Pep Boys 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 29, 2011, January 30, 2010 and January 31, 2009

NOTE 8—INCOME TAXES (Continued)

opportunity credits and $8.0 million of state and Puerto Rico tax credits of which $5.5 million have full

valuation allowances recorded against them.

The temporary differences between the book and tax treatment of income and expenses result in

deferred tax assets and liabilities, which are included within the consolidated balance sheets. The

Company must assess the likelihood that any recorded deferred tax assets will be recovered against

future taxable income. To the extent the Company believes it is more likely than not that the asset will

not be recoverable, a valuation allowance must be established. The Company considers future

projections of income and tax planning strategies, such as the potential sale of real estate to generate

taxable income sufficient to utilize the deferred tax assets. To the extent the Company establishes a

valuation allowance or changes the allowance in a future period, income tax expense will be impacted.

After considering all this evidence, the Company released $3.2 million of gross valuation allowances on

certain state net operating loss carryforwards and state credits during fiscal 2010.

The Company and its subsidiaries file income tax returns in the U.S. federal, various states and

Puerto Rico jurisdictions. The Company’s U.S. federal returns for tax years 2004 and forward are

subject to examination. State and local income tax returns are generally subject to examination for a

period of three to five years after filing of the respective return. In Puerto Rico, the 2004 through 2010

tax years are subject to examination by the Puerto Rico tax authorities. The Company has various state

income tax returns in the process of examination.

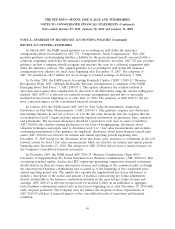

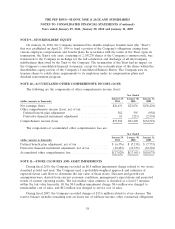

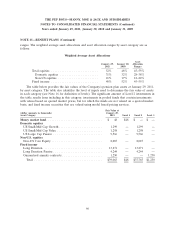

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

January 29, January 30, January 31,

(dollar amounts in thousands) 2011 2010 2009

Unrecognized tax benefit balance at the beginning of the year .... $2,411 $2,458 $3,847

Gross increases for tax positions taken in prior years ........... 1,331 646 147

Gross decreases for tax positions taken in prior years ........... — (526) (831)

Gross increases for tax positions taken in current year .......... 389 296 313

Settlements taken in current year ......................... — (271) (311)

Lapse of statute of limitations ........................... — (192) (707)

Unrecognized tax benefit balance at the end of the year ........ $4,131 $2,411 $2,458

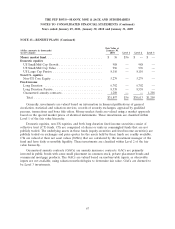

The Company recognizes potential interest and penalties for unrecognized tax benefits in income

tax expense and, accordingly, the Company recognized no material income tax expense in fiscal 2010

and an income tax benefit of $0.4 million during fiscal 2009 related to potential interest and penalties

associated with uncertain tax positions. At January 29, 2011, January 30, 2010, and January 31, 2009,

the Company has recorded $0.2 million, $0.2 million, and $1.0 million, respectively, for the payment of

interest and penalties which are excluded from the unrecognized tax benefit noted above.

Unrecognized tax benefits include $1.4 million, $1.3 million, and $1.5 million, at January 29, 2011,

January 30, 2010 and January 31, 2009, respectively, of tax benefits that, if recognized, would affect the

Company’s annual effective tax rate. The Company believes it is reasonably possible that the amount

will increase or decrease within the next twelve months; however, it is not currently possible to estimate

the impact of the change.

57