Nordstrom 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

customers, employees and shareholders,

D

eR

A

On behalf of everyone at Nordstrom, I am pleased to share with you our company’s 2007 performance

and outlook for 2008 and beyond.

Overall, we realized a number of top performances in 2007, thanks to the hard work of more than

55,000 Nordstrom employees. Let’s review the highlights:

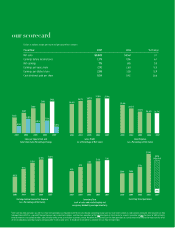

• Total sales increased 3.1% to a record high $8.8 billion and comparable sales

increased 3.9% — our sixth consecutive year of same-store sales gains.

• Improving store productivity resulted in a return on investment (ROIC) of 19.4%,

and sales of $402 per square foot on a 52-week basis, our best performance ever.

• Our SG&A rate (expenses as a percentage of net sales) improved for the

seventh year in a row at 26.7%, improving by 9 basis points over last year.

• Earnings Before Interest and Taxes (EBIT) were $1.247 billion this year,

an improvement of 8.5% over last year.

In total, 2007 was a year of good performance for our company. But 2007 was really a tale of two halves.

In the first half, the industry was robust, our team executed well, and we experienced comparable store growth

of 7.5%. Around mid-year, the market slowed dramatically and our comparable store sales growth was only 0.5%.

While we managed our operating expenses well throughout the year, inventories increased in the third and

fourth quarters, at about the same time the economy began to slow and sales softened. We addressed the

inventory issues quickly and corrected many of them by the beginning of 2008. Thus, we believe we are

positioned to perform well in what we expect to be a continued soft retail environment in 2008. Our focus

remains on growing market share with our core customers. When we challenge ourselves to offer the best

service and merchandise, we give the customer a reason to buy. We have one of the fastest inventory turns

among our direct competitors and when we continue to flow in new merchandise, our customers

respond best. By executing well, we increase comparable sales and improve profitability,

ultimately the best sign that we are taking care of our customers.