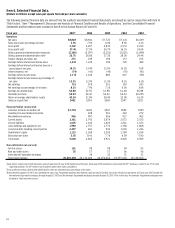

Nordstrom 2007 Annual Report Download - page 23

Download and view the complete annual report

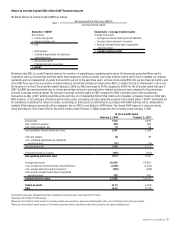

Please find page 23 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nordstrom, Inc. and subsidiaries 15

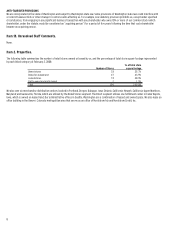

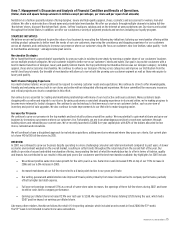

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

(Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts)

Nordstrom is a fashion specialty retailer offering designer, luxury and high-quality apparel, shoes, cosmetics and accessories for women, men and

children. We offer a wide selection of brand name and private label merchandise. We offer our products through multiple channels including full-line

‘Nordstrom’ stores, discount ‘Nordstrom Rack’ stores, ‘Jeffrey’ boutiques, catalogs and on the Internet at www.nordstrom.com. Our stores are located

throughout the United States. In addition, we offer our customers a variety of payment products and services including our loyalty program.

STRATEGIC INITIATIVES

We believe we are well positioned to grow the value of our business by executing the following key initiatives: tailoring our merchandise offering within

existing product categories to better meet the needs of our core customers, improving the consistency and shopping experience for our customers

across all channels, and continuing to increase our presence where our customers shop. We focus on customers who love fashion, value quality — both

in merchandise and design — and appreciate great service.

Merchandise Strategies

We’ve found that there’s a great deal of opportunity to grow our sales in existing stores simply by earning a greater share of our customers’ business

across multiple product categories. We use customer insight to better serve our customers’ needs and wants. Our goal is to provide customers with a

best-in-market selection of designer, luxury and quality fashion brands. Our top performing merchandise division was our designer category, including

apparel, shoes and accessories merchandise. We continue to enhance our designer offering across categories and improve our distribution from the

world’s best luxury brands. Our breadth of merchandise will allow us to serve both the growing core customer segment as well as those who aspire to

luxury and quality.

Multi-Channel Shopping Experience

As a multi-channel retailer, we are positioned to respond to evolving customer needs and expectations. We continue to strive to offer knowledgeable,

friendly and welcoming service, both in our stores and online with an integrated offering and experience. We have committed the necessary resources

and critical projects are close to completion in this effort.

Our online store is essential to creating and maintaining relationships with many of our most active and loyal customers. Many customers begin

shopping with us online and migrate to our stores. By giving customers a consistent shopping experience in-store and online, we’re making progress to

become more relevant to today’s shoppers. We continue to use technology to find new ways to serve our customers better, such as one view of

inventory and point of sale upgrades. We also continue to make improvements to our Web site to make shopping easier.

Increase Our Presence

We continue to grow our presence in the top markets and best retail locations around the country. We see potential to gain market share and grow our

business by increasing our presence where our customers live. Fortunately, we are in an advantageous position to reach new customers through

building stores and remodeling our current ones. We’ve recently launched a $3,000 five-year capital plan, with 82% of the dollars allocated to new

stores, remodels and relocations.

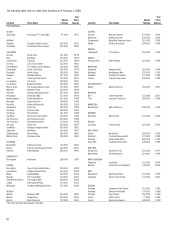

We will continue to have a disciplined approach to real estate acquisitions, adding new stores when and where they pass our criteria. Our current plan

is to have 140 to 150 full-line stores by 2015.

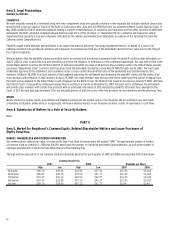

OVERVIEW

In 2007, we continued to grow our business despite operating in a more challenging consumer and retail environment compared to past years. A slower

economic environment weighed on the overall market, resulting in softer trends throughout the retail industry in the second half of the year. Our

ability to provide a focused and edited merchandise offering, incorporating the best of what the marketplace has to offer in terms of fashion, quality

and brands, has contributed to our results in this and past years. Our customers want the best merchandise available. Key highlights for 2007 include:

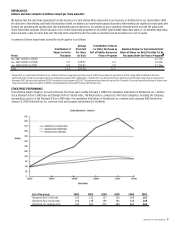

xWe achieved positive same-store sales growth for the sixth year in a row. Same-store sales increased 3.9% on top of our 7.5% increase in

2006 and our 6.0% increase in 2005.

xIncreased markdowns at our full-line stores led to a 6 basis point decline in our gross profit rate.

xOur selling, general and administrative rate improved 9 basis points primarily from lower incentives tied to company performance, partially

offset by higher bad debt expense.

xFull year net earnings increased 5.5% as a result of same-store sales increases, the openings of three full-line stores during 2007, and lower

incentive costs tied to company performance.

xEarnings per diluted share increased 12.9% over last year to $2.88. We repurchased 39 shares totaling $1,728 during the year, which had a

$0.07 positive impact on earnings per diluted share.

Like many other retailers, Nordstrom follows the retail 4-5-4 reporting calendar, which included an extra week in fiscal 2006 (the 53rd week).

The 53rd week is not included in same-store sales calculations.