Nordstrom 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

(Dollars in millions)

INTEREST RATE RISK

Our primary exposure to market risk is through changes in interest rates. In seeking to minimize risk, we manage exposure through our regular

operating and financing activities. We do not use financial instruments for trading or other speculative purposes and are not party to any leveraged

financial instruments.

We have both credit card receivables that generate interest income and debt obligations which we pay fixed and variable interest expense. We manage our

net interest rate exposure through our mix of fixed and variable rate borrowings. A portion of our credit card receivables maintains a fixed interest rate.

Additionally, a portion of this portfolio is used as convenience by our customers and revolves monthly. The annualized effect of a one-percentage-point

change in interest rates would not materially affect net earnings.

Additionally, short-term borrowing and investing activities generally bear interest at variable rates, but because they have maturities of three months or

less, we believe that the risk of material loss is low, and that the carrying amount approximates fair value.

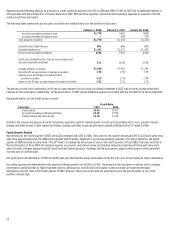

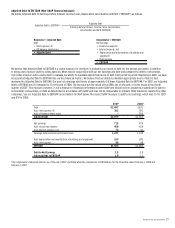

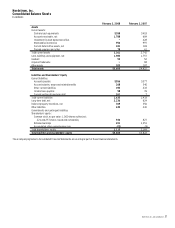

The table below presents information about our debt obligations and interest rate swaps that are sensitive to changes in interest rates at February 2, 2008.

For debt obligations, the table presents principal amounts, at book value, by maturity date, and related weighted average interest rates. For interest rate

swaps, the table presents notional amounts and weighted average interest rates by expected (contractual) maturity dates. Notional amounts are the

predetermined dollar principal on which the exchanged interest payments are based.

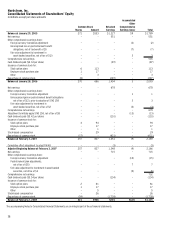

Dollars in millions 2008 2009 2010 2011 2012 Thereafter

Total at

February 2,

2008

Fair value at

February 2,

2008

Long-term debt

Fixed $260 $23 $356 $6 $6 $1,345 $1,996 $2,038

Avg. int. rate 5.7% 6.5% 5.0% 8.8% 8.5% 6.7% 6.3%

Variable — — — — $500 — $500 $475

Avg. int. rate — — — — 3.2% — 3.2%

Interest rate swap

Fixed to variable $250 — — — — — $250 $1

Avg. pay rate 5.32% — — — — — 5.32%

Avg. receive rate 5.63% — — — — — 5.63%

FOREIGN CURRENCY EXCHANGE RISK

The majority of our revenue, expense and capital expenditures are transacted in U.S. dollars. However, we periodically enter into foreign currency

purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to hedge against fluctuations in foreign currency

prices. We do not believe the fair value of our outstanding forward contracts at February 2, 2008 to be material.