Pep Boys 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

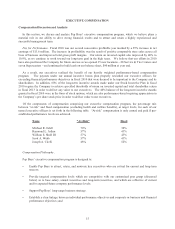

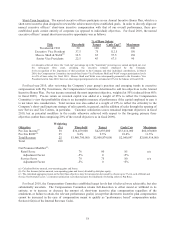

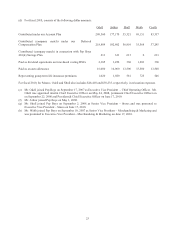

For fiscal 2010 the Company achieved the following results against its corporate objectives (i) pre-tax income at

$56,603,000, (ii) pre-tax return on invested capital at 10.9%, (iii) total revenue at $1,988,641, (iv) the retail net

promoter modifier at 76% and (v) the service net promoter modifier at 73%, resulting in an aggregate potential

payout of 137% of target. Accordingly, for fiscal 2010, the Compensation Committee approved short-term incentive

plan compensation (in accordance with the above referenced formula without any discretionary adjustment) for Mr.

Odell at 137%, Mr. Arthur at 103%, each of Mr. Shull and Mr. Webb at 89% and Mr. Cirelli at 66% of their

respective 2010 annual salaries. Mr. Odell declined $60,000 of his incentive payment that he was otherwise entitled

to receive, which amount, at Mr. Odell’s request, was allocated to accounts set aside by Pep Boys to provide

associates’ children with educational scholarships and to provide hardship assistance to Pep Boys’ associates.

Long-Term Incentives. Compensation through equity grants directly aligns the interests of management with that

of its shareholders. The Stock Incentive Plan provides for the grant of stock options, at exercise prices equal to the

fair market value (the mean between and the high and low quoted selling prices) of Pep Boys stock on the date of

grant, and for the grant of restricted stock units.

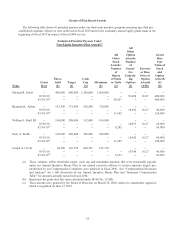

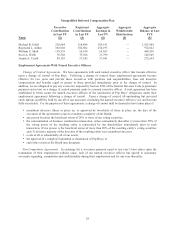

For the fiscal 2010 equity grants, the Compensation Committee worked with Pay Governance to survey our peer

group’s practices and emerging trends in long-term incentive compensation in an effort to further align this

component of the compensation program with the interests of shareholders, namely building long-term shareholder

value. Based upon this survey data, the Compensation Committee determined to award equity grants consisting of

40% time-based vesting stock options and 60% performance-based vesting restricted stock units (RSUs). Prior year

RSU grants were only subject to time-based vesting. The 2010 RSUs will only vest if predetermined objectives are

achieved by the end of a three-year period. Two-thirds of the 2010 RSUs are tied to the Company achieving at least

a threshold return on invested capital and one-third are tied to achieving at least a threshold level of total shareholder

return measured against our peer group. In fiscal 2010, taking into account the Company’s fiscal 2009 financial

performance and the relative position of each named executive officer’s total compensation to the market median of

our peer group, the Compensation Committee recommended, and the full Board approved, the following equity

grants.

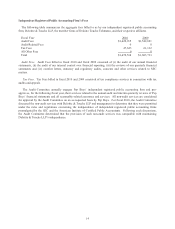

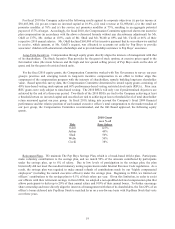

Title

2010 Grant

as a % of

Base Salary

Odell 125%

Arthur 40%

Shull 50%

Webb 50%

Cirelli 38%

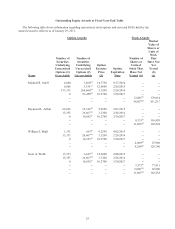

Retirement Plans. We maintain The Pep Boys Savings Plan, which is a broad-based 401(k) plan. Participants

make voluntary contributions to the savings plan, and we match 50% of the amounts contributed by participants

under the savings plan, up to 6% of salary. Due to low levels of participation in the savings plan, the plan

historically did not meet the non-discriminatory testing requirements under Internal Revenue Code regulations. As a

result, the savings plan was required to make annual refunds of contributions made by our “highly compensated

employees” (including the named executive officers) under the savings plan. Beginning in 2004, we limited our

officers’ contributions to the savings plan to 0.5% of their salary per year. Given this limitation, in order to assist

our officers with their retirement savings, in fiscal 2004, we adopted a non-qualified deferred compensation plan that

allows participants to defer up to 20% of their annual salary and 100% of their annual bonus. To further encourage

share ownership and more directly align the interests of management with that of its shareholders, the first 20% of an

officer’s bonus deferred into Pep Boys Stock is matched by us on a one-for-one basis with Pep Boys Stock that vests

over three years.