Pep Boys 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

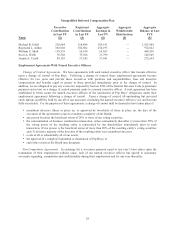

were eligible to participate in the ESPP, including our seven executive officers (which includes the five named

executive officers identified in this Proxy Statement).

Offering Period. Under the ESPP, there will be a series of consecutive offering periods, the length of which will

be determined by the Benefits Committee, but shall not exceed 27 months. Unless the Benefits Committee

determines otherwise prior to the beginning of an offering period, each offering period will commence at three-

month intervals on the first day of each January, April, July and October over the term of the ESPP and will last for

three months, ending on the last day of March, June, September and December, as the case may be. If any of the

designated dates is not a business day, the purchase date will be moved to the next business day. The Benefits

Committee may establish shorter or longer offering periods as it deems appropriate, provided that no offering period

will exceed twenty-seven months. Subject to shareholder approval of the ESPP at the Annual Meeting, the first

offering period will begin on October 3, 2011.

Participation. Each eligible employee who elects to participate in an offering period will be granted an option to

purchase shares of Pep Boys Stock on the first day of the offering period. The option will automatically be exercised

on the last day of the offering period, which is the purchase date, based on the employee’s accumulated contributions

to the ESPP. The purchase price of each share of Pep Boys Stock under the ESPP will be equal to eighty-five

percent (85%) of the fair market value per share of Pep Boys Stock on the purchase date. The Benefits Committee

may change the purchase price prior to the beginning of an offering period, provided that the purchase price does not

fall below eighty-five percent (85%) of the lower of the fair market value per share of Pep Boys Stock on the first

day of the offering period or the fair market value per share of Pep Boys Stock on the purchase date. Participants

will generally be permitted to allocate up to ten percent (10%) of their eligible compensation to purchase Pep Boys

Stock under the ESPP. In order to participate in a particular offering period, an eligible employee must complete

and file the appropriate forms prescribed by the Benefits Committee prior to the beginning of that offering period.

An eligible employee who is actively participating in the ESPP will be automatically enrolled for the next offering

period, unless the employee elects otherwise prior to the beginning of the next offering period determined by the

Benefits Committee.

Payroll Deductions. The payroll deduction authorized by participant for purposes of acquiring shares of Pep

Boys Stock may be any multiple of one percent (1%) of compensation paid to the participant during each offering

period, up to a maximum of ten percent (10%). At any time during the offering period, the participant may reduce the

rate of payroll deductions by filing the appropriate form with the Benefits Committee. A participant is limited to one

such reduction per offering period. A participant may increase the rate of payroll deductions by filing the

appropriate form with the Benefits Committee prior to the commencement of any new offering period.

Cessation of Participation. Participants may withdraw from the offering period at any time prior to the purchase

date by filing the appropriate form with the Benefits Committee within the time period required by the Benefits

Committee prior to the purchase date, and no further payroll deductions will be collected from the participant with

respect to that offering period. A participant who elects to cease participation in the ESPP for a particular offering

period may not rejoin that offering period at a later date. Participation ends automatically upon termination of

employment or if the participant ceases to be an eligible employee for any reason (including death, disability or

change in status).

Maximum Number of Purchasable Shares. The maximum number of shares of Pep Boys Stock that a participant

may purchase on any one purchase date may not exceed 10,000 shares, subject to adjustment by the Benefits

Committee prior to the beginning of the offering period and subject to share adjustments in connection with certain

events as described above. In addition, no participant may purchase more than $25,000 worth of Pep Boys Stock

under purchase rights granted under this ESPP or similar rights granted under any other employee stock purchase

plan during each calendar year in which such rights are at any time outstanding. In the event that a participant is

precluded from purchasing additional shares due to the $25,000 limit, no further payroll deductions will be collected

with respect to that purchase date, and payroll deductions will automatically resume at the beginning of the next

offering period in which participant can again participate. If the total number of shares purchasable pursuant to

outstanding purchase rights on a particular date exceeds the number of shares available for issuance under the ESPP,

the Benefits Committee will make a pro-rata allocation of available shares, and any excess payroll deductions in

excess of the aggregate payable purchase price will be promptly refunded.