Nordstrom 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 27

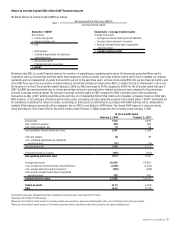

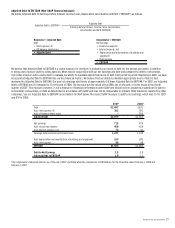

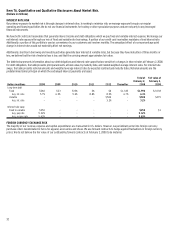

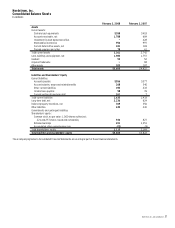

Adjusted Debt to EBITDAR (Non-GAAP financial measure)

We define Adjusted Debt to Earnings before Interest, Income Taxes, Deprecation, Amortization and Rent (“EBITDAR”) as follows:

Adjusted Debt

Adjusted Debt to EBITDAR = Earnings before Interest, Income Taxes, Depreciation,

Amortization and Rent (EBITDAR)

Numerator = Adjusted Debt Denominator = EBITDAR

Debt Net Earnings

+ Rent expense x 8 + Income tax expense

+ Off-balance sheet notes + Interest expense, net

= Adjusted Debt + Depreciation and amortization of buildings and

equipment

+ Rent expense

= EBITDAR

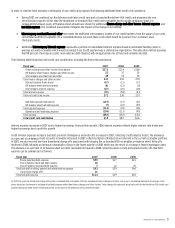

We believe that Adjusted Debt to EBITDAR is a useful measure for investors in evaluating our levels of debt for the periods presented, in addition

to being a key measure used by rating agencies. When read in conjunction with our net earnings and debt and compared to debt to net earnings,

it provides investors with a useful tool to evaluate our ability to maintain appropriate levels of debt from period to period. Beginning in 2007, we have

incorporated Adjusted Debt to EBITDAR into our key financial metrics. We believe that our ability to maintain appropriate levels of debt is best

measured by Adjusted Debt to EBITDAR. Our goal is to manage debt levels at approximately 2.0 times Adjusted Debt to EBITDAR. For 2007, our Adjusted

Debt to EBITDAR was 1.8 compared to 1.1 at the end of 2006. The increase was the result of the $988, net of discount, of notes issued in the fourth

quarter of 2007. This measure, however, is not a measure of financial performance under GAAP and should not be considered a substitute for debt to

net earnings, net earnings, or debt as determined in accordance with GAAP and may not be comparable to similarly titled measures reported by other

companies. See our Adjusted Debt to EBITDAR reconciliation to GAAP below. The closest GAAP measure is debt to net earnings, which was 3.5 for 2007

and 0.9 for 2006.

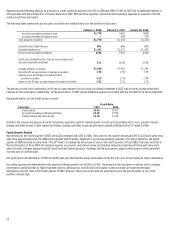

20071 20061

Debt $2,497 $631

Add: rent expense x 8 382 381

Add: off-balance sheet notes - 550

Adjusted Debt $2,879 $1,562

Net earnings 715 678

Add: income tax expense 458 428

Add: interest expense, net 74 43

Earnings before interest and income taxes 1,247 1,149

Add: depreciation and amortization of buildings and equipment 269 285

Add: rent expense 48 48

EBITDAR $1,564 $1,482

Debt to Net Earnings 3.5 0.9

Adjusted Debt to EBITDAR 1.8 1.1

1The components of adjusted debt are as of the end of 2007 and 2006, while the components of EBITDAR are for the 12 months ended February 2, 2008 and

February 3, 2007.