Pep Boys 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

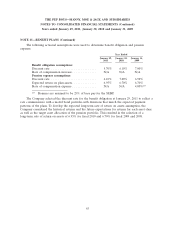

NOTE 13—BENEFIT PLANS (Continued)

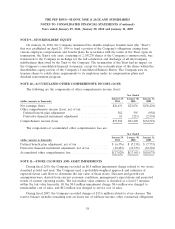

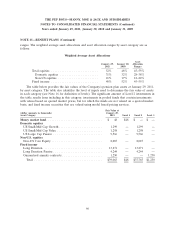

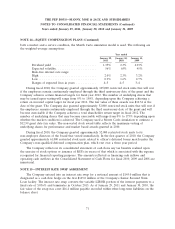

The following table provides a summary of changes in fair value of Level 3 financial assets during

fiscal 2010:

(dollar amounts in thousands) Fair Value

Balance, January 30, 2010 .................................... $1,208

Transfers from other investments .............................. 1,610

Interest income and gains .................................... 131

Administrative fees ........................................ (58)

Benefits paid during the period ................................ (1,641)

Balance, January 29, 2011 .................................... $1,250

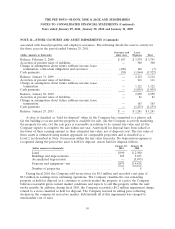

DEFERRED COMPENSATION PLAN

The Company maintains a non-qualified deferred compensation plan that allows its officers and

certain other employees to defer up to 20% of their annual salary and 100% of their annual bonus.

Additionally, the first 20% of an officer’s bonus deferred into the Company’s stock is matched by the

Company on a one-for-one basis with Company stock that vests and is expensed over three years. The

shares required to satisfy distributions of voluntary bonus deferrals and the accompanying match in the

Company’s stock are issued from its treasury account.

RABBI TRUST

The Company establishes and maintains a deferred liability for the non-qualified deferred

compensation plan and the Account Plan. The Company plans to fund this liability by remitting the

officers’ deferrals to a Rabbi Trust where these deferrals are invested in variable life insurance policies.

These assets are included in non-current other assets. Accordingly, all gains and losses on these

underlying investments, which are held in the Rabbi Trust to fund the deferred liability, are recognized

in the Company’s Consolidated Statement of Operations. Under these plans, there were liabilities of

$6.2 million at January 29, 2011 and $3.4 million at January 30, 2010, respectively, which are recorded

primarily in other long-term liabilities.

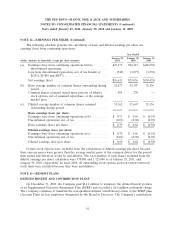

NOTE 14—EQUITY COMPENSATION PLANS

The Company has a stock-based compensation plan originally approved by the stockholders on

May 21, 1990 under which it has previously granted non-qualified stock options and incentive stock

options to key employees and members of its Board of Directors. There are no awards remaining

available for grant under the 1990 Plan. The Company has a stock-based compensation plan originally

approved by the stockholders on June 2, 1999 under which it has previously granted and may continue

to grant non-qualified stock options, incentive stock options and restricted stock units (RSUs) to key

employees and members of its Board of Directors. On June 24, 2009, the stockholders renamed the

1999 Plan to the 2009 Plan, extended its terms to December 31, 2014 and increased the number of

shares issuable thereunder by 1,500,000. As of January 29, 2011, there were 2,493,181 awards

outstanding and 1,818,706 awards available for grant under the 2009 Plan.

68