Pep Boys 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

NOTE 16—FAIR VALUE MEASUREMENTS

The Company’s fair value measurements consist of (a) non-financial assets and liabilities that are

recognized or disclosed at fair value in the Company’s financial statements on a recurring basis (at least

annually) and (b) all financial assets and liabilities.

Fair value is defined as the exit price, or the amount that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants as of the measurement

date. There is a hierarchy for inputs used in measuring fair value that maximizes the use of observable

inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be

used when available. Observable inputs are inputs market participants would use in valuing the asset or

liability developed based on market data obtained from sources independent of the Company.

Unobservable inputs are inputs that reflect the Company’s assumptions about the factors market

participants would use in valuing the asset or liability developed based upon the best information

available in the circumstances. The hierarchy is broken down into three levels. Level 1 inputs are

quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs include

quoted prices for similar assets or liabilities in active markets. Level 3 inputs are unobservable inputs

for the asset or liability. Categorization within the valuation hierarchy is based upon the lowest level of

input that is significant to the fair value measurement.

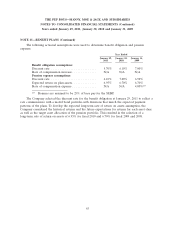

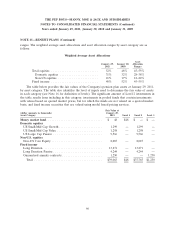

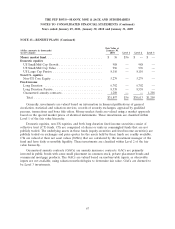

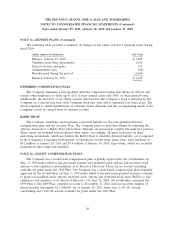

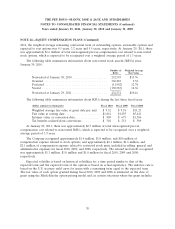

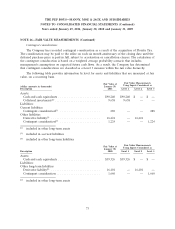

Assets and Liabilities that are Measured at Fair Value on a Recurring Basis:

The Company’s long-term investments, interest rate swap agreements and contingent consideration

are measured at fair value on a recurring basis. The information in the following paragraphs and tables

primarily addresses matters relative to these assets and liabilities.

Cash equivalents:

Cash equivalents, other than credit card receivables, include highly liquid investments with an

original maturity of three months or less at acquisition. The Company carries these investments at fair

value. As a result, the Company has determined that its cash equivalents in their entirety are classified

as a Level 1 measure within the fair value hierarchy.

Collateral investments:

Collateral investments include monies on deposit that are restricted. The Company carries these

investments at fair value. As a result, the Company has determined that its collateral investments are

classified as a Level 1 measure within the fair value hierarchy.

Derivative liability:

The Company has one interest rate swap designated as a cash flow hedge on $145.0 million of the

Company’s Senior Secured Term Loan facility that expires in October 2013. The Company values this

swap using observable market data to discount projected cash flows and for credit risk adjustments.

The inputs used to value derivatives fall within Level 2 of the fair value hierarchy.

72