Nordstrom 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

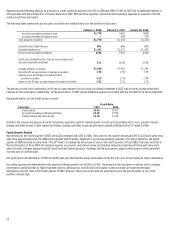

Off-Balance Sheet Financing and Securitization of Accounts Receivable

Prior to May 2007, through our wholly owned federal savings bank, Nordstrom fsb, we offered a private label card and two co-branded Nordstrom VISA

credit cards. The private label card receivables were held in a trust, which could issue third-party debt that was secured by the private label

receivables; the private label program was treated as ‘on-balance sheet.’ Both the receivables, net of bad debt allowance, and any debt were recorded

on our consolidated balance sheet. The finance charge income was recorded in finance charges and other, net, and the bad debt expense was recorded

in selling, general and administrative expenses.

The co-branded Nordstrom VISA credit card receivables were held in a separate trust (the VISA Trust), which could issue third-party debt that was

secured by the co-branded Nordstrom VISA credit card receivables. The co-branded Nordstrom VISA credit card program was treated as ‘off-balance

sheet.’ We recorded the fair value of our interest in the VISA Trust on our consolidated balance sheet, gains on the sale of receivables to the VISA Trust

and our share of the VISA Trust’s finance income in finance charges and other, net. As of February 3, 2007, the VISA Trust had co-branded Nordstrom

VISA credit card receivables with a total face amount of $908 and had outstanding two series of notes held by third parties: $200 of 2002 Class A&B

notes that matured in April 2007, and $350 of 2004-2 variable funding notes that were paid in April 2007. In fiscal 2006, the co-branded Nordstrom VISA

credit card receivables had an average gross yield of 16.8% and average annual credit losses of 2.8%. The weighted average interest rate on the third-

party notes was 5.3%.

On May 1, 2007, we converted the Nordstrom private label cards and co-branded Nordstrom VISA credit card programs into one securitization program,

which is accounted for as a secured borrowing (on-balance sheet). When we combined the securitization programs, our investment in asset backed

securities, which was accounted for as available-for-sale securities, was eliminated and we reacquired all of the co-branded Nordstrom VISA credit card

receivables previously sold to the VISA trust. These reacquired co-branded Nordstrom VISA credit card receivables were recorded at fair value at the

date of acquisition. We have transitioned the co-branded Nordstrom VISA credit card receivable portfolio to historical cost, net of bad debt allowances,

on our consolidated balance sheet as of February 2, 2008.

On May 1, 2007, the trust issued securities that are backed by substantially all of the Nordstrom private label card receivables and 90% of the

co-branded Nordstrom VISA credit card receivables. Under the securitization, the receivables are transferred to a third-party trust on a daily basis.

The balance of the receivables transferred to the trust fluctuates as new receivables are generated and old receivables are retired (through payments

received, charge-offs or credits for merchandise returns). These combined receivables back the Series 2007-1 Notes, the Series 2007-2 Notes and an

unused variable funding note.

Our earnings per diluted share were reduced by $0.06 for one-time transitional write-offs associated with bringing the co-branded VISA receivables on

balance sheet.

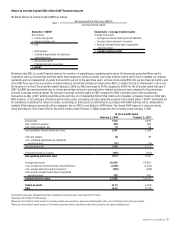

Interest Rate Swaps

To manage our interest rate risk, we entered into an interest rate swap agreement in 2003, which had a $250 notional amount expiring in January 2009.

Under the agreement, we receive a fixed rate of 5.63% and pay a variable rate based on LIBOR plus a margin of 2.3% set at six-month intervals (5.32% at

February 2, 2008). The interest rate swap agreement had a fair value of $1 and $(9) at the end of 2007 and 2006.

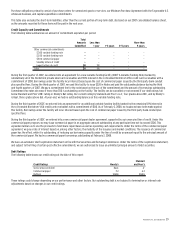

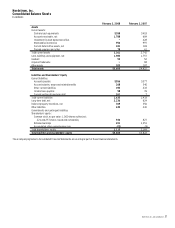

Contractual Obligations

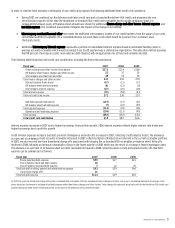

The following table summarizes our contractual obligations and the expected effect on our liquidity and cash flows as of February 2, 2008. We expect to

fund these commitments primarily with operating cash flows generated in the normal course of business and credit available to us under existing and

potential future facilities.

Total

Less than

1 year 1–3 years 3–5 years

More than

5 years

Long-term debt $4,260 $ 396 $612 $710 $2,542

Capital lease obligations 23 3 5 4 11

Other long-term liabilities 201 1 37 22 141

Operating leases 578 69 138 111 260

Purchase obligations 1,382 1,227 154 1 -

Total $6,444 $1,696 $946 $848 $2,954

Included in the required debt repayments disclosed above are estimated total interest payments of approximately $1,779 as of February 2, 2008,

payable over the remaining life of the debts.

Other long-term liabilities consist of workers’ compensation and general liability insurance reserves, postretirement benefits and Financial Accounting

Standards Board (FASB) Interpretation No. 48,

Accounting for Uncertainty in Income Taxes

(“FIN 48”) reserves. The repayment amounts presented

above were determined based on historical payment trends. We expect to pay $1 of uncertain tax positions under FIN 48 in the next 12 months and

include this balance in other long-term liabilities as due in less than 1 year. We are unable to reasonably estimate the timing of future cash flows for

the remaining balance and have excluded this in the table above. Other long-term liabilities not requiring cash payments, such as deferred property

incentives and deferred revenue, were excluded from the table above.