, all amounts due had been collected.

(e) In 2015, primarily includes $784.6 million related to an agreement in principle reached in February 2016 to resolve claims alleging that Wyeth's practices

relating to the calculation of Medicaid rebates for its drug Protonix (pantoprazole sodium) between 2001 and 2006, several years before Pfizer acquired Wyeth

in 2009, violated the Federal Civil False Claims Act and other laws (for additional information, see Note 17A4). In 2014, primarily includes approximately $610

million for Neurontin-related matters (including off-label promotion actions and antitrust actions), $400 million to resolve a securities class action against Pfizer

in New York federal court (for additional information, see Note 17A5), and approximately $56 million for an Effexor-related matter, partially offset by $130 million

of income from the reversal of two legal accruals where a loss is no longer deemed probable.

(f) In 2013, represents the gain associated with the transfer of certain product rights to Hisun Pfizer. For additional information, see Note 2E.

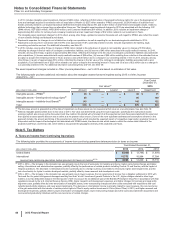

(g) In 2015, primarily includes (i) gross realized gains on sales of available-for-sale equity securities of $164 million; (ii) gross realized losses on sales of available-

for-sale debt securities of $960 million; (iii) net gain of $937 million from derivative financial instruments used to hedge the foreign exchange component of the

divested available-for-sale debt securities; (iv) gains on sales/out-licensing of product and compound rights of approximately $90 million; and (v) gains on sales

of investments in private equity securities of approximately $3 million. Proceeds from the sale of available-for-sale securities were $4.3 billion in 2015.

In 2014, primarily includes (i) gross realized gains on sales of available-for-sale equity securities of $76 million; (ii) gross realized gains on sales of available-for-

sale debt securities of $138 million; (iii) gross realized losses on sales of available-for-sale debt securities of $436 million; (iv) net gain of $323 million from

derivative financial instruments used to hedge the foreign exchange component of the divested available-for-sale debt securities; (v) gains on sales/out-

licensing of product and compound rights of approximately $135 million; and (vi) gains on sales of investments in private equity securities of approximately $39

million. Proceeds from the sale of available-for-sale securities were $10.2 billion in 2014.

In 2013, primarily includes (i) gross realized gains on sales of available-for-sale equity securities of $87 million; (ii) gross realized gains on sales of available-for-

sale debt securities of $442 million; (iii) gross realized losses on sales of available-for-sale debt securities of $310 million; (iv) net loss of $137 million from

derivative financial instruments used to hedge the foreign exchange component of the divested available-for-sale debt securities; and (v) a gain of $170 million

on the sale of various product rights, including a portion of our in-licensed generic sterile injectables portfolio. Proceeds from the sale of available-for-sale

securities were $15.2 billion in 2013.

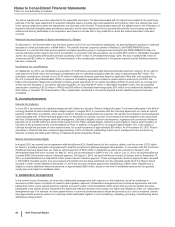

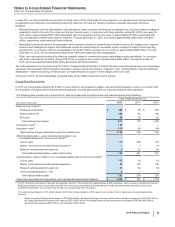

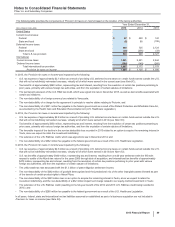

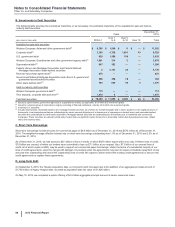

(h) In 2015, primarily includes an impairment loss of $463 million related to Pfizer’s 49%-owned equity-method investment with Zhejiang Hisun Pharmaceuticals

Co., Ltd. (Hisun) in China, Hisun Pfizer (for additional information concerning Hisun Pfizer, see Note 2E) and intangible asset impairment charges of $323

million, reflecting (i) $132 million related to indefinite-lived brands; (ii) $120 million related to developed technology rights for the treatment of attention deficit

hyperactivity disorder; and (iii) $71 million related to IPR&D compounds. The intangible asset impairment charges for 2015 are associated with the following:

GEP ($294 million), WRD ($13 million); and Consumer Healthcare ($17 million).

The intangible asset impairment charges for 2015 reflect, among other things, the impact of new scientific findings, updated commercial forecasts, changes in

pricing, and an increased competitive environment.

In 2014, includes intangible asset impairment charges of $396 million, reflecting (i) $190 million for an IPR&D compound for the treatment of skin fibrosis (full

write-off); (ii) $159 million for developed technology rights, primarily related to Quillivant XR; and (iii) $47 million for indefinite-lived brands. The intangible asset

impairment charges for 2014 are associated with the following: GIP ($12 million); GEP ($166 million); WRD ($190 million); and Consumer Healthcare ($28

million). In addition, 2014 includes an impairment charge of approximately $56 million related to our investment in Teuto.

The intangible asset impairment charges for 2014 reflect, among other things, updated commercial forecasts; and with regard to IPR&D, the impact of changes

to the development program and new scientific findings.