Pep Boys 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

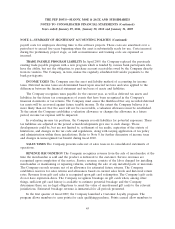

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

COMPREHENSIVE LOSS Other comprehensive loss includes pension liability and fair market

value of cash flow hedges.

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company may enter into

interest rate swap agreements to hedge the exposure to increasing rates with respect to its certain

variable rate debt agreements. The Company recognizes all derivatives as either assets or liabilities in

the statement of financial position and measures those instruments at fair value.

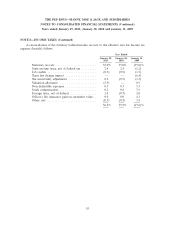

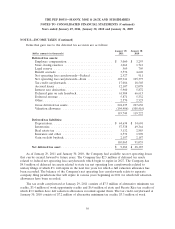

SEGMENT INFORMATION The Company has six operating segments defined by geographic

regions which are Northeast, Mid-Atlantic, Southeast, Central, West and Southern CA. Each segment

serves both DIY and DIFM lines of business. The Company aggregates all of its operating segments

and has one reportable segment. Sales by major product categories are as follows:

Year ended

January 29, January 30, January 31,

(dollar amounts in thousands) 2011 2010 2009

Parts and accessories ................... $1,261,678 $1,219,396 $1,255,975

Tires .............................. 336,490 314,223 313,689

Service labor ......................... 390,473 377,319 358,124

Total revenues ....................... $1,988,641 $1,910,938 $1,927,788

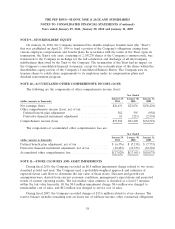

SIGNIFICANT SUPPLIERS During fiscal 2010, the Company’s ten largest suppliers accounted for

approximately 53% of merchandise purchased. No single supplier accounted for more than 20% of the

Company’s purchases. The Company has no long-term contracts or minimum purchase commitments

under which the Company is required to purchase merchandise. Open purchase orders are based on

current inventory or operational needs and are fulfilled by vendors within short periods of time and

generally are not binding agreements.

SELF INSURANCE The Company has risk participation arrangements with respect to workers’

compensation, general liability, automobile liability, and other casualty coverages. The Company has a

wholly owned captive insurance subsidiary through which it reinsures this retained exposure. This

subsidiary uses both risk sharing treaties and third party insurance to manage this exposure. In

addition, the Company self insures certain employee-related health care benefit liabilities. The

Company maintains stop loss coverage with third party insurers through which it reinsures certain of its

casualty and health care benefit liabilities. The Company records both liabilities and reinsurance

receivables using actuarial methods utilized in the insurance industry based upon historical claims

experience.

RECLASSIFICATION Certain prior period amounts have been reclassified to conform to current

period presentation. These reclassifications had no effect on reported totals for assets, liabilities,

shareholders’ equity, cash flows or net income.

48