Pfizer 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Appendix A

2015 Financial Report

Table of contents

-

Page 1

Appendix A 2015 Financial Report -

Page 2

... operating and financial performance, business plans and prospects, in-line products and product candidates, strategic reviews, capital allocation, businessdevelopment plans and plans relating to share repurchases and dividends. Such forward-looking statements are based on management's plans... -

Page 3

....7 billion, net of cash acquired). Commencing from the acquisition date, our financial statements reflect the assets, liabilities, operating results and cash flows of Hospira, and, in accordance with our domestic and international reporting periods, our consolidated financial statements for the year... -

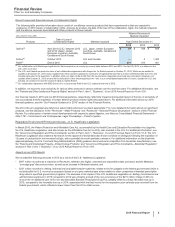

Page 4

...Pfizer-standalone increase $ $ $ See the "Analysis of the Consolidated Statements of Income--Revenues--Overview" section below for more information, including a discussion of key drivers of our revenue performance. Income from Continuing Operations Before Provision for Taxes on Income--2015 Income... -

Page 5

Financial Review Pfizer Inc. and Subsidiary Companies lose exclusivity on these products, and generic pharmaceutical manufacturers generally produce similar products and sell them for a lower price. The date at which generic competition commences may be different from the date that the patent or ... -

Page 6

... other products in various markets over the next few years. For additional information, see the "Patents and Other Intellectual Property Rights" section in Part I, Item 1, "Business", of our 2015 Annual Report on Form 10-K. Our financial results in 2015 and our 2016 financial guidance, respectively... -

Page 7

...Medicare "coverage gap" discount provision; and $362 million recorded in Selling, informational and administrative expenses, related to the fee payable to the federal government. 2014 included a $215 million charge to account for an additional year of the non-tax deductible Branded Prescription Drug... -

Page 8

... information about our Accounts Receivable, see the "Analysis of Financial Condition, Liquidity and Capital Resources" section of this Financial Review. Significant portions of our revenues and earnings, as well as our substantial international net assets, are exposed to changes in foreign exchange... -

Page 9

...we acquired Hospira, and its commercial operations are now included within GEP. Commencing from the acquisition date, and in accordance with our domestic and international reporting periods, our consolidated statement of income, primarily GEP's operating results, for the year ended December 31, 2015... -

Page 10

...Business Development Initiatives" and "Analysis of Financial Condition, Liquidity and Capital Resources" sections of this Financial Review for additional information. On September 3, 2015, (the acquisition date), we acquired Hospira for approximately $16.1 billion in cash ($15.7 billion, net of cash... -

Page 11

Financial Review Pfizer Inc. and Subsidiary Companies quarterly dividend paid during 2015. For additional information, see the "Analysis of Financial Condition, Liquidity and Capital Resources" section of this Financial Review and Notes to Consolidated Financial Statements--Note 12. Equity. We ... -

Page 12

... 6, 2012, we and Zhejiang Hisun Pharmaceuticals Co., Ltd. (Hisun), a leading pharmaceutical company in China, formed a new company, Hisun Pfizer, to develop, manufacture, market and sell pharmaceutical products, primarily branded generic products, predominately in China. In the first quarter of 2013... -

Page 13

... for full-year 2016(a), (b): Reported revenues Adjusted cost of sales as a percentage of reported revenues Adjusted selling, informational and administrative expenses Adjusted research and development expenses Adjusted other (income)/deductions Effective tax rate on adjusted income Reported diluted... -

Page 14

... to Consolidated Financial Statements--Note 11D. Pension and Postretirement Benefit Plans and Defined Contribution Plans: Plan Assets. For a discussion about the application of Fair Value to our asset impairment reviews, see "Asset Impairment Reviews" below. Revenues Our gross product revenues are... -

Page 15

...-Looking Information and Factors That May Affect Future Results" section of this Financial Review and Part I. Item 1A "Risk Factors" in our 2015 Annual Report on Form 10-K. Benefit Plans The majority of our employees worldwide are covered by defined benefit pension plans, defined contribution plans... -

Page 16

... (in millions, pre-tax): Change Assumption Expected annual rate of return on plan assets 50 basis point decline $98 Increase in 2016 Net Periodic Benefit Costs The actual return on plan assets resulted in a net gain on our plan assets of approximately $163 million during 2015. Discount Rate Used to... -

Page 17

... Hospira assets acquired and liabilities assumed as of the acquisition date, see Notes to Consolidated Financial Statements--Note 2A. Acquisitions, Licensing Agreements, Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-Method Investment: Acquisitions. The estimated values... -

Page 18

... IPR&D assets are in various stages of development with anticipated launch dates across 2016, 2017 and 2018. The fair value of finite-lived identifiable intangible assets will be recognized in our results of operations over the expected useful life of the individual assets. 2015 Financial Report 17 -

Page 19

...a successful product. Contingencies-For acquisition date contingencies, see Notes to Consolidated Financial Statements--Note 2. Acquisitions, Licensing Agreements, Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-Method Investment: Acquisitions. 18 2015 Financial Report -

Page 20

... Pfizer Inc. and Subsidiary Companies ANALYSIS OF THE CONSOLIDATED STATEMENTS OF INCOME (MILLIONS OF DOLLARS) Revenues Cost of sales % of revenues Selling, informational and administrative expenses % of revenues Research and development expenses % of revenues Amortization of intangible assets... -

Page 21

... other products in various markets over the next few years. For additional information, see the "Patents and Other Intellectual Property Rights" section in Part I, Item 1, "Business", of our 2015 Annual Report on Form 10-K. We have significant operations outside the U.S., with revenues exceeding... -

Page 22

...• For additional rebate accrual information, see Notes to Consolidated Financial Statements--Note 1G. Basis of Presentation and Significant Accounting Policies: Revenues and Trade Accounts Receivable. Our accruals for Medicare rebates, Medicaid and related state program rebates, performance-based... -

Page 23

... = the Global Established Pharmaceutical segment. On September 3, 2015, we acquired Hospira and its commercial operations are now included within GEP. Commencing from the acquisition date, and in accordance with our domestic and international reporting periods, our consolidated statement of income... -

Page 24

...Review Pfizer Inc. and Subsidiary Companies 2014 v. 2013 See the Revenues-Overview section of this Analysis of the Consolidated Statements of Income for a discussion of performance of worldwide revenues. Geographically, • in the U.S., revenues decreased $1.2 billion or 6% in 2014, compared to 2013... -

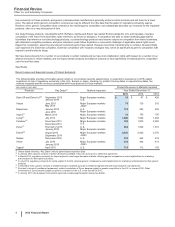

Page 25

Financial Review Pfizer Inc. and Subsidiary Companies Revenues-Major Products The following table provides revenue information for several of our major products: (MILLIONS OF DOLLARS) PRODUCT INNOVATIVE PRODUCTS BUSINESS GIP (a) (b) (a) PRIMARY INDICATIONS Year Ended December 31, 2015 2014 2013 ... -

Page 26

... all legacy Hospira commercial operations. Commencing from the acquisition date, September 3, 2015, and in accordance with our domestic and international reporting periods, our consolidated statement of income, primarily GEP's operating results, for the year ended December 31, 2015 reflects four... -

Page 27

... the treatment of elevated LDL-cholesterol levels in the blood. Lipitor faces generic competition in all major developed markets. Branded Lipitor recorded worldwide revenues of $1.9 billion, or a 4% operational decrease in 2015, compared to 2014. Foreign exchange had an unfavorable impact of 6% in... -

Page 28

... two companies share commercialization expenses and profit/losses equally on a global basis. In April 2015, we signed an agreement with BMS to transfer full commercialization rights in certain smaller markets to us, beginning in the third quarter of 2015. BMS supplies the product to us at cost plus... -

Page 29

Financial Review Pfizer Inc. and Subsidiary Companies PRODUCT DEVELOPMENTS-BIOPHARMACEUTICAL We continue to invest in R&D to provide potential future sources of revenues through the development of new products, as well as through additional uses for in-line and alliance products. Notwithstanding ... -

Page 30

Financial Review Pfizer Inc. and Subsidiary Companies REGULATORY APPROVALS AND FILINGS IN THE EU AND JAPAN PRODUCT Xalkori (Crizotinib) Eliquis (Apixaban) (a) DESCRIPTION OF EVENT Application filed in the EU for the treatment of ROS1-positive non-small cell lung cancer Approval in Japan for the ... -

Page 31

... 2014, Hospira launched Inflectra in Canada. Inflectra has also been approved in certain markets, where Hospira will market it as Remsimaâ„¢. In September 2015, in order to eliminate certain redundancies in Pfizer's biosimilar drug products pipeline created as a result of the acquisition of Hospira... -

Page 32

Financial Review Pfizer Inc. and Subsidiary Companies COSTS AND EXPENSES Cost of Sales (MILLIONS OF DOLLARS) Year Ended December 31, 2015 2014 $ 9,648 19.7% $ 9,577 19.3% $ 2013 9,586 18.6% % Change 15/14 1 14/13 - Cost of sales As a percentage of Revenues 2015 v. 2014 Cost of sales increased... -

Page 33

...-calendar-year share relative to other companies of branded prescription drug sales to specified government programs; and the favorable impact of foreign exchange of 1%, increased investments in recently launched products and certain in-line products, as well as the launch and pre-launch marketing... -

Page 34

... to Consolidated Financial Statements-Note10A. Identifiable Intangible Assets and Goodwill: Identifiable Intangible Assets. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/ Productivity Initiatives Year Ended December 31, (MILLIONS OF DOLLARS) % Change 2013 15... -

Page 35

... Financial Statements-Note 4. Other (Income)/Deductions-Net. See also the "Analysis of Operating Segment Information" section of this Financial Review. PROVISION FOR TAXES ON INCOME (MILLIONS OF DOLLARS) Year Ended December 31, 2015 2014 $ 1,990 22.2% $ 3,120 25.5% $ 2013 4,306 27.4% % Change... -

Page 36

... the results of our major operations--the discovery, development, manufacture, marketing and sale of prescription medicines, consumer healthcare (OTC) products, and vaccines--prior to considering certain income statement elements. We have defined Adjusted income as Net income attributable to Pfizer... -

Page 37

... fixed assets, amortization related to the increase in fair value of acquired debt, and the fair value changes associated with contingent consideration. Therefore, the Adjusted income measure includes the revenues earned upon the sale of the acquired products without considering the acquisition cost... -

Page 38

... intangible asset impairments; adjustments related to the resolution of certain tax positions; the impact of adopting certain significant, event-driven tax legislation; or charges related to certain legal matters, such as certain of those discussed in Notes to Consolidated Financial Statements... -

Page 39

... PER COMMON SHARE DATA Revenues Cost of sales Selling, informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs Other (income)/deductions--net Income from continuing operations before... -

Page 40

... PER COMMON SHARE DATA Revenues Cost of sales Selling, informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs Other (income)/deductions--net Income from continuing operations before... -

Page 41

...applicable tax rate. Included in Restructuring charges and certain acquisition-related costs (see Notes to Consolidated Financial Statements-Note 3. Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives). Restructuring charges include employee... -

Page 42

... in Discontinued operations--net of tax. For 2015 and 2014, represents post-close adjustments. For 2013, virtually all relates to our former Animal Health business, through June 24, 2013, the date of disposal (see Notes to Consolidated Financial Statements-Note 2D. Acquisitions, Licensing Agreements... -

Page 43

...and Subsidiary Companies ANALYSIS OF OPERATING SEGMENT INFORMATION The following tables and associated notes provide additional information about the performance of our three operating segments-the Global Innovative Pharmaceutical segment (GIP); the Global Vaccines, Oncology and Consumer Healthcare... -

Page 44

...) Revenues Cost of sales Selling, informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs Other (income)/deductions--net Income from continuing operations before provision for taxes on... -

Page 45

...based on product-specific R&D costs or revenue metrics, as applicable. Management believes that the allocations are reasonable. * Calculation not meaningful. Global Innovative Pharmaceutical Operating Segment 2015 vs. 2014 • Revenues increased 1% in 2015, compared to 2014. Foreign exchange had an... -

Page 46

Financial Review Pfizer Inc. and Subsidiary Companies Total GIP revenues from emerging markets were $1.6 billion in 2015, consistent with $1.6 billion in 2014, reflecting 9% operational growth, which was offset by the unfavorable impact of foreign exchange. • Cost of sales as a percentage of ... -

Page 47

... newly launched Consumer Healthcare product line extensions, Prevnar 13 in adults and Ibrance, partially offset by favorable foreign exchange. • Research and development expenses increased 13% in 2015, compared to 2014, primarily reflecting increased costs associated with our vaccine and oncology... -

Page 48

Financial Review Pfizer Inc. and Subsidiary Companies Global Established Pharmaceutical Operating Segment 2015 vs. 2014: • Revenues decreased 14% in 2015, compared to 2014. Foreign exchange had an unfavorable impact of 7% on GEP revenues in 2015, compared to 2014. Revenues decreased by 7% ... -

Page 49

... 11% in 2014 compared to 2013, due to lower clinical trial expenses and the benefits from cost-reduction and productivity initiatives, partially offset by increased spending on our biosimilars development programs. ANALYSIS OF THE CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Changes in the... -

Page 50

Financial Review Pfizer Inc. and Subsidiary Companies ANALYSIS OF THE CONSOLIDATED BALANCE SHEETS For information about certain of our financial assets and liabilities, including Cash and cash equivalents, Short-term investments, Long-term investments, Short-term borrowings, including current ... -

Page 51

...15.7 billion, net of cash acquired, in 2015 for the acquisition of Hospira (see Notes to Consolidated Financial Statements- Note 2A. Acquisitions, Licensing Agreements, Collaborative Arrangements, Divestitures, Equity-Method Investments and Cost-Method Investment: Acquisitions); and • cash paid of... -

Page 52

... and development activities; • investments in our business; • dividend payments and potential increases in the dividend rate; • share repurchases; • the cash requirements associated with our cost-reduction/productivity initiatives; • paying down outstanding debt; 2015 Financial Report 51 -

Page 53

... held and for a description of credit risk related to our financial instruments held. Selected net financial assets decreased during 2015 as net cash provided by operating activities decreased, and cash paid for the Hospira acquisition, dividend payments and share purchases, among other things, more... -

Page 54

... a group of banks and other financial intermediaries. We maintain cash and cash equivalent balances and short-term investments in excess of our commercial paper and other short-term borrowings. As of December 31, 2015, we had access to $8.1 billion of lines of credit, of which $687 million expire... -

Page 55

Financial Review Pfizer Inc. and Subsidiary Companies In the second quarter of 2015, the Venezuelan government identified three official rates of exchange. These are the CENCOEX rate of 6.3; the SICAD rate of 13.5 (as of February 2016); and the SIMADI rate of 200 (as of February 2016). News reports ... -

Page 56

... share, payable on March 2, 2016, to shareholders of record at the close of business on February 5, 2016. The first-quarter 2016 cash dividend will be our 309th consecutive quarterly dividend. Our current and projected dividends provide a return to shareholders while maintaining sufficient capital... -

Page 57

Financial Review Pfizer Inc. and Subsidiary Companies NEW ACCOUNTING STANDARDS Recently Issued Accounting Standards, Not Adopted as of December 31, 2015 See Notes to Consolidated Financial Statements-Note 1B. Basis of Presentation and Significant Accounting Policies: Adoption of New Accounting ... -

Page 58

... and financial liabilities by measurement category and form of financial asset on the balance sheet or the accompanying notes to the financial statements. 4. Clarifies that an entity should evaluate the need for a valuation allowance on a deferred tax asset related to availablefor-sale securities in... -

Page 59

... with any discussion of, among other things, our anticipated future operating and financial performance, business plans and prospects, in-line products and product candidates, strategic reviews, capital allocation, business-development plans, and plans relating to share repurchases and dividends. In... -

Page 60

... market price of Pfizer's common stock and on Pfizer's operating results, risks relating to the value of the Allergan shares to be issued in the transaction, significant transaction costs and/or unknown liabilities, the risk of litigation and/or regulatory actions, the loss of key senior management... -

Page 61

Financial Review Pfizer Inc. and Subsidiary Companies companies following the transaction, changes in global, political, economic, business, competitive, market and regulatory forces, future exchange and interest rates, changes in tax and other laws, regulations, rates and policies, future business ... -

Page 62

Financial Review Pfizer Inc. and Subsidiary Companies With respect to our long-term borrowings, we strive to maintain a predominantly floating-rate basis position, but here too, we may change our strategy depending upon prevailing market conditions. We generally issue debt with a fixed rate, and ... -

Page 63

... 31, 2015, Hospira, Inc.'s and its subsidiaries' internal control over financial reporting associated with total assets of $24.2 billion and total revenues of $1.5 billion included in the consolidated financial statements of Pfizer Inc. and Subsidiary Companies as of and for the year ended December... -

Page 64

... with management and the independent registered public accounting firm regarding the fair and complete presentation of Pfizer's results and the assessment of Pfizer's internal control over financial reporting. We discussed significant accounting policies applied in Pfizer's financial statements, as... -

Page 65

... tax assets, liabilities and associated valuation allowances as non-current. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Pfizer Inc. and Subsidiary Companies' internal control over financial reporting... -

Page 66

... balance sheets of Pfizer Inc. and Subsidiary Companies as of December 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, equity, and cash flows for each of the years in the three-year period ended December 31, 2015, and our report dated February 29, 2016... -

Page 67

Consolidated Statements of Income Pfizer Inc. and Subsidiary Companies (MILLIONS, EXCEPT PER COMMON SHARE DATA) Revenues Costs and expenses: Cost of sales(a) Selling, informational and administrative expenses(a) Research and development expenses(a) Amortization of intangible assets Restructuring ... -

Page 68

... pension cost, into Cost of sales, Selling, informational and administrative expenses, and/or Research and development expenses, as appropriate, in the consolidated statements of income. For additional information, see Note 11. Pension and Postretirement Benefit Plans and Defined Contribution Plans... -

Page 69

Consolidated Balance Sheets Pfizer Inc. and Subsidiary Companies (MILLIONS, EXCEPT PREFERRED STOCK ISSUED AND PER COMMON SHARE DATA) As of December 31, 2015 $ 2014 Assets Cash and cash equivalents Short-term investments Trade accounts receivable, less allowance for doubtful accounts: 2015-$384; ... -

Page 70

... Total Equity $ 81,678 22,072 2,593 (6,509) (2) (121) 2,296 (16,290) (11) 2,479 (11,408) (145) (12) 76,620 9,168 (4,042) Deconsolidation of subsidiary sold(a) Other Balance, December 31, 2013 Net income Other comprehensive income/(loss), net of tax Cash dividends declared: Common stock Preferred... -

Page 71

...of acquisitions and divestitures: Trade accounts receivable Inventories Other assets Trade accounts payable Other liabilities Other tax accounts, net Net cash provided by operating activities Investing Activities Purchases of property, plant and equipment Purchases of short-term investments Proceeds... -

Page 72

...Equity-Method Investments and Cost-Method Investment: Divestitures. (b) In October 2015, Pfizer exchanged $1.7 billion debt of its recently acquired subsidiary Hospira for virtually the same amount of Pfizer Inc. debt. See Note 7D. Financial Instruments: Long-Term Debt. (c) See Note 2D. Acquisitions... -

Page 73

... $16.1 billion in cash. Commencing from the acquisition date, our financial statements reflect the assets, liabilities, operating results and cash flows of Hospira, and, in accordance with our domestic and international reporting periods, our consolidated financial statements for the year ended... -

Page 74

... D. Acquisitions Our consolidated financial statements include the operations of an acquired business after the completion of the acquisition. We account for acquired businesses using the acquisition method of accounting, which requires, among other things, that most assets acquired and liabilities... -

Page 75

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies G. Revenues and Trade Accounts Receivable Revenue Recognition-We record revenues from product sales when the goods are shipped and title passes to the customer. At the time of sale, we also record estimates for a ... -

Page 76

...assets benefit multiple business functions. Amortization expense related to intangible assets that are associated with a single function and depreciation of property, plant and equipment are included in Cost of sales, Selling, informational and administrative expenses and/or Research and development... -

Page 77

... costs associated with acquiring and integrating an acquired business. (If the restructuring action results in a change in the estimated useful life of an asset, that incremental impact is classified in Cost of sales, Selling, informational and administrative expenses and/or Research and development... -

Page 78

... standard. Liabilities associated with uncertain tax positions are classified as current only when we expect to pay cash within the next 12 months. Interest and penalties, if any, are recorded in Provision for taxes on income and are classified on our consolidated balance sheet with the related tax... -

Page 79

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Hospira's principal business was the development, manufacture, marketing and distribution of generic acute-care and oncology injectables, biosimilars and integrated infusion therapy and medication management systems. Hospira... -

Page 80

... related to the preliminary purchase price allocation of the assets acquired and the liabilities assumed from Hospira. The unaudited supplemental pro forma consolidated results reflect the historical financial information of Pfizer and Hospira, adjusted to give effect to the acquisition of Hospira... -

Page 81

... Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The above adjustments were then adjusted for the applicable tax impact. The taxes associated with the adjustments related to the preliminary estimate of the fair value adjustment for acquired intangible assets, property, plant... -

Page 82

...(b) Total revenues from collaborative arrangements Cost of sales(c) Selling, informational and administrative expenses Research and development expenses(e) Other income/(deductions)-net(f) (a) (b) (d) (287) (330) 482 (c) (d) (e) (f) Represents sales to our partners of products manufactured by... -

Page 83

...of Pfizer common stock (held in Treasury stock) valued at approximately $11.4 billion. The operating results of the animal health business through June 24, 2013, the date of disposal, are reported as Income from discontinued operations--net of tax in the consolidated statement of income for the year... -

Page 84

... commercialized and all associated intellectual property rights. As a result of the contributions from both parties, Hisun Pfizer holds a broad portfolio of branded generics covering cardiovascular disease, infectious disease, oncology, mental health and other therapeutic areas. We hold a 49% equity... -

Page 85

... the combined company. For up to a three-year period post-acquisition, we expect to incur costs of approximately $1 billion (not including costs of $215 million in 2015 associated with the return of acquired in-process research and development rights as described in the Current-Period Key Activities... -

Page 86

...costs recorded in our consolidated statements of income as follows(e): Cost of sales Selling, informational and administrative expenses Research and development expenses Other (income)/deductions--net Total implementation costs Total costs associated with acquisitions and cost-reduction/productivity... -

Page 87

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The restructuring charges in 2014 are associated with the following: • GIP ($35 million); VOC ($28 million); GEP ($57 million); WRD/M ($37 million); manufacturing operations ($97 million); and Corporate ($65 million),... -

Page 88

... billion in 2013. In 2015, primarily includes an impairment loss of $463 million related to Pfizer's 49%-owned equity-method investment with Zhejiang Hisun Pharmaceuticals Co., Ltd. (Hisun) in China, Hisun Pfizer (for additional information concerning Hisun Pfizer, see Note 2E) and intangible asset... -

Page 89

... asset impairments. The decrease in international income is primarily related to lower revenues, the non-recurrence of the gain associated with the transfer of certain product rights to Pfizer's equity-method investment in China (Hisun Pfizer) in 2013, and higher research and development expenses... -

Page 90

...to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following table provides the components of Provision for taxes on income based on the location of the taxing authorities: Year Ended December 31, (MILLIONS OF DOLLARS) 2015 2014 2013 United States Current income taxes... -

Page 91

... of the U.S. R&D tax credit in January 2013 resulted in the full-year benefit of the 2012 and 2013 U.S. R&D tax credit being recorded in 2013. All other, net in 2015 primarily relates to tax benefits associated with certain tax initiatives in the normal course of business. 90 2015 Financial Report -

Page 92

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies C. Deferred Taxes On December 31, 2015, we adopted a new accounting standard that requires all deferred tax assets and liabilities to be classified as noncurrent in the balance sheet. We elected to apply this new standard... -

Page 93

...., the IRS is auditing 2010-2011 and 2012-2013. Tax years 2014-2015 (through date of acquisition) are open but not under audit. All other tax years are closed. The open tax years and audits for Hospira, Inc. and its subsidiaries are not considered material to Pfizer. • 92 2015 Financial Report -

Page 94

... of $26 million loss in 2015, $3 million gain in 2014 and $62 million loss in 2013. Relates to Zoetis (our former Animal Health subsidiary). See Note 2D. As of December 31, 2015, we estimate that we will reclassify into 2016 income the following pre-tax amounts currently held in Accumulated other... -

Page 95

... 53,627 Selected financial assets measured at fair value on a recurring basis(a) Trading funds and securities(b) Available-for-sale debt securities(c) Money market funds Available-for-sale equity securities(c) Derivative financial instruments in a receivable position(d): Interest rate swaps Foreign... -

Page 96

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following methods and assumptions were used to estimate the fair value of our financial assets and liabilities Trading equity securities-quoted market prices. Trading debt securities-observable market interest rates... -

Page 97

... due to the addition of an aggregate principal amount of $1,750 million of legacy Hospira debt, recorded at acquisition-date fair value of $1,928 million. On May 15, 2014, we completed a public offering of $4.5 billion aggregate principal amount of senior unsecured notes. 96 2015 Financial Report -

Page 98

... to changes in foreign exchange rates. We seek to manage our foreign exchange risk, in part, through operational means, including managing same-currency revenues in relation to same-currency costs and same-currency assets in relation to same-currency liabilities. Depending on market conditions... -

Page 99

...Statements Pfizer Inc. and Subsidiary Companies All derivative contracts used to manage foreign currency risk are measured at fair value and are reported as assets or liabilities on the consolidated balance sheet. Changes in fair value are reported in earnings or in Other comprehensive income/(loss... -

Page 100

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following table provides information about the gains/(losses) incurred to hedge or offset operational foreign exchange or interest rate risk: Amount of Gains/(Losses) Recognized in OID(a), (b), (c) 2015 2014 Amount ... -

Page 101

... by amortization, impairments and the impact of foreign exchange. For information about the assets acquired as part of the acquisition of Hospira and Baxter's portfolio of marketed vaccines, see Note 2A. For information about impairments of intangible assets, see Note 4. 100 2015 Financial Report -

Page 102

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Our identifiable intangible assets are associated with the following, as a percentage of total identifiable intangible assets, less accumulated amortization: December 31, 2015 GIP Developed technology rights Brands, finite... -

Page 103

.... GEP additions relate to our acquisition of Hospira and are subject to change until we complete the recording of the assets acquired and liabilities assumed from Hospira. For additional information, see Note 2A. Note 11. Pension and Postretirement Benefit Plans and Defined Contribution Plans The... -

Page 104

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies 2014 v. 2013--The decrease in net periodic benefit costs for our U.S. qualified pension plans was primarily driven by (i) the decrease in the amounts amortized for actuarial losses resulting from the increase, in 2013, in... -

Page 105

... benefit plans is determined annually and evaluated and modified to reflect at yearend the prevailing market rate of a portfolio of high-quality fixed income investments, rated AA/Aa or better that reflect the rates at which the pension benefits could be effectively settled. For our international... -

Page 106

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies C. Obligations and Funded Status The following table provides an analysis of the changes in our benefit obligations, plan assets and funded status of our benefit plans: Year Ended December 31, Pension Plans U.S. Qualified... -

Page 107

...Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following table provides information as to how the funded status is recognized in our consolidated balance sheets: As of December 31, Pension Plans U.S. Qualified (MILLIONS OF DOLLARS) U.S. Supplemental (Non-Qualified) 2015... -

Page 108

...Fixed income commingled funds Other investments: Partnership investments(b) Insurance contracts Other commingled funds(c) Total International pension plans Cash and cash equivalents Equity securities: Global equity securities Equity commingled funds Fixed income securities: Corporate debt securities... -

Page 109

... annuity insurance contract that was executed by legacy Wyeth for certain members of its defined benefit plans prior to Pfizer acquiring the company in 2009, and $129 million related to an investment in a partnership whose primary holdings are public equity securities. 108 2015 Financial Report -

Page 110

... Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Global plan assets are managed with the objective of generating returns that will enable the plans to meet their future obligations, while seeking to minimize net periodic benefit costs and cash contributions over the long-term... -

Page 111

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Note 12. Equity A. Common Stock We purchase our common stock through privately negotiated transactions or in open market purchases as circumstances and prices warrant. Purchased shares under each of the share-purchase plans... -

Page 112

...grant date using the closing price of Pfizer common stock. The values determined through this fair value methodology generally are amortized on a straight-line basis over the vesting term into Cost of sales, Selling, informational and administrative expenses, and/or Research and development expenses... -

Page 113

...Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following table provides data related to all RSU activity: Year Ended December 31, (MILLIONS OF DOLLARS) 2015 $ $ 371 279 1.8 $ $ 2014 401 255 1.8 $ $ 2013 379 239 1.8 Total fair value of shares vested Total compensation... -

Page 114

...line basis over the probable vesting term into Cost of sales, Selling, informational and administrative expenses and/or Research and development expenses, as appropriate, and adjusted each reporting period, as necessary, to reflect changes in the price of Pfizer's common stock, changes in the number... -

Page 115

... method, for which we use the closing price of Pfizer common stock. The values are amortized on a straight-line basis over the probable vesting term into Cost of sales, Selling, informational and administrative expenses, and/or Research and development expenses, as appropriate, and adjusted each... -

Page 116

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following table provides data related to all PSA activity: (MILLIONS OF DOLLARS) 2015 $ $ Total fair value of shares vested Total compensation cost related to nonvested PSA grants not yet recognized, pre-tax Weighted... -

Page 117

... could result in a loss of patent protection for the drug at issue, a significant loss of revenues from that drug and impairments of any associated assets. Product liability and other product-related litigation, which can include personal injury, consumer, off-label promotion, securities, antitrust... -

Page 118

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Actions In Which We Are The Plaintiff Sutent (sunitinib malate) In May 2010, Mylan notified us that it had filed an abbreviated new drug application with the FDA seeking approval to market a generic version of Sutent ... -

Page 119

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Matters Involving Our Collaboration/Licensing Partners Nexium 24HR (esomeprazole) We have an exclusive license from AstraZeneca PLC (AstraZeneca) to market in the U.S. the over-the-counter (OTC) version of Nexium (... -

Page 120

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Effexor • Personal Injury Actions A number of individual lawsuits and multi-plaintiff lawsuits have been filed against us and/or our subsidiaries in various federal and state courts alleging personal injury as a result of... -

Page 121

... wholesale price (AWP) information for certain of their products that was higher than the actual average prices at which those products were sold. The AWP is used to determine reimbursement levels under Medicare Part B and Medicaid and in many private-sector insurance policies and medical plans. All... -

Page 122

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Monsanto-Related Matters In 1997, Monsanto Company (Former Monsanto) contributed certain chemical manufacturing operations and facilities to a newly formed corporation, Solutia Inc. (Solutia), and spun off the shares of... -

Page 123

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies In 2012, Pfizer sold the UK Marketing Authorisation for phenytoin sodium capsules to a third party, but retained the right to supply the finished product to that third party. In May 2013, the U.K. Competition & Markets ... -

Page 124

...we acquired Hospira, and its commercial operations are now included within GEP. Commencing from the acquisition date, and in accordance with our domestic and international reporting periods, our consolidated statement of income, primarily GEP's operating results, for the year ended December 31, 2015... -

Page 125

... statement of income for the year ended December 31, 2015 reflects four months of legacy Hospira U.S. operations and three months of legacy Hospira international operations. See Note 2A for additional information. Other business activities includes the revenues and operating results of Pfizer... -

Page 126

... September 3, 2015, we acquired Hospira. Commencing from the acquisition date, and in accordance with our domestic and international reporting periods, our consolidated statement of income for the year ended December 31, 2015 reflects four months of legacy Hospira U.S. operations and three months of... -

Page 127

... 2014. In 2013, sales to our three largest U.S. wholesaler customers represented approximately 12%, 9% and 8% of total revenues, respectively. For all years presented, these sales and related trade accounts receivable were concentrated in our biopharmaceutical businesses. 126 2015 Financial Report -

Page 128

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Significant Product Revenues The following table provides detailed revenue information: (MILLIONS OF DOLLARS) INNOVATIVE PRODUCTS BUSINESS(a) GIP(a) Lyrica GIP(b) Enbrel (Outside the U.S. and Canada) Viagra GIP(c) ... -

Page 129

... all legacy Hospira commercial operations. Commencing from the acquisition date, September 3, 2015, and in accordance with our domestic and international reporting periods, our consolidated statement of income, primarily GEP's operating results, for the year ended December 31, 2015 reflects four... -

Page 130

... Allergan, a global pharmaceutical company incorporated in Ireland, under which we have agreed to combine with Allergan in a stock transaction valued at $363.63 per Allergan share, for a total enterprise value of approximately $160 billion, based on the closing price of Pfizer common stock of $32... -

Page 131

..., our consolidated statement of income for the fourth quarter of 2015 reflects three months of legacy Hospira global operations. The fourth quarter of 2015 historically reflects higher costs in Cost of sales, Selling, informational and administrative expenses and Research and development expenses... -

Page 132

... Earnings per common share-diluted: Income from continuing operations attributable to Pfizer Inc. common shareholders Discontinued operations-net of tax Net income attributable to Pfizer Inc. common shareholders Cash dividends paid per common share Stock prices High Low (a) (b) $ $ 0.35 0.01 0.36... -

Page 133

.... and Subsidiary Companies Year Ended/As of December 31,(a) (MILLIONS, EXCEPT PER COMMON SHARE DATA) Revenues(b) Income from continuing operations(b) Total assets(b), (c) Long-term obligations(b), (c), (d) Earnings per common share-basic Income from continuing operations attributable to Pfizer Inc... -

Page 134

...$75 $50 2010 2011 PFIZER 2012 2013 2014 S&P 500 2015 PEER GROUP Five Year Performance 2010 PFIZER PEER GROUP S&P 500 $100.0 $100.0 $100.0 2011 $128.8 $115.0 $102.1 2012 $155.1 $129.2 $118.4 2013 195.7 171.8 156.8 2014 $206.1 $193.2 $178.2 2015 $220.7 $196.0 $180.7 2015 Financial Report 133