Pep Boys 2010 Annual Report Download - page 84

Download and view the complete annual report

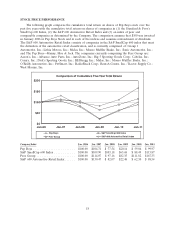

Please find page 84 of the 2010 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.automotive sales remained relatively flat year over year. Service revenues increased in fiscal 2009 as

compared to fiscal 2008 primarily due to increased customer counts.

During fiscal 2009, customer traffic generated by improved store execution, promotional events and

an improved hard parts inventory position resulted in an increase in service and commercial customer

count. However, total customer count declined as a result of a decrease in DIY customer count. We

believe the decrease in retail customer count is due to reduced spending as a result of the current

economic environment and our competitors continuing to open new stores as well as the result of the

long-term industry decline in the DIY business, as discussed in the ‘‘Business’’ section of our

Form 10-K. In addition, we carry a large assortment of more discretionary retail product that is more

susceptible to consumer spending deferrals. We continue to believe that providing a differentiated

merchandise assortment, better customer experience, low-price value proposition and innovative

marketing will stem the overall decline in customer counts and sales over the long-term. In fact,

customer count in our DIY space declined at a much lower rate in fiscal 2009 as compared to the prior

year and we experienced our first increase in total customer count and sales in our third fiscal quarter

since the first quarter of fiscal 2004, and the fourth quarter of fiscal 2006, respectively.

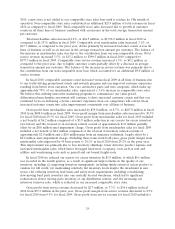

Gross profit from merchandise sales increased by $8.3 million to $448.8 million for fiscal 2009

from $440.5 million in the prior year. Gross profit from merchandise sales increased to 29.3% for fiscal

2009 from 28.1% for fiscal 2008. Gross profit from merchandise sales in fiscal 2009 includes the

reversal of inventory accruals of approximately $2.0 million established in the prior year related to our

temporarily restricting the sale of certain small engine merchandise that was subject to an ongoing EPA

inquiry and a gain from insurance settlements of $0.6 million, mostly offset by an asset impairment

charge of $2.2 million as a result of continued declines in real estate values of previously closed

locations. In the prior year, gross profit from merchandise sales included an asset impairment charge of

$2.8 million and a $3.0 million inventory accrual due to the EPA inquiry referred to above. Excluding

these adjustments from both years, gross profit from merchandise sales increased to 29.2% for fiscal

2009 from 28.4% in the prior year. Gross profit from merchandise sales increased despite a 2.3%

decrease in merchandise sales as discussed above, primarily as a result of an improvement in inventory

shrinkage, lower in-bound freight costs, lower warehousing costs (which declined by 40 basis points to

3.7% of merchandise sales) and lower store occupancy costs (which declined by 20 basis points to

11.4% of merchandise sales.) Warehousing costs declined primarily due to lower out-bound freight costs

to stores and occupancy costs declined due to lower building maintenance costs and the elimination of

equipment leasing costs.

Gross profit from service revenue increased to 9.9% for fiscal 2009 from 7.0% in fiscal 2008. Gross

profit from service revenue increased by $12.4 million, or 49.6%. Both the current year and the prior

year gross profit from service revenue included an asset impairment charge related to previously closed

stores of $0.7 million and $0.6 million, respectively. Excluding these adjustments from both years, gross

profit from service revenues increased to 10.1% for fiscal 2009 from 7.1% in the prior year. The

increase in gross profit was primarily due to increased service revenue which resulted in higher

absorption of fixed expenses such as occupancy costs and, to a certain extent, labor costs.

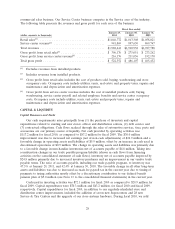

Selling, general and administrative expenses, decreased to 22.5% of total revenues in fiscal 2009

from 25.2% in fiscal 2008. Selling, general and administrative expenses decreased $54.8 million or

11.4%. The decrease was primarily due to lower media expense of $21.2 million, lower legal expenses

and professional services fees of $13.3 million, reduced payroll and related expenses of $7.5 million,

lower travel expenses of $2.3 million and improved general liability claims expense of $1.3 million.

Net gains from the disposition of assets for fiscal 2009 and fiscal 2008 reflect gains of $1.2 million

and $9.7 million, respectively, primarily as a result of sale leaseback transactions. The Company

completed sale leaseback transactions on four stores during fiscal 2009, as compared to sale leaseback

transactions on approximately 70 stores in fiscal 2008.

26