Nordstrom 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

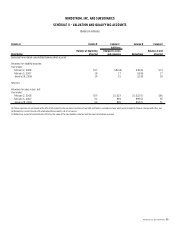

Nordstrom, Inc. and subsidiaries 59

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

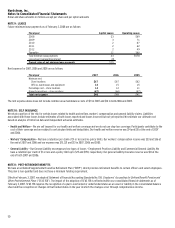

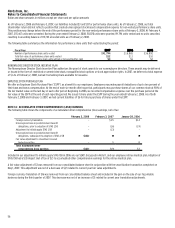

The following tables set forth the information for our reportable segments and a reconciliation to the consolidated totals:

Retail

Fiscal year 2007 Stores Direct Credit Other Eliminations Total

Net sales (a) $8,168 $633 — $27 — $8,828

Net sales increase 3.2% 16.7% N/A (74.7%) N/A 3.1%

Intersegment revenues — — $1 — $(1) —

Interest expense, net (b) — — (37) (37) — (74)

Finance charges and other, net (1) — 250 22 — 271

Depreciation and amortization 228 3 1 37 — 269

Earnings before income taxes 1,256 165 (11) (237) — 1,173

Earnings before income taxes

as a percentage of net sales 15.4% 26.0% N/A N/A N/A 13.3%

Goodwill 38 15 — — — 53

Acquired tradename — — — — — —

Assets (c) 2,555 133 1,783 1,129 — 5,600

Capital expenditures 431 35 3 32 — 501

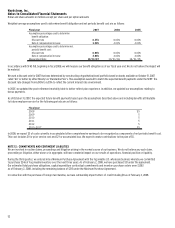

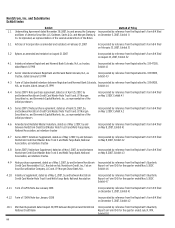

Retail

Fiscal year 2006 Stores Direct Credit Other Eliminations Total

Net sales (a) $7,913 $543 - $105 — $8,561

Net sales increase 10.0% 23.5% N/A 20.3% N/A 10.8%

Intersegment revenues — — $1 — $(1) —

Interest expense, net (b) — — (11) (32) — (43)

Finance charges and other, net (1) — 214 26 — 239

Depreciation and amortization 237 3 1 44 — 285

Earnings before income taxes 1,203 134 73 (304) — 1,106

Earnings before income taxes

as a percentage of net sales 15.2% 24.7% N/A N/A N/A 12.9%

Goodwill 8 16 - 28 — 52

Acquired tradename — — - 84 — 84

Assets (c) 2,306 105 1,063 1,348 — 4,822

Capital expenditures 224 3 1 36 — 264

Retail

Fiscal year 2005 Stores Direct Credit Other Eliminations Total

Net sales (a) $7,197 $439 - $87 — $7,723

Net sales increase 8.5% (1.7%) N/A 62.1% N/A 8.3%

Intersegment revenues — — — — — —

Interest expense, net (b) — — $(17) (28) — (45)

Finance charges and other, net (2) 1 186 11 — 196

Depreciation and amortization 223 3 1 49 — 276

Earnings before income taxes 998 88 53 (254) — 885

Earnings before income taxes

as a percentage of net sales 13.9% 20.2% N/A N/A N/A 11.5%

Goodwill 8 16 - 28 — 52

Acquired tradename — — — 84 — 84

Assets (c) 2,285 85 1,164 1,387 — 4,921

Capital expenditures 232 3 1 36 — 272

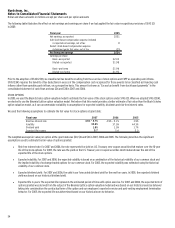

(a) Net sales in Other include foreign sales of $62, $104 and $94 for 2007, 2006 and 2005.

(b) Interest income of $14, $13 and $12 for 2007, 2006 and 2005 is recorded in our Other segment as an offset to interest expense, net.

(c) Assets in Other include foreign assets of $0, $212 and $205 at the end of 2007, 2006 and 2005. It also includes unallocated assets in corporate headquarters, consisting primarily of

cash, land, buildings and equipment, and deferred tax assets.