Pep Boys 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

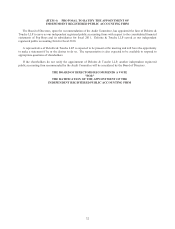

(ITEM 6) SHAREHOLDER PROPOSAL REGARDING

LOWERING THE THRESHOLD REQUIRED TO CALL A SPECIAL MEETING OF SHAREHOLDERS

John Chevedden, 2215 Nelson Avenue, No. 205, Redondo Beach, California 90278 has notified us that he

intends to introduce the following resolution at the meeting:

Special Shareowner Meetings

RESOLVED, Shareowners ask our board to take the steps necessary unilaterally (to the fullest extent permitted by

law) to amend our bylaws and each appropriate governing document to give holders of 10% of our outstanding

common stock (or the lowest percentage permitted by law above 10%) the power to call a special shareowner

meeting.

This includes that such bylaw and/or charter text will not have any exclusionary or prohibitive language in regard to

calling a special meeting that apply only to shareowners but not to management and/or the board (to the fullest extent

permitted by law).

Special meetings allow shareowners to vote on important matters, such as electing new directors that can arise

between annual meetings. If shareowners cannot call special meetings, management may become insulated and

investor returns may suffer. Shareowner input on the timing of shareowner meetings is especially important during a

major restructuring – when events unfold quickly and issues may become moot by the next annual meeting. This

proposal does not impact our board's current power to call a special meeting.

This proposal topic won more than 60% support at CVS Caremark, Sprint, Safeway and Motorola.

The merit of this Special Shareowner Meeting proposal should also be considered in the context of the need for

additional improvement in our company's 2010 reported corporate governance status:

The Corporate Library www.thecorporatelibrary.com. an independent investment research firm, rated our company

"Moderate Concern" in Executive Pay - only 52% of executive pay was incentive based.

The Corporate Library said long-term executive incentives consisted solely of market-priced stock options that vest

over time. Market-priced stock options are a risk for shareholders because they may give executives pay due to a

rising market alone, regardless of individual executive performance. Performance-vesting restricted stock units for

executives covered a three-year performance period (not a 5-years period) and were two-thirds based on return on

invested capital, one of the same performance measures already used for our executive's annual plan.

Both Jane Scaccetti, chair of our Audit Committee, and John Sweetwood, chair of our Nomination Committee had

no other major corporate directorship experience. Shan Atkins, chair of our Executive Pay committee, was on the

Shoppers Drug Mart Corporation board, which was rated "High Concern" in Executive Pay by The Corporate

Library.

Directors with experience at boards rated "D" by The Corporate Library included Irvin Reid at Mack-Cali Realty

Corporation (CLI), Nick White at Dillard's, Inc. (DDS) and Robert Hotz at Universal Health Services (UBS).

Finally, James Mitarotonda was a director at Griffon Corporation (GFF) rated "F."

Please encourage our board to respond positively to this proposal to initiate improved corporate governance and

financial performance: Special Shareowner Meetings - Yes on (Item 6).