Pep Boys 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

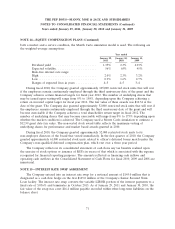

NOTE 17—LEGAL MATTERS (Continued)

The Company is also party to various other actions and claims arising in the normal course of

business. The Company believes that amounts accrued for awards or assessments in connection with all

such matters are adequate and that the ultimate resolution of these matters will not have a material

adverse effect on the Company’s financial position. However, there exists a possibility of loss in excess

of the amounts accrued, the amount of which cannot currently be estimated. While the Company does

not believe that the amount of such excess loss could be material to the Company’s financial position,

any such loss could have a material adverse effect on the Company’s results of operations in the

period(s) during which the underlying matters are resolved.

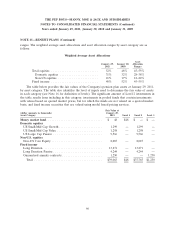

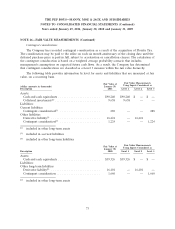

NOTE 18—QUARTERLY FINANCIAL DATA (UNAUDITED)

Earnings

Per Share

from

Earnings Cash

Continuing Earnings Market Price

from Dividends

Operations Per Share Per Share

Total Gross Operating Continuing Per

Revenues Profit Profit Operations Earnings Basic Diluted Basic Diluted Share High Low

Year Ended January 29,

2011

4th quarter ...........$477,389 $124,400 $17,605 $ 8,538 $ 8,365 $0.16 $0.16 $0.16 $0.16 $0.0300 $15.96 $11.37

3rd quarter ........... 496,364 125,856 15,125 5,674 5,718 0.11 0.11 0.11 0.11 0.0300 12.00 8.82

2nd quarter ........... 504,855 134,501 23,842 10,799 10,598 0.21 0.20 0.20 0.20 0.0300 13.26 7.86

1st quarter ........... 510,033 137,595 26,008 12,160 11,950 0.23 0.23 0.23 0.23 0.0300 13.42 8.08

Year Ended January 30,

2010

4th quarter ...........$452,896 $110,047 $ 6,760 $ 2,835 $ 2,268 $0.05 $0.06 $0.04 $0.04 $0.0300 $ 9.29 $ 7.76

3rd quarter ........... 472,643 118,269 10,056 2,357 2,124 0.05 0.04 0.04 0.04 0.0300 10.69 8.40

2nd quarter ........... 488,911 128,190 18,692 7,858 7,735 0.15 0.15 0.15 0.15 0.0300 10.83 5.87

1st quarter ........... 496,488 129,601 21,551 11,063 10,909 0.21 0.21 0.21 0.21 0.0300 8.52 2.76

The sum of individual share amounts may not equal due to rounding.

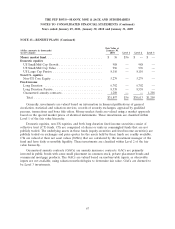

In the fourth quarter of 2010, the Company recorded a $4.6 million reduction to its reserve for

excess inventory and an income tax benefit of $1.0 million related to the reduction of a valuation

allowance on certain state net operating loss carryforwards and credits.

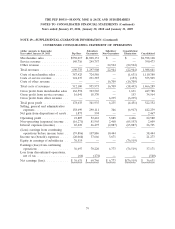

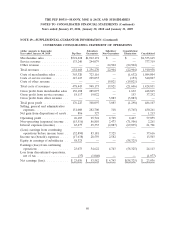

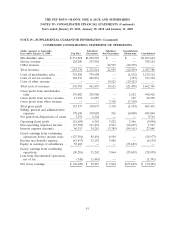

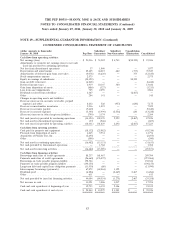

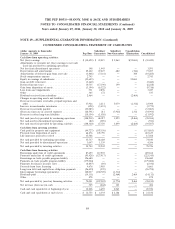

NOTE 19—SUPPLEMENTAL GUARANTOR INFORMATION

The Company’s Notes are fully and unconditionally and joint and severally guaranteed by certain

of the Company’s direct and indirectly wholly-owned subsidiaries—namely, The Pep Boys Manny

Moe & Jack of California, The Pep Boys—Manny Moe & Jack of Delaware, Inc. (the ‘‘Pep Boys of

Delaware’’), Pep Boys—Manny Moe & Jack of Puerto Rico, Inc. and PBY Corporation (as of

January 29, 2011), (collectively, the ‘‘Subsidiary Guarantors’’). The Notes are not guaranteed by the

Company’s wholly owned subsidiary, Colchester Insurance Company.

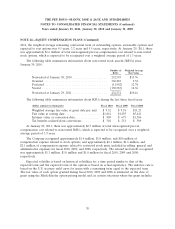

The following condensed consolidating information presents, in separate columns, the condensed

consolidating balance sheets as of January 29, 2011 and January 30, 2010 and the related condensed

consolidating statements of operations and condensed consolidating statements of cash flows for fiscal

2010, 2009 and 2008 for (i) the Company (‘‘Pep Boys’’) on a parent only basis, with its investment in

75