Pep Boys 2010 Annual Report Download - page 94

Download and view the complete annual report

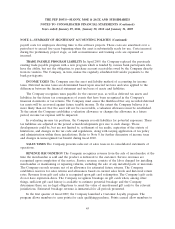

Please find page 94 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ASU 2010-06 also clarifies existing disclosures for the level of disaggregating, disclosures about

valuation techniques and inputs used to determine level 2 or 3 fair value measurements and includes

conforming amendments to the guidance on employers’ disclosures about postretirement benefit plan

assets. ASU 2010-06 was effective for interim and annual reporting periods beginning after

December 15, 2009 except for the disclosures about purchases, sales, issuances or settlements in the roll

forward activity for level 3 fair value measurements which are effective for interim and annual periods

beginning after December 15, 2010. The adoption of ASU 2010-06 did not have a material impact on

the Company’s consolidated financial statements.

In December 2010, the FASB issued ASU 2010-29 ‘‘Business Combinations (Topic 805)—

Disclosure of Supplementary Pro Forma Information for Business Combinations’’ (ASU 2010-29). This

accounting standard update clarifies that SEC registrants presenting comparative financial statements

should disclose in their pro forma information revenue and earnings of the combined entity as though

the current period business combinations had occurred as of the beginning of the comparable prior

annual reporting period only. The update also expands the supplemental pro forma disclosures to

include a description of the nature and amount of material, nonrecurring pro forma adjustments

directly attributable to the business combination included in the reported pro forma revenue and

earnings. ASU 2010-29 is effective prospectively for material (either on an individual or aggregate

basis) business combinations entered into in fiscal years beginning on or after December 15, 2010 with

early adoption permitted. The Company does not believe the adoption of those requirements of ASU

2010-29 will have a material impact on the consolidated results of operations and financial condition.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

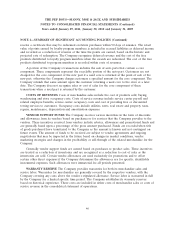

The Company has market rate exposure in its financial instruments due to changes in interest rates

and prices.

Variable and Fixed Rate Debt

The Company’s Revolving Credit Agreement bears interest at LIBOR or Prime plus 2.75% to

3.25% based upon the then current availability under the facility. At January 29, 2011, there were no

outstanding borrowings under the agreement. Additionally, the Company has a Senior Secured Term

Loan facility with a balance of $148.6 million at January 29, 2011, that bears interest at three month

LIBOR plus 2.00%. Excluding our interest rate swap, a one percent change in the LIBOR rate would

have affected net earnings by approximately $1.0 million for fiscal 2010. The risk related to changes in

the three month LIBOR rate are substantially mitigated by our interest rate swap.

At January 29, 2011, the fair value of the Company’s fixed rate debt instruments, principally the

$147.6 million 7.50% Senior Subordinated Notes, due December 15, 2014, was $149.8 million. At

January 30, 2010, the fair value of the Company’s fixed rate debt instruments, principally the

$157.6 million 7.50% Senior Subordinated Notes, due December 15, 2014, was $148.9 million. The

Company determines fair value on its fixed rate debt by using quoted market prices and current

interest rates.

Interest Rate Swaps

The Company entered into an interest rate swap for a notional amount of $145.0 million that is

designated as a cash flow hedge on the first $145.0 million of the Company’s Senior Secured Term

Loan facility. The interest rate swap converts the variable LIBOR portion of the interest payments to a

fixed rate of 5.036% and terminates in October 2013. As of January 29, 2011 and January 30, 2010, the

fair value of the swap was a net $16.4 million payable recorded within other long-term liabilities on the

balance sheet.

36