Nordstrom 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

As of February 2, 2008 and February 3, 2007, our liabilities included $3 and $13 for performance share units. As of February 2, 2008, our total

shareholder return did not reflect a position that created unrecognized stock-based compensation expense for non-vested performance share units.

This position may change before the end of the performance period for the non-vested performance share units at February 2, 2008. At February 4,

2007, 255,467 units were unvested. During the year ended February 2, 2008, 50,070 units were granted, 191,794 units vested and no units cancelled,

resulting in an ending balance of 113,743 unvested units as of February 2, 2008.

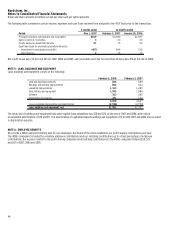

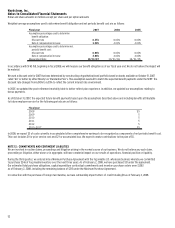

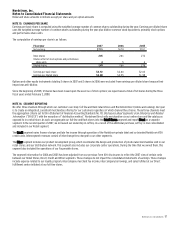

The following table summarizes the information for performance share units that vested during the period:

Fiscal Year 2007 2006 2005

Number of performance share units vested 191,794 216,865 336,892

Total fair value of performance share units vested $12 $11 $10

Total amount of performance share units settled or to be settled for cash $3 $6 $2

NONEMPLOYEE DIRECTOR STOCK INCENTIVE PLAN

The Nonemployee Director Stock Incentive Plan authorizes the grant of stock awards to our nonemployee directors. These awards may be deferred

or issued in the form of restricted or unrestricted stock, nonqualified stock options or stock appreciation rights. In 2007, we deferred a total expense

of $1. As of February 2, 2008, we had 1 remaining share available for issuance.

EMPLOYEE STOCK PURCHASE PLAN

We offer an Employee Stock Purchase Plan (“ESPP”) as a benefit to our employees. Employees may make payroll deductions of up to ten percent of

their base and bonus compensation. At the end of each six-month offering period, participants may purchase shares of our common stock at 90% of

the fair market value on the last day of each offer period. Beginning in 2006, we recorded compensation expense over the purchase period at the

fair value of the ESPP at the end of each reporting period. We issued 1 share under the ESPP during the year ended February 2, 2008. As of both

February 2, 2008 and February 3, 2007, we had current liabilities of $6 for future purchase of shares under the ESPP.

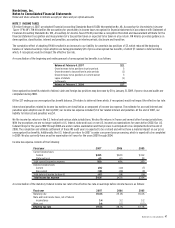

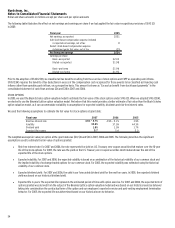

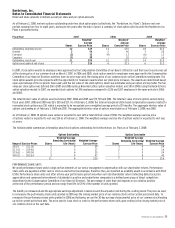

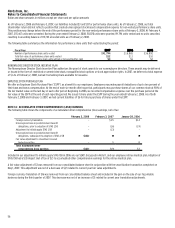

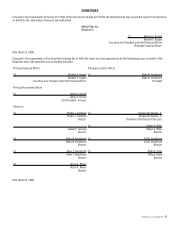

NOTE 14: ACCUMULATED OTHER COMPREHENSIVE (LOSS) EARNINGS

The following table shows the components of accumulated other comprehensive (loss) earnings, net of tax:

February 2, 2008 February 3, 2007 January 28, 2006

Foreign currency translation — $15 $14

Unrecognized loss on postretirement benefit

obligations, prior to adoption of SFAS 158 — (16) (19)

Adjustment to initially apply SFAS 158 — (13) —

Unrecognized loss on postretirement benefit

obligations, subsequent to adoption of SFAS 158 $(22) — —

Fair value adjustment to investment in asset

backed securities — 5 8

Total accumulated other

comprehensive (loss) earnings $(22) $(9) $3

Included in our adjustment to initially apply SFAS 158 in 2006 are our SERP, discussed in Note 11, and our employee retiree medical plan. Adoption of

SFAS 158 had a $(3) impact (net of tax of $2) to accumulated other comprehensive earnings for the retiree medical plan.

A fair value adjustment of $3 was removed from our consolidated balance sheet in conjunction with the securitization transaction completed on

May 1, 2007. This adjustment was net of a decrease of $(2) related to current year fair value adjustments.

Foreign currency translation of $16 was removed from our consolidated balance sheet and included in the gain on the sale of our Façonnable

business during the third quarter of 2007. This decrease was net of an increase of $1 related to current year translation adjustments.