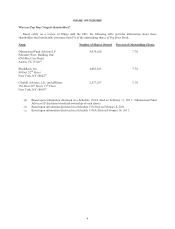

Pep Boys 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

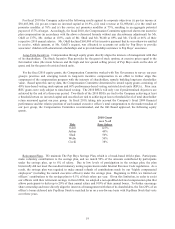

Executive Sessions of the Independent Directors. Our non-executive Chairman, Mr. Lukens, presides over all

such sessions, which are held, at a minimum, immediately following all regularly scheduled Board meetings.

Board Leadership Structure and Role in Risk Oversight. Pep Boys currently separates the roles of Chairman of

the Board and Chief Executive Officer. Given the relatively short tenure of both our current Chairman of the Board

and President & Chief Executive Officer, the Board believes that the separation of these roles currently allows the

President & Chief Executive Officer to focus his efforts primarily on the successful short and long-term operations of

the Company for the benefit of all its constituents, while allowing the Chairman of the Board to manage the

operation of the Board in its oversight of the President & Chief Executive Officer and Pep Boys’ strategic direction.

Pep Boys has adopted an enterprise risk oversight program pursuant to which management, lead by Pep Boys’

Chief Financial Officer and General Counsel, together with the Audit Committee identifies the most significant risks

faced by the Company. On a quarterly basis, management assesses the status of these risks and the Company’s

mitigation efforts against them, which are reporting in writing to the full Board and discussed in detail with the Audit

Committee and in summary fashion with the full Board.

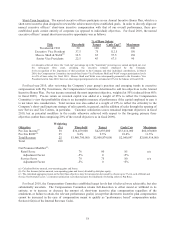

Compensation Policies and Practices Risk. In connection with its annual review of Pep Boys’ compensation

policies and practices, our Compensation Committee of the Board of Directors, together with senior management

and the Compensation Committee’s independent executive compensation consultant, considered whether any of our

compensation policies and practices has the potential to create risks that are reasonably likely to have a material

adverse effect on Pep Boys. The Compensation Committee considered the risk profile of our business and the design

and structure of our compensation policies and practices. We concluded that the risks arising from our compensation

policies and practices are not reasonably likely to have a material adverse effect on Pep Boys based on the following:

• Pep Boys is not engaged in speculative activities that have the potential for creating unusual gains or losses.

• Our base salaries, retirement benefits, perquisites and generally available benefit programs create little, if any,

risk to Pep Boys.

• Except as provided below, all of our management employees who receive short-term incentive-based

compensation do so pursuant to the terms of our shareholder approved Annual Incentive Bonus Plan. The

bonus targets under such plan for Officer’s are entirely based, and for middle-management are primarily

based, upon the achievement of stated corporate-level financial objectives, which are in alignment with our

overall business plan. In particular, we do not place disproportionate weight on any one metric, do not

include an inordinate amount of metrics, reasonably leverage the selected metrics and employ features to

mitigate risks, including limitations on annual cash payouts. Accordingly, we do not believe that the structure

of the Annual Incentive Bonus Plan encourages associates to take risks that are reasonably likely to have a

material adverse effect on Pep Boys. (The aforementioned exception is for store level associates who have a

separate bonus program and whose bonus compensation, individually or in the aggregate, is of an amount that

creates little, if any, risk to Pep Boys.)

• Our long-term incentive-based compensation is granted in the form of equity awards, which are subject to

time-based and performance-based vesting that is aligned to our corporate objective of creating value for our

shareholders. The nature of such awards discourages short-term risk taking. In addition, our officers are

subject to share ownership guidelines requiring them to be invested in our future performance.

• We believe that our mix of fixed compensation and “at risk” compensation does not encourage inappropriate

risk-taking by our associates.

Personal Loans to Executive Officers and Directors. Pep Boys has no personal loans extended to its executive

officers or directors.

Director Attendance at the Annual Meeting. All Board members are strongly encouraged to attend the Annual

Meeting of Shareholders. All nominees then standing for election attended the 2010 Annual Meeting.