Pep Boys 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

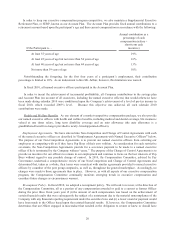

Equity Grants. The 2009 Stock Incentive Plan provides for an annual equity grant having an aggregate value of

$55,000 to non-management directors. The Stock Incentive Plan is administered, interpreted and implemented by

the Compensation Committee.

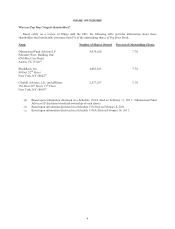

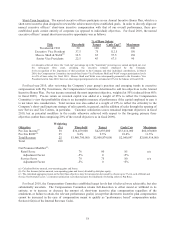

The following table details the compensation paid to non-employee directors during the fiscal year ended January

29, 2011.

Director Compensation Table

Name

Fees Earned or

Paid in Cash

($)

Equity Awards

($)

Total

($)

M. Shân Atkins 52,500 55,000 107,500

Robert H. Hotz 52,500 55,000 107,500

Max L. Lukens 90,000 55,000 145,000

James A. Mitarotonda 46,250 55,000 101,250

Irvin D. Reid 51,000 55,000 106,000

Jane Scaccetti 57,500 55,000 112,500

John T. Sweetwood 47,500 55,000 102,500

Nick White 45,000 55,000 100,833

James A. Williams 53,500 55,000 108,500

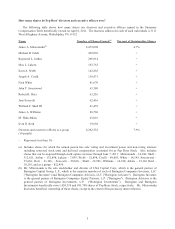

Share Ownership Guidelines. Each of our non-employee directors is expected to hold shares equal to 4x the

annual director retainer (i.e., $140,000). The share ownership levels may be satisfied through direct share ownership

and/or by holding unvested time-based RSUs and vested “in the money” stock options. Non-employee directors

have five years from their appointment to Board to achieve their expected ownership level. If in a shortfall position,

(i) a non-employee director may not sell Pep Boys Stock and (ii) all net after-tax shares acquired upon the exercise

of stock options must be retained. All of our non-employee directors are currently in compliance with our share

ownership guidelines.

Certain Relationships and Related Transactions

The Audit Committee, which is comprised of independent directors, has established a written Related Party

Transaction Policy. Such policy provides that to help identify related-party transactions and relationships (i) all

transactions between the Company and another party are reviewed by the Company’s legal and finance departments

prior to the execution of definitive transaction documents and (ii) each director and executive officer completes a

questionnaire that requires the disclosure of any transaction or relationship that the person, or any member of his or

her immediate family, has or will have with the Company. The full Board of Directors reviews and approves,

ratifies or rejects any transactions and relationships of the nature that would be required to be disclosed under Item

404 of Regulation S-K. In reviewing any such related-party transaction or relationship, the Board considers such

information as it deems important to determine whether the transaction is on reasonable and competitive terms and is

fair to the Company. No such relationships or transactions of a nature required to be disclosed under Item 404 of

Regulation S-K currently exist.

Involvement of Certain Legal Proceedings

None of our directors or executive officers are currently involved, or have been involved during the last ten

years, in a legal proceeding of the type required to be disclosed under Item 402 of Regulation S-K.