Pep Boys 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

offices within ten days of the date of such public announcement will be considered timely. The shareholder’s notice

must also set forth all of the following information:

•the name and address of the shareholder making the nomination;

•a representation that the shareholder intends to appear in person or by proxy at the meeting to nominate the

proposed nominee;

•the name of the proposed nominee;

•the proposed nominee’s principal occupation and employment for the past 5 years;

•a description of any other directorships held by the proposed nominee; and

•a description of all arrangements or understandings between the nominee and any other person or persons

relating to the nomination of, and voting arrangements with respect to, the nominee.

How are candidates identified and evaluated?

Identification. The Nominating and Governance Committee considers all candidates recommended by our

shareholders, directors and senior management on an equal basis. The Nominating and Governance Committee’s

preference is to identify nominees using our own resources, but has the authority to and will engage search firms(s)

as necessary.

Qualifications. The Nominating and Governance Committee evaluates each candidate’s professional background

and experience, judgment and diversity (age, gender, ethnicity and personal experiences) and his or her

independence from Pep Boys. Such qualifications are evaluated against our then current requirements, as expressed

by the full Board and our President & Chief Executive Officer, and the current make up of the full Board.

Evaluations. Candidates are evaluated on the basis of their resume, third party references, public reputation and

personnel interviews. Before a candidate can be recommended to the full Board, such candidate is generally

interviewed by each member of the Nominating and Governance Committee and meets, in person, with at least one

member of the Nominating and Governance Committee, the Chairman of the Board and the President & Chief

Executive Officer.

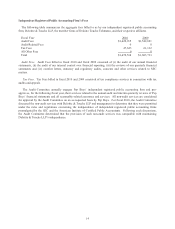

How are directors compensated?

In 2010, in consultation with Pay Governance, LLC, our compensation consultant, we reviewed our director

compensation in comparison to the compensation paid to the directors of the companies comprising our peer group

(see, “EXECUTIVE COMPENSATION -- Compensation Discussion & Analysis – Summary” for a description of

our peer group) and as it related to the changing workload of our Board as dictated by the emerging trends in

corporate governance. As a result, in June 2010, we revised our director compensation to (i) increase the aggregate

value of the annual equity grants by $10,000, (ii) increase the base compensation of our Chairman of the Board (who

does not receive committee fees despite attending most committee meetings as a non-voting participant) by $20,000,

(iii) increase the Compensation Committee chair and member fees by $5,000 and $2,500, respectively, and (iv)

decrease the Audit Committee chair and member fees by $5,000 and $3,000, respectively. The current director

compensation is detailed below.

Base Compensation. Each non-management director (other than the Chairman of the Board) receives an annual

director’s fee of $35,000. Our Chairman of the Board receives an annual director’s fee of $100,000.

Committee Compensation. Directors serving on our committees also receive the following annual fees.

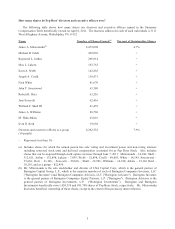

Chair Member

Audit $20,000 $12,000

Compensation $15,000 $ 7,500

Nominating and Governance $10,000 $ 5,000

Operating Efficiency $10,000 $ 5,000