Pep Boys 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

commercial sales business. Our Service Center business competes in the Service area of the industry.

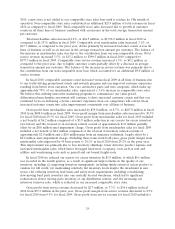

The following table presents the revenues and gross profit for each area of the business.

Fiscal Year ended

January 29, January 30, January 31,

(dollar amounts in thousands) 2011 2010 2009

Retail sales(1) ...................................... $1,046,772 $1,013,308 $1,058,021

Service center revenue(2) ............................. 941,869 897,630 869,767

Total revenues ..................................... $1,988,641 $1,910,938 $1,927,788

Gross profit from retail sales(3) ......................... $ 306,176 $ 275,051 $ 273,262

Gross profit from service center revenue(4) ................ 216,176 211,056 192,170

Total gross profit ................................... $ 522,352 $ 486,107 $ 465,432

(1) Excludes revenues from installed products.

(2) Includes revenues from installed products.

(3) Gross profit from retail sales includes the cost of products sold, buying, warehousing and store

occupancy costs. Occupancy costs include utilities, rents, real estate and property taxes, repairs and

maintenance and depreciation and amortization expenses.

(4) Gross profit from service center revenue includes the cost of installed products sold, buying,

warehousing, service center payroll and related employee benefits and service center occupancy

costs. Occupancy costs include utilities, rents, real estate and property taxes, repairs and

maintenance and depreciation and amortization expenses.

CAPITAL & LIQUIDITY

Capital Resources and Needs

Our cash requirements arise principally from (1) the purchase of inventory and capital

expenditures related to existing and new stores, offices and distribution centers, (2) debt service and

(3) contractual obligations. Cash flows realized through the sales of automotive services, tires, parts and

accessories are our primary source of liquidity. Net cash provided by operating activities was

$117.2 million for fiscal 2010, as compared to $87.2 million for fiscal 2009. The $30.0 million

improvement was due to increased net earnings (net of non-cash adjustments) of $24.9 million and a

favorable change in operating assets and liabilities of $5.9 million, offset by an increase in cash used in

discontinued operations of $0.9 million. The change in operating assets and liabilities was primarily due

to a favorable change in merchandise inventories net of accounts payable of $4.8 million. Taking into

consideration changes in our trade payable program liability (shown as cash flows from financing

activities on the consolidated statement of cash flows), inventory net of accounts payable improved by

$24.8 million primarily due to increased inventory purchases and an improvement in our vendor trade

payable terms. The ratio of accounts payable, including our trade payable program, to inventory was

47.3% at January 29, 2011, and 42.4% at January 30, 2010. The favorable change in all other long-term

assets and liabilities was due to increased accruals for payroll tax in the current year due to timing of

payments to taxing authorities mostly offset by a discretionary contribution to our defined benefit

pension plan of $5.0 million (see Note 13 to the consolidated financial statements) in the current year.

Cash used in investing activities was $72.1 million for fiscal 2010 as compared to $29.9 million for

fiscal 2009. Capital expenditures were $70.3 million and $43.2 million, for fiscal 2010 and fiscal 2009,

respectively. Capital expenditures for fiscal 2010, in addition to our regularly-scheduled store and

distribution center improvements, included the addition of seven new Supercenters and 28 new

Service & Tire Centers and the upgrade of our store systems hardware. During fiscal 2010, we sold

28