Pep Boys 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

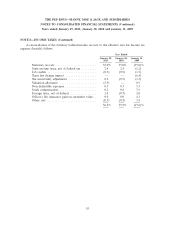

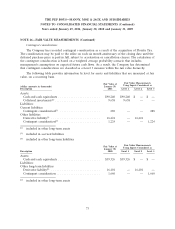

NOTE 13—BENEFIT PLANS (Continued)

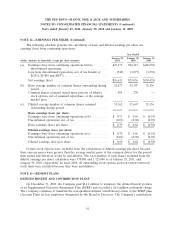

The following table sets forth the reconciliation of the benefit obligation, fair value of plan assets

and funded status of the Company’s defined benefit plans:

Year ended

January 29, January 30,

(dollar amounts in thousands) 2011 2010

Change in benefit obligation:

Benefit obligation at beginning of year .............................. $42,744 $ 36,996

Interest cost ................................................. 2,561 2,539

Actuarial loss ................................................ 2,454 4,626

Benefits paid ................................................. (1,641) (1,417)

Benefit obligation at end of year .................................. $46,118 $ 42,744

Change in plan assets:

Fair value of plan assets at beginning of year ......................... $31,857 $ 27,692

Actual return on plan assets (net of expenses) ......................... 3,847 5,582

Employer contributions ......................................... 5,000 —

Benefits paid ................................................. (1,641) (1,417)

Fair value of plan assets at end of year .............................. $39,063 $ 31,857

Unfunded status at fiscal year end ................................. $(7,055) $(10,887)

Net amounts recognized on consolidated balance sheet at fiscal year end

Noncurrent benefit liability (included in other long-term liabilities) ......... $(7,055) $(10,887)

Net amount recognized at fiscal year end ............................ $(7,055) $(10,887)

Amounts recognized in accumulated other comprehensive income (pre-tax) at

fiscal year end

Actuarial loss ................................................ $10,402 $ 11,316

Prior service cost .............................................. 40 54

Net amount recognized at fiscal year end ............................ $10,442 $ 11,370

Other comprehensive (income) loss attributable to change in pension liability

recognition ................................................ $ (928) $ (932)

Accumulated benefit obligation at fiscal year end ...................... $46,118 $ 42,744

Other information

Employer contributions expected in fiscal 2011 ........................ $ — $ —

Estimated actuarial loss and prior service cost amortization in fiscal 2011 ..... $ 1,530 $ 1,642

64