Nordstrom 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

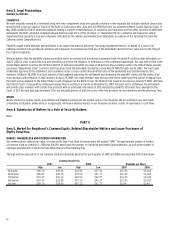

2006 VS 2005 NET EARNINGS AND EARNINGS PER DILUTED SHARE

In 2006, our 7.5% same-store sales increase combined with gross profit rate and selling, general and administrative rate improvement drove net

earnings of $678 and earnings per diluted share of $2.55. The 53rd week contributed $0.02 to earnings per diluted share. Additionally, in 2006, we

repurchased 16 shares of our common stock.

2008 FORECAST OF EARNINGS PER DILUTED SHARE

We expect our earnings per diluted share to be in the range of $2.75 to $2.90 in 2008.

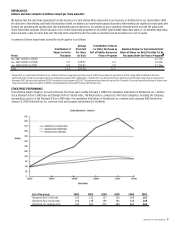

Credit Card Contribution

The Nordstrom Credit card products are designed to grow retail sales and customer relationships by providing superior payment products, services and

loyalty benefits. Nordstrom cards are issued by Nordstrom fsb, a federally chartered thrift and wholly owned subsidiary of the Company. Qualified

customers have a choice of the Nordstrom private label card, two co-branded Nordstrom VISA® cards, or a Nordstrom MOD® card. The MOD card

facilitates purchases at Nordstrom, drawing funds from the customer’s existing checking account at any financial institution. Each card enables

participation in the Nordstrom Fashion RewardsTM program, through which the customer accumulates points which, upon reaching a cumulative

purchase threshold, result in Nordstrom Notes®, which can be redeemed for goods or services in our stores. Primary benefits of the Fashion Rewards

program include:

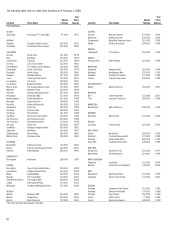

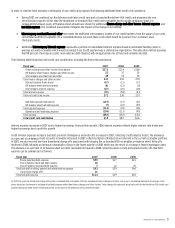

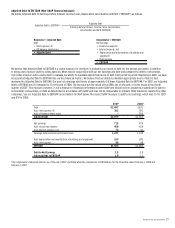

Level

Annual Nordstrom

purchases on

Nordstrom Card Primary Fashion Rewards Benefits

1Membership with

Nordstrom Card

2 rewards points per dollar spent at Nordstrom

1 rewards point per dollar spent outside Nordstrom where Visa cards are accepted

$20 Nordstrom Notes certificate per 2,000 points earned

2 $2,000 – 9,999

Level 1 benefits plus...

Complimentary in-store/online standard shipping

Other specified benefits

3 $10,000 – 19,999

Level 1 and 2 benefits plus...

Complimentary alterations - up to $300 annually

Bonus $200 Nordstrom Notes certificate

Other complimentary services

4 $20,000+

Level 1, 2 and 3 benefits plus...

Unlimited complimentary alterations

An additional $200 Nordstrom Notes certificate

Other complimentary services and access to special events

We believe participation in the Fashion Rewards program has resulted in beneficial shifts in customer spending patterns and incremental sales. The

estimated cost of Nordstrom Notes that will be issued and redeemed under the rewards program are recorded in cost of sales in the Consolidated

Statement of Earnings in the Credit segment.

Credit card revenues include finance charges, late and other fees, and interchange fees which are recorded in “Finance charges and other, net” in the

accompanying Consolidated Statements of Earnings. Interchange fees are earned from the use of Nordstrom VISA cards at merchants outside of

Nordstrom. We do not charge fees to our retail stores when customers use our cards in our Retail and Direct segments. The majority of credit account

balances have finance charge rates that vary with changes in the prime rate. We believe that the design of the Nordstrom credit card products as well

as the Fashion Rewards programs have contributed to the growth in our Credit segment.

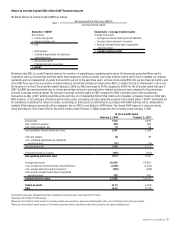

Interest is allocated to the Credit segment based on the debt that is secured by our Nordstrom private label and co-branded Nordstrom VISA credit

card receivables. Operational and marketing expenses are incurred to support and service our credit card products.

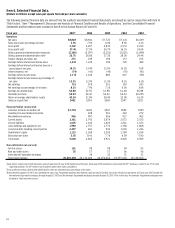

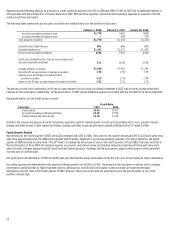

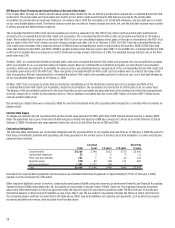

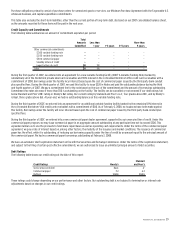

The following table illustrates a detailed view of our operational results of the Credit segment, consistent with the segment disclosure provided in the

notes to the consolidated financial statements.

Fiscal year 2007 2006 2005

Finance charges and other income1 $271 $214 $186

Interest expense (37) (11) (17)

Net credit card income 234 203 169

Bad debt expense1 (107) (17) (21)

Operational and marketing expense (138) (113) (95)

Total expense (245) (130) (116)

Credit card contribution to earnings before income tax expense, as

presented in segment disclosure $(11) $73 $53

1In 2007, the one-time transitional charge-offs on the co-branded VISA receivables of $21 are included in finance charges and other, net on our consolidated statement of earnings. In the

above disclosure this amount is included in bad debt expense rather than finance charges and other income. These charge-offs represent actual write-offs on the Nordstrom VISA credit card

portfolio during the eight-month transitional period, as discussed in Securitization of Accounts Receivable.