Pep Boys 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

Transferability. Neither payroll deductions credited to a participant nor any rights with regard to the exercise of a

purchase right under the ESPP may be assigned, transferred, pledged or otherwise disposed of in any way (other than

by will or the laws of descent and distribution) by the participant.

Change of Control. If we experience a Change of Control, as defined in the ESPP, while the ESPP is in effect,

unless the Benefits Committee determines otherwise, all outstanding options under the ESPP will automatically be

exercised immediately prior to the effective date of any Change of Control and the purchase price for each share of

Pep Boys Stock under the ESPP on such purchase date will be equal to eighty-five percent (85%) of the fair market

value of Pep Boys Stock immediately prior to the effective date of the Change of Control. If a Change of Control

occurs, the limitation on the aggregate number of shares that a participant may purchase on any given purchase date

will continue to apply.

Amendment. The Board of Directors may amend or terminate the ESPP at any time, with such amendment or

termination to become effective immediately following the close of an offering period. However, the Board of

Directors may not amend the ESPP without stockholder approval if such amendment increases the number of shares

of Pep Boys Stock issuable under the ESPP except for permissible adjustments in the event of changes in our

capitalization, if required to do so under Section 423 of the Internal Revenue Code, or if required to do so under

applicable stock exchange requirements.

Termination. Unless sooner terminated by the Board of Directors, the ESPP will terminate upon the earlier of (i)

the date all shares available for issuance under the ESPP have been issued or (ii) the date all options are exercised in

connection with a Change of Control.

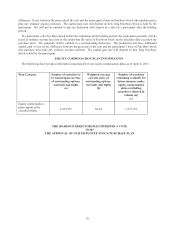

Benefits Under the ESPP. The benefits to be received by our executive officers and employees under the ESPP

are not determinable because, under the terms of the ESPP, the amounts of future stock purchases are based upon

elections made by eligible employees subject to the terms and limits of the ESPP. Directors who are not employees

do not qualify as eligible employees and thus cannot participate in the ESPP. Future purchase prices are not

determinable because they will be based upon the closing selling price of Pep Boys Stock. No shares of Pep Boys

Stock have been issued with respect to the ESPP for which stockholder approval is being sought under this proposal.

On April 8, 2011, the closing price of a share of Pep Boys Stock on the New York Stock Exchange was $13.85.

Federal Income Tax Consequences

The following is a brief description of the U.S. federal income tax consequences generally arising with respect to

options that may be awarded under the ESPP. The ESPP is intended to qualify as an employee stock purchase plan

within the meaning of Section 423 of the Internal Revenue Code. The ESPP is not intended to qualify under Section

401 of the Internal Revenue Code and is not subject to the requirements of the Employee Retirement Income

Security Act of 1974, as amended. This description of the federal income tax consequences of the ESPP is not a

complete description. There may be different tax consequences under certain circumstances, and there may be

federal gift and estate tax consequences and state, local and foreign tax consequences. All affected individuals

should consult their own advisors regarding their own situation. This discussion is intended for the information of

the shareholders considering how to vote at the annual meeting and not as tax guidance to individuals who will

participate in the ESPP.

Under the Internal Revenue Code as currently in effect, a participant in the ESPP will not be deemed to have

recognized income, nor will we be entitled to a deduction, upon the participant’s purchase of Pep Boys Stock under

the ESPP. Instead, a participant will recognize income when he or she sells or otherwise disposes of Pep Boys Stock

or upon his or her death.

If a participant sells Pep Boys Stock purchased under the ESPP more than two years after the date on which the

option to purchase Pep Boys Stock was granted and more than one year after the purchase of Pep Boys Stock (the

holding period), a portion of the participant’s gain will be ordinary income and a portion will be capital gain. The

participant will be taxed at ordinary income tax rates on lesser of the excess of the fair market value of the shares at

the time the option was granted over the purchase price or the excess of the fair market value of the shares at the time

of disposition or death over the purchase price. The participant will have additional capital gain or loss equal to the