Nordstrom 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

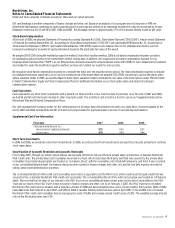

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

On May 1, 2007, we converted the Nordstrom private label cards and co-branded Nordstrom VISA credit card programs into one securitization

program, which is accounted for as a secured borrowing (on-balance sheet). When we combined the securitization programs, our investment in asset

backed securities, which was accounted for as available-for-sale securities, was eliminated and we reacquired all of the co-branded Nordstrom VISA

credit card receivables previously held off-balance sheet. These reacquired co-branded Nordstrom VISA credit card receivables were recorded at fair

value at the date of acquisition. We have transitioned the co-branded Nordstrom VISA credit card receivable portfolio to historical cost, net of bad

debt allowances, on our consolidated balance sheet.

Also on May 1, 2007, the trust issued securities that are backed by substantially all of the Nordstrom private label card receivables and 90% of the

co-branded Nordstrom VISA credit card receivables. Under the securitization, the receivables are transferred to a third-party trust on a daily basis.

The balance of the receivables transferred to the trust fluctuates as new receivables are generated and old receivables are retired (through

payments received, charge-offs or credits for merchandise returns). These combined receivables back the Series 2007-1 Notes, the Series 2007-2

Notes, and an unused variable funding note that are discussed in Note 8: Long-term debt.

Our credit card securitization agreements set a maximum percentage of receivables that can be associated with various receivable categories, such

as employee or foreign receivables. As of February 2, 2008, these maximums were not exceeded.

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market, using the retail method (weighted average cost).

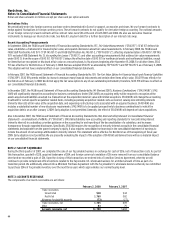

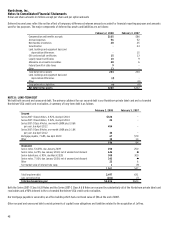

Land, Buildings and Equipment

Depreciation is computed using the straight-line method. Estimated useful lives by major asset category are as follows:

Asset Life (in years)

Buildings and improvements 5–40

Store fixtures and equipment 3–15

Leasehold improvements Shorter of initial lease term or asset life

Software 3–7

Intangible Asset Impairment Testing

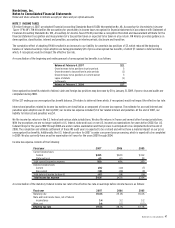

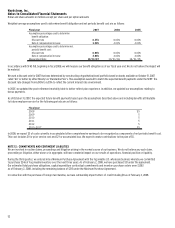

We review our goodwill annually for impairment in the first quarter or when circumstances indicate the carrying value of these assets may not be

recoverable. We removed the goodwill of $28 and acquired tradename of $84 associated with our Façonnable business from our consolidated

balance sheet when we sold that business in the third quarter of 2007. In association with our May 2007 increase in ownership of Jeffrey, we

recorded $29 of goodwill. As of the end of 2007, we believe no indicators of impairment exist.

Leases

We recognize lease expense, net of landlord reimbursements, on a straight-line basis over the minimum lease term from the time that we control the

leased property.

We lease the land or the land and buildings at many of our full-line stores, and we lease the buildings at many of our Rack stores. Additionally, we

lease office facilities, warehouses and equipment. Most of these leases are classified as operating leases and they expire at various dates through

2080. We have no significant individual or master lease agreements.

Our fixed, noncancelable lease terms generally are 20 to 30 years for full-line stores and 10 to 15 years for Rack stores. Many of our leases include

options that allow us to extend the lease term beyond the initial commitment period, subject to terms agreed to at lease inception.

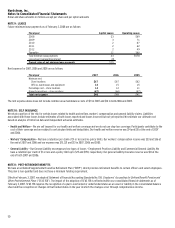

For leases that contain predetermined, fixed escalations of the minimum rent, we recognize the rent expense on a straight-line basis and record the

difference between the rent expense and the rent payable as a liability.

Most of our leases also provide for payment of operating expenses, such as common area charges, real estate taxes and other executory costs.

Some leases require additional payments based on sales and are recorded in rent expense when the contingent rent is probable.

Leasehold improvements made at the inception of the lease are amortized over the shorter of the asset life or the initial lease term as described

above. Leasehold improvements made during the lease term are also amortized over the shorter of the asset life or the remaining lease term.

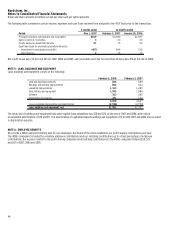

We receive incentives to construct stores in certain developments. These incentives are recorded as a deferred credit and recognized as a reduction

to rent expense on a straight-line basis over the lease term as described above. At the end of 2007 and 2006, this deferred credit balance was $408

and $392. Also, we may receive incentives based on a store’s net sales; we recognize these incentives in the year that they are earned as a reduction

of rent expense.