Nordstrom 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 29

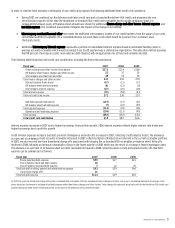

Purchase obligations primarily consist of purchase orders for unreceived goods or services, our Minimum Purchase Agreement with the Façonnable U.S.

wholesale business, and capital expenditure commitments.

This table also excludes the short-term liabilities, other than the current portion of long-term debt, disclosed on our 2007 consolidated balance sheet,

as the amounts recorded for these items will be paid in the next year.

Credit Capacity and Commitments

The following table summarizes our amount of commitment expiration per period:

Total

Amounts

Committed

Less than

1 year 1–3 years 3–5 years

More than

5 years

Other commercial commitments

$300 variable funding note - — — — —

$100 variable funding note - - — — —

$500 commercial paper - - — — —

Standby letters of credit - - — — —

Import letters of credit $8 $8 — — —

Total $8 $8 — — —

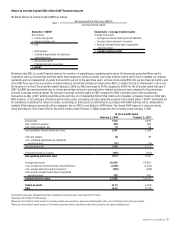

During the first quarter of 2007, we entered into an agreement for a new variable funding facility (2007-A Variable Funding Note) backed by

substantially all of the Nordstrom private label card receivables and 90% interest in the co-branded Nordstrom VISA credit card receivables with a

commitment of $300. Borrowings under the facility incur interest based upon the cost of commercial paper issued by the third party bank conduit

plus specified fees. During the third quarter of 2007, we used this facility to issue $220 in Notes and paid the outstanding balance during the third

and fourth quarters of 2007. We pay a commitment fee for the note based on the size of the commitment and the amount of borrowings outstanding.

Commitment fee rates decrease if more than $50 is outstanding on the facility. The facility can be cancelled or not renewed if our debt ratings fall

below Standard and Poor’s BB+ rating or Moody’s Ba1 rating. Our current rating by Standard and Poor’s is A-, four grades above BB+, and by Moody’s

is Baa1, three grades above Ba1. At year-end, we had no outstanding balance on this variable funding note.

During the third quarter of 2007, we entered into an agreement for an additional variable funding facility backed by the remaining 10% interest in

the co-branded Nordstrom VISA credit card receivables with a commitment of $100. As of February 2, 2008, no issuances have been made against

this facility. Borrowings under the facility will incur interest based upon the cost of commercial paper issued by the third party bank conduit plus

specified fees.

During the third quarter of 2007, we entered into a new commercial paper dealer agreement, supported by our unsecured line of credit. Under this

commercial paper program, we may issue commercial paper in an aggregate amount outstanding at any particular time not to exceed $500. This

agreement allows us to use the proceeds to fund share repurchases as well as operating cash requirements. Under the terms of the commercial paper

agreement, we pay a rate of interest based on, among other factors, the maturity of the issuance and market conditions. The issuance of commercial

paper has the effect, while it is outstanding, of reducing our borrowing capacity under the line of credit by an amount equal to the principal amount of

the commercial paper. We had no commercial paper borrowings outstanding at February 2, 2008.

We have an automatic shelf registration statement on file with the Securities and Exchange Commission. Under the terms of the registration statement,

and subject to the filing of certain post-effective amendments, we are authorized to issue an unlimited principal amount of debt securities.

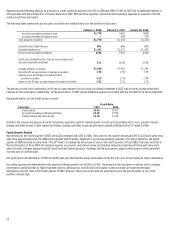

Debt Ratings

The following table shows our credit ratings at the date of this report:

Credit Ratings Moody’s

Standard

and Poor’s

Senior unsecured debt Baa1 A-

Commercial paper P-2 A-2

Outlook Stable Stable

These ratings could change depending on our performance and other factors. Our outstanding debt is not subject to termination or interest rate

adjustments based on changes in our credit ratings.