Pep Boys 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

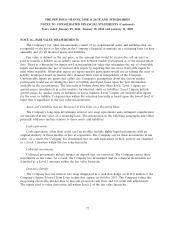

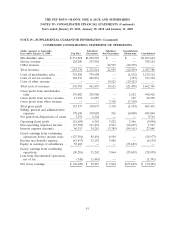

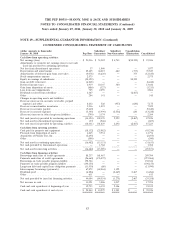

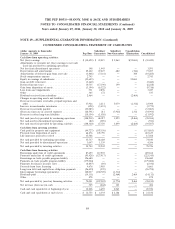

NOTE 16—FAIR VALUE MEASUREMENTS (Continued)

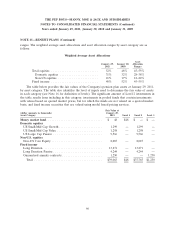

The following represents the impact of fair value accounting for the Company’s derivative liability

on its consolidated financial statements:

Amount of Loss

in Other Amount of Loss

Comprehensive Earnings Recognized in

Income Statement Earnings

(dollar amounts in thousands) (Effective Portion) Classification (Effective Portion)

Fiscal 2010 ............................ $ 14 Interest expense $6,905

Fiscal 2009 ............................ $373 Interest expense $5,796

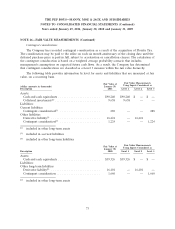

Non-financial assets measured at fair value on a non-recurring basis:

Certain assets are measured at fair value on a non-recurring basis, that is, the assets are subject to

fair value adjustments in certain circumstances such as when there is evidence of impairment. In

response to a continuing weak real estate market, the Company reduced its prices for certain properties

held for disposal and recorded impairment charges of $0.2 million, $3.1 million and $5.4 million in

fiscal 2010, 2009 and 2008, respectively. The fair values were based on selling prices of comparable

properties, net of expected disposal costs. These measures of fair value, and related inputs, are

considered level 2 measures under the fair value hierarchy.

NOTE 17—LEGAL MATTERS

In September 2006, the United States Environmental Protection Agency (‘‘EPA’’) requested certain

information from the Company as part of an investigation to determine whether the Company had

violated the Clean Air Act and its non-road engine regulations. The information requested concerned

certain generator and personal transportation merchandise offered for sale by the Company. In the

fourth quarter of fiscal 2008, the United States Environmental Protection Agency (‘‘EPA’’) informed the

Company that it believed that the Company had violated the Clean Air Act by virtue of the fact that

certain of this merchandise did not conform to their corresponding EPA Certificates of Conformity.

During the third quarter of fiscal 2009, the Company and the EPA reached a settlement in principle of

this matter requiring that the Company (i) pay a monetary penalty of $5.0 million, (ii) take certain

corrective action with respect to certain inventory that had been restricted from sale during the course

of the investigation, (iii) implement a formal compliance program and (iv) participate in certain

non-monetary emission offset activities. The Company had previously accrued an amount equal to the

agreed upon civil penalty and a $3.0 million contingency accrual with respect to the restricted

inventory. During fiscal 2009, the Company reversed approximately $2.0 million of the inventory accrual

as a portion of the subject inventory was released for sale by the EPA as remediation efforts had been

completed. During the second quarter of fiscal 2010, the Company completed the remediation efforts

and accordingly reversed approximately $1.0 million of the inventory accrual. Further, the Company

reached an agreement with the merchandise vendor to cover the entire cost of retrofitting a portion of

the remaining subject merchandise and to accept the balance of the subject inventory for return for full

credit. During the second quarter of fiscal 2010, the formal settlement agreement between the

Company and the EPA became effective and the Company paid the monetary penalty.

74