Nordstrom 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

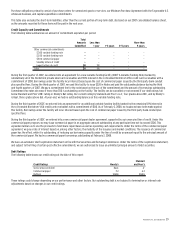

Nordstrom, Inc. and subsidiaries 39

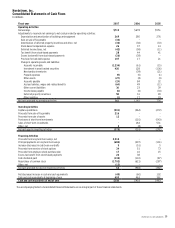

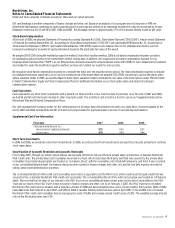

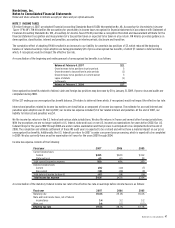

Nordstrom, Inc.

Consolidated Statements of Cash Flows

In millions

Fiscal year 2007 2006 2005

Operating Activities

Net earnings $715 $678 $551

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization of buildings and equipment 269 285 276

Gain on sale of Façonnable (34) — —

Amortization of deferred property incentives and other, net (36) (36) (33)

Stock-based compensation expense 26 37 13

Deferred income taxes, net (42) (58) (11)

Tax benefit from stock-based payments 28 44 41

Excess tax benefit from stock-based payments (26) (38) —

Provision for bad debt expense 107 17 21

Change in operating assets and liabilities:

Accounts receivable (1,234) (61) (15)

Investment in asset backed securities 420 128 (136)

Merchandise inventories — (39) (21)

Prepaid expenses (9) (5) (1)

Other assets (27) (8) (3)

Accounts payable (19) 84 32

Accrued salaries, wages and related benefits (64) 49 (11)

Other current liabilities 36 23 39

Income taxes payable (6) (6) (34)

Deferred property incentives 58 31 49

Other liabilities (1) 17 19

Net cash provided by operating activities 161 1,142 776

Investing Activities

Capital expenditures (501) (264) (272)

Proceeds from sale of Façonnable 216 — —

Proceeds from sale of assets 12 — —

Purchases of short-term investments — (110) (543)

Sales of short-term investments — 164 531

Other, net 3(8) (8)

Net cash used in investing activities (270) (218) (292)

Financing Activities

Proceeds from long-term borrowings, net 2,510 — —

Principal payments on long-term borrowings (680) (307) (101)

Increase (decrease) in cash book overdrafts 5(51) 5

Proceeds from exercise of stock options 34 51 73

Proceeds from employee stock purchase plan 17 16 15

Excess tax benefit from stock-based payments 26 38 —

Cash dividends paid (134) (110) (87)

Repurchase of common stock (1,702) (621) (287)

Other, net (12) — —

Net cash provided by (used in) financing activities 64 (984) (382)

Net (decrease) increase in cash and cash equivalents (45) (60) 102

Cash and cash equivalents at beginning of year 403 463 361

Cash and cash equivalents at end of year $358 $403 $463

The accompanying Notes to Consolidated Financial Statements are an integral part of these financial statements.