Nordstrom 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

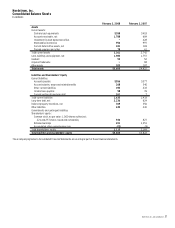

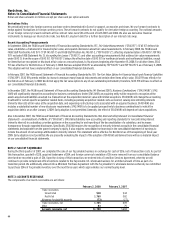

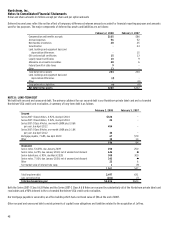

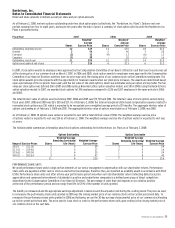

The following table summarizes certain income, expenses and cash flows received from and paid to the VISA Trust prior to the transaction:

3 months ended 12 months ended

Period May 1, 2007 February 3, 2007 January 28, 2006

Principal collections reinvested in new receivables $819 $3,094 $2,597

Gains on sales of receivables 320 20

Income earned on beneficial interests 21 75 54

Cash flows (used in) provided by beneficial interests:

Investment in asset backed securities (457) 494 130

Servicing fees 216 13

Net credit losses were $9, $22 and $25 for 2007, 2006 and 2005, and receivables past due for more than 30 days were $16 at the end of 2006.

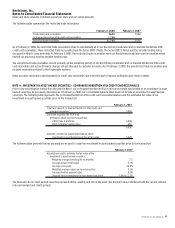

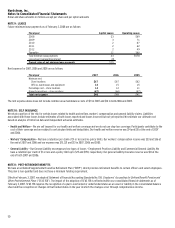

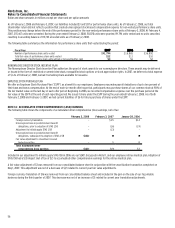

NOTE 5: LAND, BUILDINGS AND EQUIPMENT

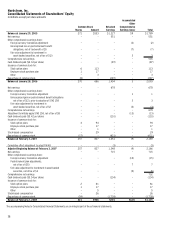

Land, buildings and equipment consist of the following:

February 2, 2008 February 3, 2007

Land and land improvements $65 $65

Buildings and building improvements 842 812

Leasehold improvements 1,313 1,269

Store fixtures and equipment 1,995 1,984

Software 303 285

Construction in progress 391 132

4,909 4,547

Less accumulated depreciation and amortization (2,926) (2,790)

Land, buildings and equipment, net $1,983 $1,757

The total cost of buildings and equipment held under capital lease obligations was $28 and $20, at the end of 2007 and 2006, with related

accumulated amortization of $20 and $17. The amortization of capitalized leased buildings and equipment of $1 in both 2007 and 2006 was recorded

in depreciation expense.

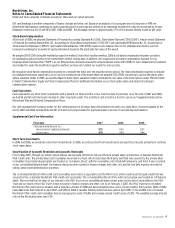

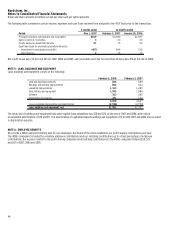

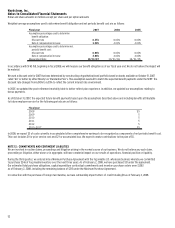

NOTE 6: EMPLOYEE BENEFITS

We provide a 401(k) and profit sharing plan for our employees. Our Board of Directors establishes our profit sharing contribution each year.

The 401(k) component is funded by voluntary employee contributions and our matching contributions up to a fixed percentage of employee

contributions. Our expense related to the profit sharing component and matching contributions to the 401(k) component totaled $50, $73

and $67 in 2007, 2006 and 2005.