Pep Boys 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

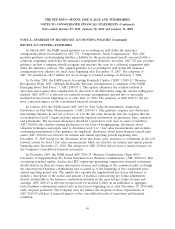

NOTE 9—STOCKHOLDERS’ EQUITY

On January 26, 2010, the Company terminated the flexible employee benefits trust (the ‘‘Trust’’)

that was established on April 29, 1994 to fund a portion of the Company’s obligations arising from

various employee compensation and benefit plans. In accordance with the terms of the Trust, upon its

termination, the Trust’s sole asset, consisting of 2,195,270 shares of the Company’s common stock, was

transferred to the Company in exchange for the full satisfaction and discharge of all intercompany

indebtedness then owed by the Trust to the Company. The termination of the Trust had no impact on

the Company’s consolidated financial statements, except for the reclassification of the shares within the

shareholders equity section of the Company’s Consolidated Balance Sheets. The Company uses its

treasury shares to satisfy share requirements to its employees under its compensation plans and

dividend reinvestment program.

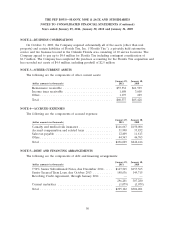

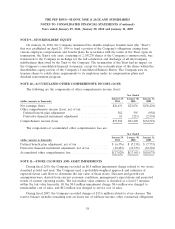

NOTE 10—ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

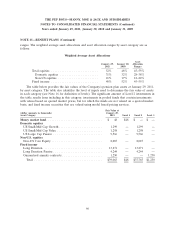

The following are the components of other comprehensive income (loss):

Year Ended

January 29, January 30, January 31,

(dollar amounts in thousands) 2011 2010 2009

Net earnings (loss) .................................... $36,631 $23,036 $(30,429)

Other comprehensive income (loss), net of tax:

Defined benefit plan adjustment ........................ 582 595 (958)

Derivative financial instrument adjustment ................. 81 (211) (2,934)

Comprehensive income (loss) ............................ $37,294 $23,420 $(34,321)

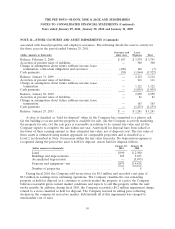

The components of accumulated other comprehensive loss are:

Year Ended

January 29, January 30, January 31,

(dollar amounts in thousands) 2011 2010 2009

Defined benefit plan adjustment, net of tax .................. $ (6,576) $ (7,158) $ (7,753)

Derivative financial instrument adjustment, net of tax .......... (10,452) (10,533) (10,322)

Accumulated other comprehensive loss ..................... $(17,028) $(17,691) $(18,075)

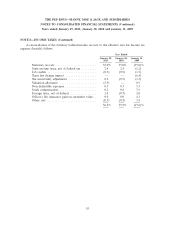

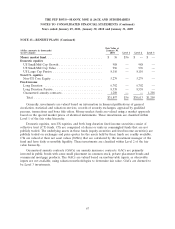

NOTE 11—STORE CLOSURES AND ASSET IMPAIRMENTS

During fiscal 2010, the Company recorded an $0.8 million impairment charge related to two stores

classified as held and used. The Company used a probability-weighted approach and estimates of

expected future cash flows to determine the fair value of these stores. Discount and growth rate

assumptions were derived from current economic conditions, management’s expectations and projected

trends of current operating results. The fair market value estimate is classified as a Level 3 measure

within the fair value hierarchy. Of the $0.8 million impairment charge, $0.6 million was charged to

merchandise cost of sales, and $0.2 million was charged to service cost of sales.

During fiscal 2007, the Company recorded charges of $15.6 million related to store closures. The

reserve balance includes remaining rent on leases net of sublease income, other contractual obligations

58