Nordstrom 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

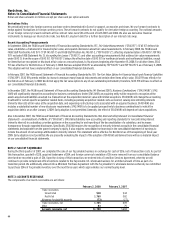

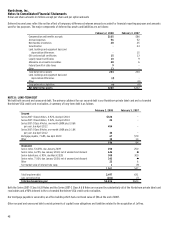

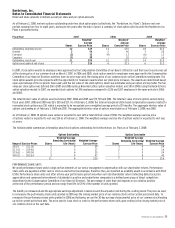

Weighted-average assumptions used to determine benefit obligation and net periodic benefit cost are as follows:

Fiscal year 2007 2006 2005

Assumption percentages used to determine

benefit obligation:

Discount rate 6.35% 6.00% 6.00%

Rate of compensation increase 3.00% 4.00% 4.00%

Assumption percentages used to determine net

periodic benefit cost:

Discount rate 6.00% 6.00% 6.00%

Rate of compensation increase 4.00% 4.00% 4.00%

Measurement date 10/31/07 10/31/06 10/31/05

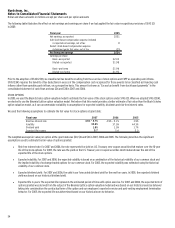

In accordance with SFAS 158, beginning in fiscal 2008, we will measure our benefit obligation as of our fiscal year-end. We do not believe the impact will

be material.

We used a discount rate for 2007 that was determined by constructing a hypothetical bond portfolio based on bonds available on October 31, 2007

rated “AA” or better by either Moody’s or Standard & Poor’s. This assumption was built to match the expected benefit payments under the SERP. The

discount rate changed from 6.00% to 6.35% to reflect the current interest rate environment.

In 2007, we updated the post-retirement mortality table to better reflect plan experience. In addition, we updated our assumptions relating to

bonus payments.

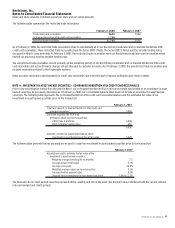

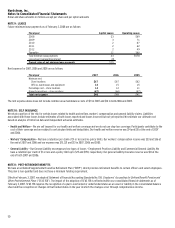

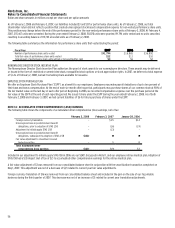

As of October 31, 2007, the expected future benefit payments based upon the assumptions described above and including benefits attributable

to future employee service for the following periods are as follows:

Fiscal year

2008 $5

2009 5

2010 5

2011 5

2012 5

2013-2017 35

In 2008, we expect $3 of costs currently in accumulated other comprehensive earnings to be recognized as components of net periodic benefit cost.

This cost includes $1 for prior service cost and $2 for accumulated loss. We expect to make contributions to the plan of $5.

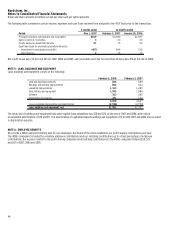

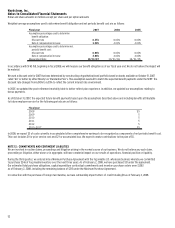

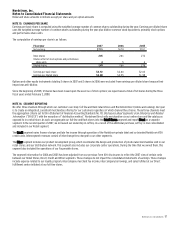

NOTE 12: COMMITMENTS AND CONTINGENT LIABILITIES

We are involved in routine claims, proceedings and litigation arising in the normal course of our business. We do not believe any such claim,

proceeding or litigation, either alone or in aggregate, will have a material impact on our results of operations, financial position or liquidity.

During the third quarter, we entered into a Minimum Purchase Agreement with the Façonnable U.S. wholesale business whereby we committed

to purchase $246 of Façonnable inventory over the next three years. As of February 2, 2008, we have purchased $31 under the agreement.

Our estimated total purchase obligations, capital expenditure contractual commitments and inventory purchase orders were $1,382

as of February 2, 2008, including the remaining balance of $215 under the Minimum Purchase Agreement.

In connection with the purchase of foreign merchandise, we have outstanding import letters of credit totaling $8 as of February 2, 2008.