Pep Boys 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

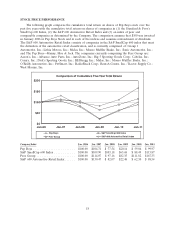

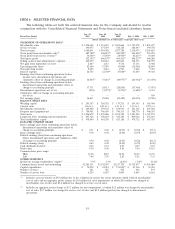

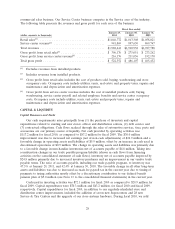

ITEM 6 SELECTED FINANCIAL DATA

The following tables set forth the selected financial data for the Company and should be read in

conjunction with the Consolidated Financial Statements and Notes thereto included elsewhere herein.

Jan. 29, Jan. 30, Jan. 31,

Fiscal Year Ended 2011 2010 2009 Feb. 2, 2008 Feb. 3, 2007

(dollar amounts are in thousands, except per share data)

STATEMENT OF OPERATIONS DATA(6)

Merchandise sales ........................ $1,598,168 $ 1,533,619 $ 1,569,664 $ 1,749,578 $ 1,853,077

Service revenue ......................... 390,473 377,319 358,124 388,497 390,778

Total revenues .......................... 1,988,641 1,910,938 1,927,788 2,138,075 2,243,855

Gross profit from merchandise sales(7) ........... 487,788(1) 448,815(2) 440,502(3) 443,626(4) 533,276

Gross profit from service revenue(7) ............. 34,564(1) 37,292(2) 24,930(3) 42,611(4) 33,004

Total gross profit ......................... 522,352(1) 486,107(2) 465,432(3) 486,237(4) 566,280

Selling, general and administrative expenses ........ 442,239 430,261 485,044 518,373 546,399

Net gain from disposition of assets ............. 2,467 1,213 9,716 15,151 8,968

Operating profit (loss) ..................... 82,580 57,059 (9,896) (16,985) 28,849

Non-operating income ..................... 2,609 2,261 1,967 5,246 7,023

Interest expense ......................... 26,745 21,704(5) 27,048(5) 51,293 49,342

Earnings (loss) from continuing operations before

income taxes, discontinued operations and

cumulative effect of change in accounting principle . . 58,444(1) 37,616(2) (34,977)(3) (63,032)(4) (13,470)

Earnings (loss) from continuing operations before

discontinued operations and cumulative effect of

change in accounting principle ............... 37,171 24,113 (28,838) (37,438) (7,071)

Discontinued operations, net of tax ............. (540) (1,077)(2) (1,591)(3) (3,601)(4) 4,333

Cumulative effect of change in accounting principle,

net of tax ............................————189

Net earnings (loss) ....................... 36,631 23,036 (30,429) (41,039) (2,549)

BALANCE SHEET DATA

Working capital ......................... $ 203,367 $ 205,525 $ 179,233 $ 195,343 $ 163,960

Current ratio ........................... 1.36 to 1 1.40 to 1 1.33 to 1 1.35 to 1 1.27 to 1

Merchandise inventories .................... $ 564,402 $ 559,118 $ 564,931 $ 561,152 $ 607,042

Property and equipment-net .................. $ 700,981 $ 706,450 $ 740,331 $ 780,779 $ 906,247

Total assets ............................ $1,556,672 $ 1,499,086 $ 1,552,389 $ 1,583,920 $ 1,767,199

Long-term debt, excluding current maturities ....... $ 295,122 $ 306,201 $ 352,382 $ 400,016 $ 535,031

Total stockholders’ equity ................... $ 478,460 $ 443,295 $ 423,156 $ 470,712 $ 567,755

DATA PER COMMON SHARE

Basic earnings (loss) from continuing operations before

discontinued operations and cumulative effect of

change in accounting principle ............... $ 0.71 $ 0.46 $ (0.55) $ (0.72) $ (0.13)

Basic earnings (loss) ...................... 0.70 0.44 (0.58) (0.79) (0.05)

Diluted earnings (loss) from continuing operations

before discontinued operations and cumulative effect

of change in accounting principle ............. 0.70 0.46 (0.55) (0.72) (0.13)

Diluted earnings (loss) ..................... 0.69 0.44 (0.58) (0.79) (0.05)

Cash dividends declared .................... 0.12 0.12 0.27 0.27 0.27

Book value ............................ 9.10 8.46 8.10 9.10 10.53

Common share price range:

High ............................... 15.96 10.83 12.56 22.49 16.55

Low ............................... 7.86 2.76 2.62 8.25 9.33

OTHER STATISTICS

Return on average stockholders’ equity(8) ......... 7.9% 5.3% (6.8)% (7.9)% (0.4)%

Common shares issued and outstanding .......... 52,585,131 52,392,967 52,237,750 51,752,677 53,934,084

Capital expenditures ...................... $ 70,252 $ 43,214 $ 151,883(9) $ 43,116 $ 53,903

Number of stores ........................ 621 587 562 562 593

Number of service bays ..................... 6,259 6,027 5,845 5,845 6,162

(1) Includes a pretax benefit of $5.9 million due to the reduction in reserve for excess inventory which reduced merchandise

cost of sales and an aggregate pretax charge of $1.0 million for asset impairment, of which $0.8 million was charged to

merchandise cost of sales and $0.2 million was charged to service cost of sales.

(2) Includes an aggregate pretax charge of $3.1 million for asset impairment, of which $2.2 million was charged to merchandise

cost of sales, $0.7 million was charged to service cost of sales and $0.2 million (pretax) was charged to discontinued

operations.

19